Low Fee IRA – Is It Really The Best Way To Save For Retirement

Lately I’ve been seeing a lot of commercials on TV talking about low fee IRA programs such as Vanguard. This company offers low cost IRA fees versus most of the other brokers out there. In fact some of these fees can be so low you almost have to wander how to they stay in business. This prompted me to do some research and find out, are low fee IRA companies a good way to invest for your retirement?

Lately I’ve been seeing a lot of commercials on TV talking about low fee IRA programs such as Vanguard. This company offers low cost IRA fees versus most of the other brokers out there. In fact some of these fees can be so low you almost have to wander how to they stay in business. This prompted me to do some research and find out, are low fee IRA companies a good way to invest for your retirement?

Fee Comparison

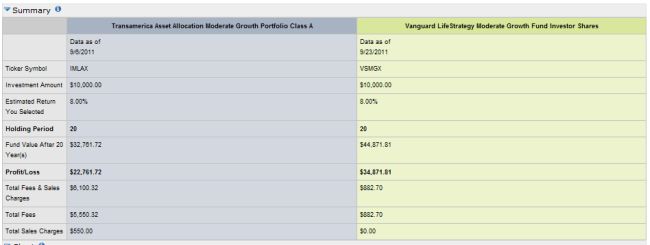

To start I’m going to do a fee comparison between two similar funds. One being a fund I actually invest in, the Transamerica Moderate Growth Fund and the second being a low cost mutual fund, the Vanguard Life Strategy Moderate Growth Fund. Here is what I found when I compared the cost on these two funds.

When you compare these two funds side by side you can obviously see which fund cost more in fees. Both funds earned an 8% return and started with an investment of $10,000. The Transamerica fund charged a total of $6100 over a 20 year period.

On the other hand the Vanguard fund only charged a total of $882 in total fees. By going with the Vanguard fund you saved yourself a total of $5218!

On top of that by going with the Vanguard fund you earned a total of $34,871, while the Transamerica fund only earned you a total of $22,761. That’s a difference of $12,110!

Now obviously from the research I did it looks as if the low cost mutual funds with Vanguard are the clear winner but I want to take things a step further and compare the returns between the Transamerica fund and what the low fee mutual funds with Vanguard had over the last 20 years.

Fee And Performance Comparison

To start we will look at the Transamerica Fund first. This fund earned a return of 7.45% since the fund was started, and carries the same fees as the first example.

If you look at the picture above you can see that by investing $10,000 over a 10 year period it cost me a total of $2435. However this fund had over a 7% return and yielded me $16,719 as a result. That’s a total gain of $6719, not bad.

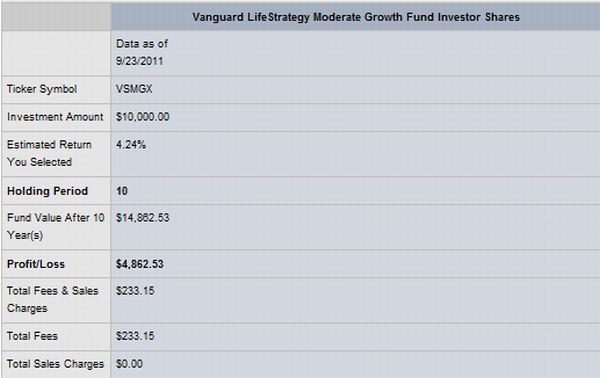

Now lets compare are results with the Vanguard low fee IRA company. The Vanguard low cost mutual fund earned only 4.24% since the fund started. Here is what I found.

In picture above after investing $10,000 with Vanguard for 10 years I only paid a total of $223 in fees, which isn’t bad at all. However when you compare the earning this fund only showed a profit of $4,862 for a total of $14,862.

The Results

When you compare the total results the Vanguard fund has less fees than the Transamerica fund but the performance is better with the Transamerica fund versus the low fee mutual fund with Vanguard.

As a result the Transamerica fund actually out earned the Vanguard fund, earning $1857 more than the Vanguard fund even though it had lower fees. In this comparison Transamerica is the clear winner.

So what are your thoughts, feel free to share your thoughts and questions below.

This article was recently featured in the carnival of personal finance by Hope To Prosper.

In general, the lower a funds fees are, the more likely they are to outperform their peer group over the long term. Despite the claims of many financial advisors, funds with very high fees rarely outperform their peers. Having said that, it’s the total performance that really counts. And, the high fees usually undermine the total performance.