15 Year Mortgage Vs 30 Year Mortgage – Which Is Better

Earlier this week I talked about how I plan to pay off my mortgage in 5 to 10 years, however one of the big controversy’s I’ve been facing lately as I plan to buy my new house is whether I should go with a 15 year mortgage vs 30 year mortgage.

Earlier this week I talked about how I plan to pay off my mortgage in 5 to 10 years, however one of the big controversy’s I’ve been facing lately as I plan to buy my new house is whether I should go with a 15 year mortgage vs 30 year mortgage.

So in this article I’m going to cover these two types of mortgages on 3 levels, the first being how they do on interest, the second on what the payments are like, and finally how the loan term effects the end result.

The Variables

Before I dive into the details of the 30 year vs 15 year mortgage I want to establish a few of the variables I’m working with. So below are few of the variables.

- Loan Amount. The loan amount in all the examples will be $120,000.

- 30 Year Fixed Rate. The 30 year rate in all examples will be 4.25% which is current rate for today.

- 15 Year Fixed Rate. The 15 year rate in all examples will be 3.75% which is the current rate determined by Quicken loans.

- Points. None of these example will include points.

So now that we have the variables established let’s get started.

The Interest

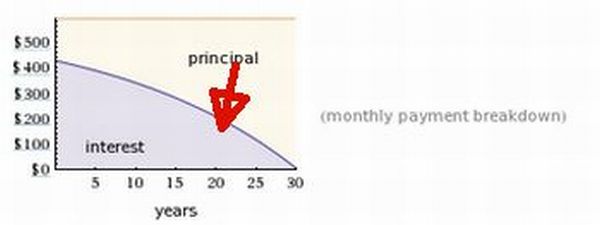

First off, let’s compare each mortgage based on the total amount of interest we pay. To start let’s look at the 30 year fixed mortgage. With a $120,000 mortgage I would pay $92,518 in interest. In essence I could pay for two thirds of my home with just the interest I paid in this option, consider the picture below.

In the picture above notice how much interest you pay in the early years of a 30 year mortgage. Nearly 85% of all the payments in the first 5 to 7 years you make on your mortgage are interest. On top of that it typically isn’t until year 21 of a 30 year mortgage till half of the home is paid for. That means the last 9 years of your 30 year fixed loan is nearly all principle and hardly any interest.

In the picture above notice how much interest you pay in the early years of a 30 year mortgage. Nearly 85% of all the payments in the first 5 to 7 years you make on your mortgage are interest. On top of that it typically isn’t until year 21 of a 30 year mortgage till half of the home is paid for. That means the last 9 years of your 30 year fixed loan is nearly all principle and hardly any interest.

Now that we know how a 30 year loan stacks up on interest let’s consider a 15 year fixed loan.

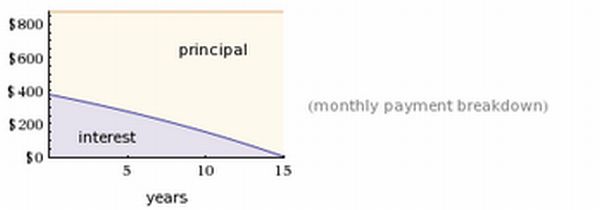

With a 15 year mortgage you will only pay $37,080. That’s a savings of $55,438 in interest by just going with a 15 year versus 30 year mortgage.

With a 15 year mortgage you will only pay $37,080. That’s a savings of $55,438 in interest by just going with a 15 year versus 30 year mortgage.

So in the end when we compare a 15 year vs 30 year mortgage, the 15 year wins by a land slide. I should also mention the 15 year mortgage gets higher marks because lower term mortgages will get lower interest rates as well.

The Payment

Now lets move onto the payment and see how things stack up. To start lets look at the 30 year mortgage first.

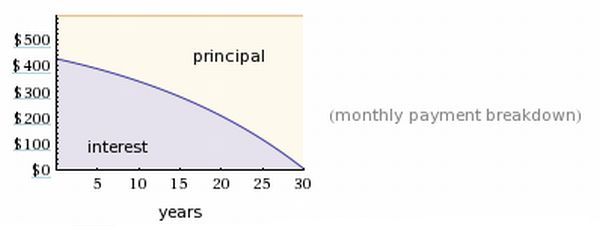

With the 30 year mortgage you will have a payment of $590 a month, and in the first 5 years you will pay anywhere from $400 to $450 of that payment towards interest and the remaining balance will go to pay off the balance of the loan. It isn’t until year 15 of this loan that half of the payments you make will go towards the principle portion of the loan.

With the 30 year mortgage you will have a payment of $590 a month, and in the first 5 years you will pay anywhere from $400 to $450 of that payment towards interest and the remaining balance will go to pay off the balance of the loan. It isn’t until year 15 of this loan that half of the payments you make will go towards the principle portion of the loan.

Now lets look at a 15 year vs 30 year mortgage.

With a 15 year mortgage you would have a payment of $873 a month. That’s $283 more than the 30 year mortgage. However when we compare how much interest vs principle you are paying each month we find that only $400 a month or less is going towards interest and that a majority of the payment is going towards the principle.

With a 15 year mortgage you would have a payment of $873 a month. That’s $283 more than the 30 year mortgage. However when we compare how much interest vs principle you are paying each month we find that only $400 a month or less is going towards interest and that a majority of the payment is going towards the principle.

In the end a 15 year mortgage will have a higher payment and the 30 year will have a lower payment. However when comparing the 30 vs 15 year mortgage it will pay a lot more interest than the 15 year mortgage.

The Loan Term

The final thing we need to consider when look at a 15 or 30 year mortgage is the length of the loan. Now obviously we know that a 30 year mortgage last 30 years and a 15 year mortgage last 15 years but let’s see what would happen if we would apply extra payments that are exactly the same.

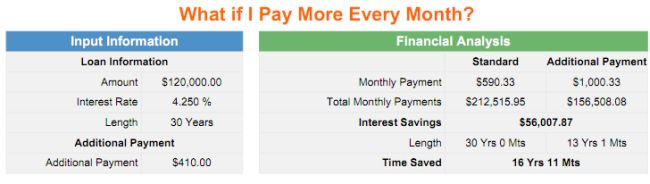

In the first example we will consider the 30 year mortgage and make a total payment of $1000 since this is all I have available to spend on a given month towards my mortgage. This means $590 will be the original payment and $410 will be added on extra each month.

In the results above by going with a 30 year mortgage and applying the extra money we have available we would be able to cut 16 years and 11 months off the length of the loan and pay the loan off in nearly 13 years and save a total of roughly $56,000 in interest, not bad.

In the results above by going with a 30 year mortgage and applying the extra money we have available we would be able to cut 16 years and 11 months off the length of the loan and pay the loan off in nearly 13 years and save a total of roughly $56,000 in interest, not bad.

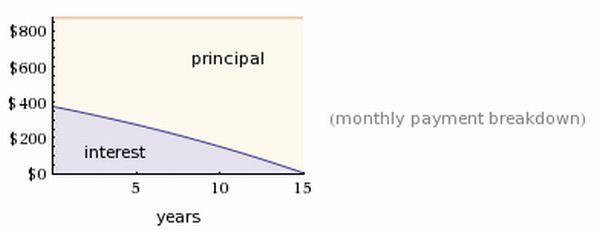

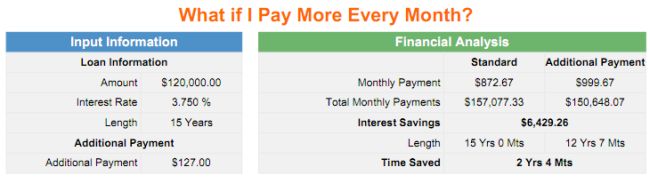

Now lets consider a 15 year mortgage making the same $1000 payment towards the loan. However with the 15 year loan we will have an initial payment of $873 and only an extra payment of $127 since this is all we have in extra cash to put towards the loan.

In the chart above by going with a 15 year mortgage and making a full $1000 payment we would pay off the mortgage 2 years and 4 months earlier saving around $6429 in interest. When compared to the 30 year mortgage you would pay off your loan off 6 months faster with a 15 year mortgage.

In the chart above by going with a 15 year mortgage and making a full $1000 payment we would pay off the mortgage 2 years and 4 months earlier saving around $6429 in interest. When compared to the 30 year mortgage you would pay off your loan off 6 months faster with a 15 year mortgage.

So Which Is Better: The 15 Year Or 30 Year Mortgage

So in the end let’s see how things stacked up on each level.

Interest: The 15 year mortgage paid far less in interest, while the 30 year mortgage paid far more.

Payments: The 30 year mortgage has a lower payment but pays more towards interest each month, while the 15 year mortgage has a higher payment but pays far less interest towards the loan each month.

Loan Term: Finally when we compared paying the same payment toward both types of loans we found that the 15 year loan will actually pay off your loan a lot faster even if you can’t pay as much in an extra payments towards the loan.

Final Thoughts…

Now as a final thought when you compare a 30 year mortgage vs 15 year mortgage the 15 year mortgage is defiantly the best way to go. However even though the 15 year mortgage is better you also need to consider one final factor, your financial situation. If you can’t make the 15 year payment every month or think it might be a stretch to make this payment it may be better to stick with the 30 year mortgage.

So what are your thoughts? Do you prefer the 15 year mortgage vs 30 year mortgage or do you prefer the 30 year vs 15 year mortgage? Feel free to share your thoughts, comments, and questions below.

One Comment