Timeshare Scam Companies -10 Ways To Spot Them

Are you in the market to buy a timeshare?

Today, timeshares are everywhere: eBay, Craig’s List, and hundreds of other sites around the web and abroad. Then, the timeshare companies use their hard-sell tactics to sell overpriced properties.

The question is, how do you spot these scam companies from getting taken advantage of?

10 Ways to Spot Timeshare Scam Companies

In this article, I’ll share ten ways to spot these timeshare scam companies based on my personal experience and where the best places are to buy a timeshare.

1. They Use Hard Sales Tactics

First, you must know that timeshare resorts will use any hard-selling tactic to get you to buy.

When I was looking at buying a timeshare, we were crammed into a room for over four hours.

They wanted to keep you in there till you cracked, and that’s exactly what they do. In that time, they will say anything to get you interested.

If you’ve ever seen the movie Boiler Room, you’ll know exactly what I’m talking about.

2. They Will Give You Anything To Get You To Buy

Next, a timeshare scam company will give you anything to say yes. First off, they will wine you and dine you. They will take you out to eat at their resort restaurant to show you how great their resort is.

Second, they usually give you a free vacation for just checking them out. This is the only benefit I could find in attending a timeshare meeting. However, you may want to read the fine print beforehand because you may only have a limited time to take advantage of the opportunity.

The resort I got my free vacation from was real but had a restriction that we had to be 25 years of age to use the voucher. We, of course, couldn’t use it since we were only 23 at the time, how covenant for them.

3. High-Interest Rates

Third, one of the biggest timeshare scams is that resorts will give you a high interest rate on the loan you take out for your timeshare.

A typical timeshare ranges from $ 5,000 to $20,000+ and will charge ridiculously high rates.

My loan on the timeshare I bought was 16%, and the resort claimed I could get it refinanced once I got back home.

However, instead of refinancing the loan, I paid it off and avoided all the refinance fees.

4. Maintenance Fees

Fourth, every timeshare has maintenance fees. The reason resorts charge this fee is that once you sign on the dotted line, you will be an owner of a piece of time at a resort, one week, and now have to pay for resort maintenance.

The resort will then charge a maintenance fee to cover the cost of running the resort.

However, this doesn’t mean it’s cheap, at my resort I paid around $350 a year and the fee increased as much as 10% every year.

5. Club Fees

Fifth, once you buy a timeshare, you must pay a club fee to bank or exchange your timeshare. I’m unsure if this is required, but the resort I bought mine from said we had to have it.

The first year of the service is usually free, but it will cost you after that.

A typical annual fee runs around $60 to $100. However, if you buy longer, you will usually get a cheaper rate. If you would like to learn more about these companies, check out Interval International.

6. Exchange Fees

Once you own a timeshare, you may not want to always go to the same resort. If so, you can exchange using the Interval International exchange network.

However, this will also come as a fee as well. The typical fee for exchanging a timeshare with another resort will be around $100.

7. Impossible To Sell

Timeshares are next to impossible to sell. I tried selling mine, and it took over four years to get rid of it. They lie if the salesperson tells you that timeshares are easy to sell.

I recently got an email from someone who said they desperately needed to sell their timeshare. It is almost a regular occurrence for me to get one or two emails like this every month.

I feel sorry for these people, especially when I hear they still have a loan and can’t get even one offer on the property.

8. Timeshare Resale Companies Don’t Work

Eight, one of the things people will do to sell their timeshare is get in touch with a timeshare resale company. The short and sweet of it is they don’t work.

I bought into two different timeshare resale companies and never received one offer in the years I had the ads out. I even called these companies, and they claimed they were busy at work trying to sell my timeshare.

The typical fee with a company like this is around $600; the worst part is they offer no refund. My best advice for you here is to avoid this timeshare scam altogether.

9. Timeshares Don’t Increase In Value

One thing I learned the hard way with timeshares was the fact that timeshares do not increase in value. This was probably the biggest lie I’ve ever heard a timeshare salesman say.

They don’t increase in value because when you buy a timeshare, you aren’t buying an actual piece of land but rather just a piece of time, one week to be exact.

Since time itself doesn’t increase in value, the value of your week doesn’t increase at all. In fact, in most cases, they are worth a lot less when going to sell, which brings me to my final point.

10. No Return On Investment

Finally, the worst thing about a timeshare is that you will not get back the money you originally paid for the timeshare.

However, there is always that outside chance that it might happen, and if it does, please leave a comment. I would love to hear your story.

In my situation, I bought my timeshare for $4500 and ended up selling it back to the resort for $400. After four years of trying to sell the timeshare, I couldn’t find one buyer.

Where to Buy a Timeshare

The best place to go to buy a timeshare is on eBay. This is because most people selling timeshares here have already tried everything to sell it and are selling it on eBay as a last-ditch effort.

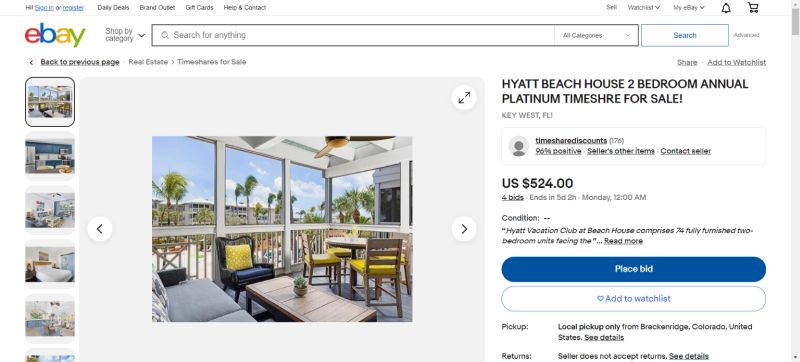

Here is one timeshare I found on eBay with a few minutes of searching.

This Hyatt Beach House is going for $524! Something like this would normally go for $20,000. Now, of course, you will need to research before you buy, but you can save a lot of money by avoiding the boiler rooms and hard-sell tactics.

Before you buy a timeshare, make sure you look at all the details and remember it can be hard to sell once you buy it.

Final Thoughts

Now that I’ve educated you a little more on buying a timeshare, are you still going to buy one?

I don’t want to scare you away if you have your heart set on it, but my goal in this article is to point out some of the major pitfalls accompanying a timeshare.

Ultimately, I hope I’ve educated you enough to help you avoid the timeshare scam companies and not get ripped off as I did.

If you have already bought a timeshare and want to sell it, read this article to learn how I did it.

Tuesday, I went surfing with a buddy of mine in Carlsbad, CA. He bought a timeshare in Hawaii on his honeymoon and was really sorry he had. His wife and him are since divorced and they are still stuck with the timeshare. They each have to take it every other year and split the expenses. I think I will be renting hotels instead.

I agree renting a hotel room or even going all inclusive is a much better option. The biggest problem with timeshares is once you have one it’s very hard for you to get rid of it.

I recently purchased a timeshare with Royal holiday in Mexico. When I tried to cancel, I was told that I was not able to since my contract was activated immediately. I I read an article saying this is not true, that I always have five days to cancel a timeshare contract. Here is the link:

http://www.timesharescam.com/timeshare-cancel/do-you-always-have-5-days-to-can-10

My question to anybody is: Does anyone have ever been able to recover any monies from Royal Holiday after the cooling off period is over?

Thank you in advance for your responses.

Hello my fellow timeshare owners, my name is Andrew A. and I currently work for the Vacation Ownership Group (Independent Timeshare Consulting Firm). Over the past two years, we have been investigating different timeshare companies and realized that more than 77% of timeshare owners were misrepresented and lied to when purchasing their timeshares. Being that our CEO, Vice President, and several managers used to be higher ups for the biggest company in the timeshare industry, they know all the ins and outs when it comes to the timeshare business. As we started getting deeper into the investigations, we found out there are over a half million timeshare owners that are victims of some type of misrepresentation and unethical sales practices. Apparently, these billion dollar corporations don’t have a solution for their upset customers because they blatantly don’t care and just want to make money. Well, our company went to the fullest extent to find a direct path to help these families out and get them a resolution to their timeshare issues. Please contact us, if you need any help with your timeshare situation and we will be more than glad to lead you to a solution. 1-800-381-9469 ext:120 or send me an email at [email protected].

please call me @ 608 7701415. i have problems with the sunset group in cancun , mexico. thank you, alan

Here is what I learned since buying our timeshare in Mexico, three companies later:

Any and all riders on a contract are meaningless once the timeshare is sold to another company. Since we bought our timeshare in Mexico, ownership has been transferred two times. The rider on our contract guaranteeing no increase in our maintenance fees over the life of the contract is no longer valid. We are at the mercy of the new owner who is threatening our credit rating. Does anyone have any advice? Our lawyer here has been of no help. Beware…Torrenza timeshares!

Patricia, I’m sorry to hear about your situation. My only suggestion would be to contact the resort that holds the timeshare and see if they have a buy back option avaliable . This is how I was able to rid myself of my timeshare, however you will not get much back for it. In fact I paid $4500 for mine and only got around $400 in return for selling it back. I hope this helps.

Hi … “Summer Sun International” – have you had any dealings with this company? … TATOC (Timeshare Association) do not list them as an “iffy” company.

Summer Sun is linked to Beauregard Marketing Solutions. Summer Sun International contacted me with a buyer for my holiday club membership. They wanted my credit card details to set up a escrow account as insurance liability in case I pulled out. I got independent advice and did not provide the details. It is a scam. Up front payments of any kind are illegal under Timeshare Regs 2010

Thanks for letting us know Derek.

Thanks for that infomation Derek, we have just had a call from Summer sun, saying they have a buyer for our timeshare. Just another scam!!

The problem with the TIMESNARE INDUSTRY is everybody who has been bilked out of their hard earned money won’t form a coalition to end this treachery and deceit. Timesnares in general seem to enjoy using FEAR & SMEAR tactics to convince even the most savvy of people to purchase a virtually worthless product, and then hang the contract over their head for a lifetime of remorse. It’s time to form an coalition of disgruntled timesnare owners and form our own rendition of the 99% to combat the SLEAZY HARD SALES PRESENTATIONS, and put an end this lugubrious situation for those who have been taken. Just remember they brought the hardball to you. Now it’s time to serve it back to them. Take it to the streets, and get the public involved. Stage a protest and march in the streets until our voices are heard. Get the NEWS MEDIA INVOLVED in exposing the things that need to be brought to public attention.

Add Grand Paradise Club to the list of rotten companies. They are connected to a company called Advantage Services in Las Vegas. That alone says volumes. Stay away

Thanks for the update Fred.

In all reality most are a scam and most are high pressure… Not all though… Mexico timeshres are the worst… How time share works is if you want to trade with the world you want something theWORLD wants to trade with… Locations such as SoCal, Hawaii on the beach… Maybe new York Manhattan club… Otherwise you are not going to get your exchange…

Can you help me get rid of Diamond Resorts? I still owe money?

Karen I also bought a Diamond Resort Timeshare …I used Mitchell Reed Sussman to get me out.I didn’t get anything back but got out of the contract and those fees every year.Google his name to get the numberI was very satisfied with the results.I wish I hadn’t paid for the timeshare in full but at lest im out of it.Its a shame we have to give them our hard earned money.Timeshares are nothing but scams.