How Pay Off A 30 Year Fixed Mortgage In 5 To10 Years

Lately, I’ve been talking about the process of selling my house and gearing up to buy a new house and as a result, I’ve been covering topics such as fixing a bad credit score to improve my loan rates setting up a budget to watch my finances a bit closer and now I’m going to be covering how to pay off a 30 year fixed mortgage in 5 to 10 years, which is one of my goals once I buy my new home.

So in this article, I’m going to show you 3 different options I’ve been considering on how to pay off my mortgage in 5 years. These options will consider traditional ideas all the way up to the extreme on how to pay off a mortgage early.

Option 1 – Make Two Payments A Month

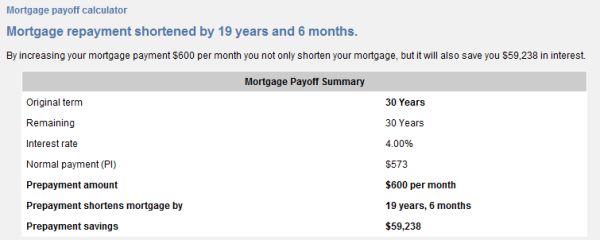

The first option to consider is a more traditional way most people pay down their mortgage, and that is to make two payments a month. So in my case after I put my down payment on my new house I will have a $120,000 balance left on my mortgage and below is a chart of what would happen if I paid my home off this way.

In the example above I would have a payment of around $573 and I would also make an extra payment of $600 every month by doing this I would have my home paid off in 10 years and 6 months. This isn’t a bad way to pay off your home but there is a risk to doing this.

The risk with paying off a mortgage in 5 years this way is that you are giving your lender all the power when you give them your extra payments each and every month. For example, if you were to follow this plan for 7 years and suddenly lose your job and couldn’t afford to make your payment anymore you could risk falling into foreclosure and losing your home and all the extra money you were paying towards it.

However on the positive side by paying down your mortgage this way you’ll save on interest payments and you won’t risk spending the money on something else.

So what are your thoughts on this method to pay off a mortgage in 5 years?

Option 2 – Invest It

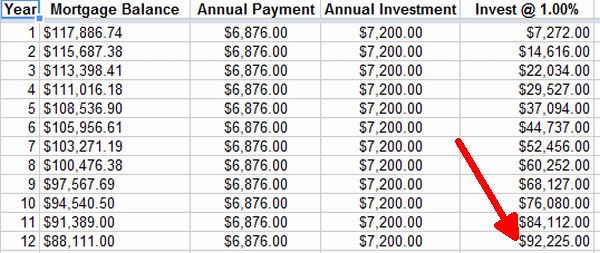

The next option that I considered is to invest my hard-earned money instead of paying it directly to the lender. To do this though you’ll want to invest it in a place where you can’t access it so easily. Some places to consider are bank CDs, and money market funds however one place I like a lot is the ING DIRECT Savings Account, simply because their saving program earns a 1.00% interest rate.

If you follow this plan you will invest $600 a month in the ING DIRECT Saving Plan and it will pay your home off in around 11 and a half years. If you compare this to option 1 it will actually take a year longer to pay down your home since you are not paying down the interest. ING DIRECT USA makes saving money simple! Open your account online today. No fees and no minimums!

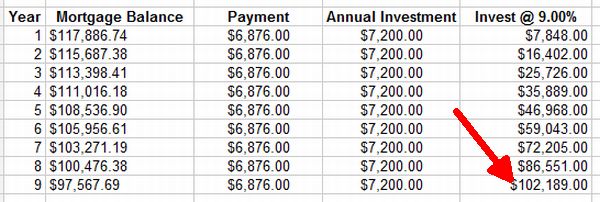

However, one way to beat this is to increase the interest rate. However what I am about to suggest is a much riskier option but can help you pay off your home much faster, and one way to do this is to invest with Lending Club. Lending Club is a peer-to-peer lending company that allows you to lend out your money to others who need it. To learn more check out my review on Lending Club.

The chart below it shows a typical 9% interest rate that an average investor with Lending Club might see.

If you would invest your money with Lending Club you would have your home paid off in 8 and a half years which is 2 years faster than option 1. I also should mention that by following this plan you would not invest any more money than in option 1 as well.

So what are your thoughts is this a method to pay off your mortgage in 5 years?

Option 3 – Create A New Income

The final option to consider on how to pay off a mortgage fast is to create a new income. You could do this by starting a part-time job or starting your own part-time business as I have. The great thing about this option is that it doesn’t take any money from your existing budget which allows you to put more towards paying off your home.

To prove my point I’ve been running this website for a few years now and have been earning a pretty decent profit from it, and the best part about it is anybody can do it. In fact below is a snapshot of my current income.

Now I should mention this option does take some time and hard work to make happen but I assure you that anybody can do it. In fact in the earning table above shows that I’ve earned nearly $45 today and over $800 this month and the best part is that the income is passive which means I don’t have to work for every single dollar.

Now I should mention this option does take some time and hard work to make happen but I assure you that anybody can do it. In fact in the earning table above shows that I’ve earned nearly $45 today and over $800 this month and the best part is that the income is passive which means I don’t have to work for every single dollar.

In my current position with my web business, I am creating enough income to pay off my home within the next 5 years however not everyone will see the same results that I have. To learn more about this option check The Keyword Academy, they will show you everything you need to know about how to set up your own online business.

So what are your thoughts on this method on how to pay a mortgage off early?

A Final Thought…

As a final thought on how to pay off your mortgage in 5 years consider these ideas carefully. Also, feel free to share your ideas on how to pay off a mortgage in 5 years. Is there anything you would do differently, or do you have a specific question concerning your situation?

Share your thoughts below.

Excellent advice there! Being both an investor and a blogger, I really liked option 3 and the AdSense screen shot! If only creating new income was that easy for most people paying a mortgage.