High Return Investments: A Lending Club Review

Have you ever wanted to be your own banker, lending out money to respective borrowers and earning the same returns that they do? To do so 20 or 30 years ago would almost be a complete dream but today it is very possible through something known as social lending by a company called Lending Club

Have you ever wanted to be your own banker, lending out money to respective borrowers and earning the same returns that they do? To do so 20 or 30 years ago would almost be a complete dream but today it is very possible through something known as social lending by a company called Lending Club.

In this article I’m going to show you how you can take advantage of the same high return investments that your banker does without really owning your own bank.

What Is Lending Club

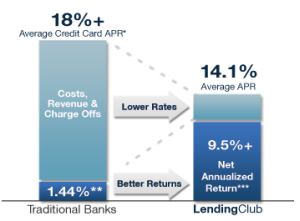

Lending Club is short term social lending company that allows it’s members to invest and borrow between each other through short term notes usually 3 to 5 years in length. By doing this they allow their members to seek out investments with high returns and borrowers with lower than normal interest rates.

Lending Club is short term social lending company that allows it’s members to invest and borrow between each other through short term notes usually 3 to 5 years in length. By doing this they allow their members to seek out investments with high returns and borrowers with lower than normal interest rates.

With Lending Club you can build portfolios with a variety of different notes across different risk levels. For example, if you have $5000 thousand dollars you could build a portfolio with nearly 200 different note, investing $25 per note.

On top of that you can also sell and trade notes with other members. However I should mention that these services are not available in all states. For example, Ohio has yet to be approved, in fact I’ve even emailed them several times asking them when they will so I can even take advantage of this opportunity.

What They Offer

When getting started with Lending Club they will offer you several different types of investment vehicles for you to invest into with your money. The first option is to open a standard account which requires no minimum balance to get started.

The send account you can open is a PRIME Account, which is an account which will give you greater access to the lending club team, but will require a minimum $5000 balance to get started.

On top of that Lending Club also offers retirement accounts such as a No Fee IRA

, ROTH IRA’s, SEP Plans, and Simple IRA to invest your money in, and all of which allow you to invest in the lending club notes.

However I should mention that in order to take advantage of the retirement options through lending club you will have to have a minimum investment of $10,000 otherwise you will have to pay a $100 annual fee to take advantage.

What Kind Of Returns You Can Get

Now that we know what Lending Club offers and what they do you might be wondering what kind of returns lending club offers. Well, you might be surprised to learn that they’re able to beat almost every bank on CD rates, in fact according to Bank Rate.com the highest earning 1 year CD in country is only seeking returns just over 1.50%.

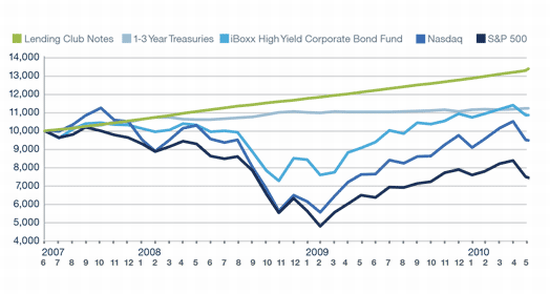

With Lending Club their returns have been much better, in fact if you look at the chart below provided by lending club you can see that a simple investment in Lending Club Notes in June of 2007 has earned around 9.5%.

Another thing I notices about this chart I should mention before I move is that Lending Clubs returns are much less volatile with literally no up’s and downs rather than the S&P 500 and other investments are far more volatile. However I should also mention that past performance does not indicate future results in any way and you can still lose money if a borrower does not decide to pay back on his loan.

Another thing I notices about this chart I should mention before I move is that Lending Clubs returns are much less volatile with literally no up’s and downs rather than the S&P 500 and other investments are far more volatile. However I should also mention that past performance does not indicate future results in any way and you can still lose money if a borrower does not decide to pay back on his loan.

What Kind Of Risk Is Involved

Next you might be wondering what kind of risk might be involved in doing something like this? To answer that question we need to look at the type of people loan that are being given out.

Currently almost 60% of all loans with lending club are for people who want to consolidate debt and refinance their credit cards. For example if someone has several credit cards with an interest payment of 30% they might be able to cut down that rate by getting a 5 year note with Lending Club at 12% and pay it back over time.

However these are not the only types of loans given out. Some are for home remodeling, business loans, medical expenses, or even car loans. On top of that the average FICO score for the borrowers that gets accepted will usually run between 680 to 720, which means that those who are getting the loans are qualified for them.

However these are not the only types of loans given out. Some are for home remodeling, business loans, medical expenses, or even car loans. On top of that the average FICO score for the borrowers that gets accepted will usually run between 680 to 720, which means that those who are getting the loans are qualified for them.

Next these loans are also less riskier because they can be diversified through several hundred different loans. For example you could in $5000 into one loan but if that one borrower would happen to miss payments and skip town you would lose everything you invested.

On the other hand if you would invest $5000 and spread it out over 200 loans and one of the borrowers would happen to default in their loan you would lose 0.5% of your loan, not 100%.

Finally, to prove that these investments are not that risky you need to look at the beta score on the investment. Beta is an investment term that measures how much risk a particular investment has, and is usually compared to the S&P 500.

In the case of lending club it score is far less compared to the S&P 500 which is a 1.00.

The Fees

Finally, you might wondering what the real cost to invest and borrow with Lending Club. First off, Lending Club will issue interest rates to it’s borrowers based on the amount of risk they have. Lending Club will charge a base fee plus and adjust for risk and volatility. This will depend on your loan grade, guidance limits, and credit history. The origination fee will range from 2.25% to 4.5% for riskier loans plus the risk and volatility.

As for the investing fees the Lending Club will charge a 1% service charge for to maintain the loan itself. They will also charge a if for collections if the borrower would happen to default on the loan.

An Offer You Can’t Refuse

So does investing in a 9.5% sound better than 1.5%? If so to get started all you have to do is check out Lending Club here. Once signed up you can will have to fund your account, once this is done you can either pick a portfolio like the one show here which is a moderate portfolio, or you could browse notes yourself and pick loans that you wish participate in.

Once you’ve selected your portfolio everything will be done by ETF (Electronic Transfer of Funds) and as fund are paid back by the borrower the money will be dispersed back to your account.

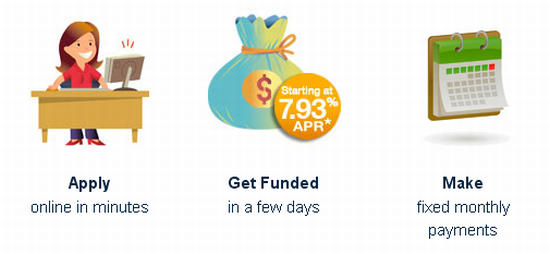

If you would like to take advantage of Lending Clubs personal loans you can apply online in minutes, get funded in a few days with interest rates as low as 7.93% APR, and make fixed monthly payments.

Finally, in order to achieve a high return on investment you don’t need to look to CD’s, money market accounts, or online saving accounts anymore. Instead take a look at Lending Club today.

Question or Comments? Leave Them Below.

Actually, there are ups and downs as borrowers will periodically default.

True their will be some ups and downs as nothing is guaranteed and you can lose money with these investments but compared to the DOW or S&P 500 you won’t see as many ups & downs.