How To Fix A Bad Credit Score In 5 Actionable Steps

Recently, I’ve been in the process buying a new house and as a result I’ve been thinking about the role my credit score and report is playing in this process. Think about it, if I have a bad credit score I could go from getting an interest rate of 4.5% or better, to a rate of 6% or higher. On a $120,000 mortgage that’s a payment difference of $600 to $720.

Recently, I’ve been in the process buying a new house and as a result I’ve been thinking about the role my credit score and report is playing in this process. Think about it, if I have a bad credit score I could go from getting an interest rate of 4.5% or better, to a rate of 6% or higher. On a $120,000 mortgage that’s a payment difference of $600 to $720.

This prompted me to check my credit score. Now luckily in my score it’s in pretty decent shape at a 741, but this isn’t the case for everyone so in this article I’m going to walk you through the steps on how to fix a bad credit score for free and get you back on track fast.

What Is A Bad Credit Score

Before I go any further I should define exactly what is a bad credit score versus and excellent credit score so we know exactly where the difference between bad and good lie. A credit score can go as low as 300 but as high as 850 with the typical scoring models.

A bad credit score range is usually 650 and less . The reason a 650 is considered a lower score is because most lenders like to see a score higher than this in order to get a loan. However this doesn’t necessarily mean some lenders won’t give out loans below this score in fact some will go as low as a 620.

To be on the safe side of things though you’ll want to a score at 650 and higher.

Step 1: Check Your Score

The first thing you need to do before fixing your bad credit score is you need to know what it is. To do this I suggest checking it in 2 different places. The first place to go is AnnualCreditReport.com. This site is sort of the official place to check your credit report. Here you can get all 3 of your credit reports entirely for free.

These reports are also fairly detailed, however in order to repair your score for each report you are going to have to pay a fee. Now if you don’t exactly like this option don’t worry I agree with you 100%. This is why I suggest you also check another site I like called CreditKarma.com.

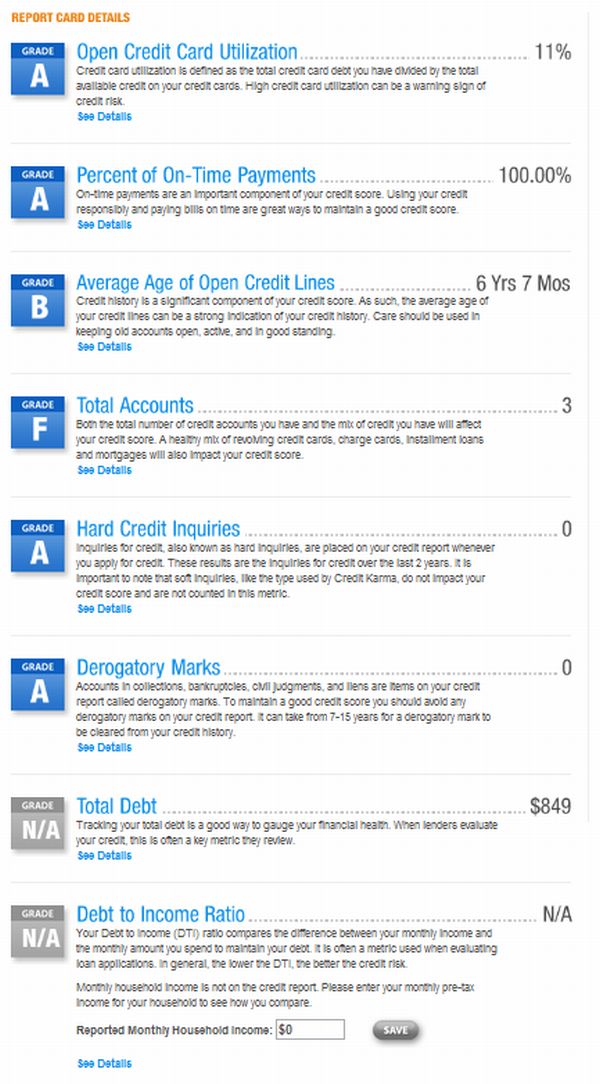

With Credit Karma you can check your credit report and score all for free. Now you don’t get all three scores or reports but rather one report and score which all comes from Trans Union. On top of that with Credit Karma you also get a simple report card that shows you exactly how you are doing in each individual area of your credit report. Below is a picture of mine.

Action Step: Go to Annual Credit Report and Credit Karma and sign up now for your free credit score.

Step 2: Check For Faulty Credit Issues

Did you sign up and check your score? If you didn’t stop what you are doing and don’t move on till you have done this. Trust me when you have your credit score in front of you, you’ll start to get that feeling of empowerment, which means you’re on the right track.

OK, now that you have your credit report in hand we are one step closer to improving your bad credit score. The next thing you need to do is scan your reports for any mistakes. It may take some time to actually fix some your financial mistakes on your credit report but when it comes to mistakes it will allow you the chance to erase a bad credit score.

Here are a few reasons mistakes tend to show up on your credit score.

- Similar Names. A common mistake found on peoples credit reports is when two people have very similar names. For example, if you have a last name of Smith it would be easy to get information crossed. In fact a close family member of mine had this very thing happen to him.

- Sr. Versus Jr. Another issue that typically comes up is when a father who has the same name as his son.

- Stolen Identity. Finally, if someone would happen to steal your identity without your knowledge they could open new accounts and do some terrible damage to your credit score.

Action Step: Take the time to look through all three of your credit reports from annual credit report to see if their are any mistakes.

Step: 3: List Out Possible Solutions

Now that you’ve gone through your credit reports and searched out all the mistakes it’s time to get down to business. The easiest way to erase bad credit report scores is to break your report down into specific areas and Credit Karma does a great job at this. So in this section I going to refer back to my credit report which I showed you in the beginning, and list some possible ideas as to how I could improve my score. To find your credit report card go to Credit Karma, sign in, and click on the tab credit report card.

- Increase The Age Of My Credit. This is a hard one to fix because you can’t just magically whisk a wand and the age of your credit will go up. Instead, the only way to fix this issue is to let time do it’s thing, besides the average age of my credit lines are 6 years and 7 months and anything over an average of 8 years will give the best score. On top of that I will not want to close any accounts because if I do I could risk shorting my age and lowering my credit score.

- Open More Lines Of Credit. Another problem I see with my credit score is the amount of credit lines I have open. In my case I have to open lines and one closed line of credit. To fix this all I would have to do is open another line of credit or increase the amount of credit on an existing line. However if you have bad credit scores it may be hard to do this and it may take some time for things to heal before you can even think about opening another line of credit.

- Lower My Debt. Finally, the last thing I could go about fixing a bad credit score is to lower the overall amount of debt I have. According to my credit report I have a total debt of $849. By paying off this entire debt I would in effect lower my debt to income ratio to 0%. Now I know a lot of you have far more debt than I do but one of the quickest ways to improving your score is to cut down the debt you have and to improve your debt to income ratio.

Action Step: Now that I’ve found a few areas I can use a little help with on my credit report how about you? Take the time now to look at your credit report card on Credit Karma and list some possible solutions to improving your credit score.

Step 4: Test Your Ideas

Now that we have some ideas of what we could do to improve and how to fix a bad credit score and report it’s time to test are ideas and see how much they might just improve are score, and the best way to do this is with the credit simulator from Credit Karma.

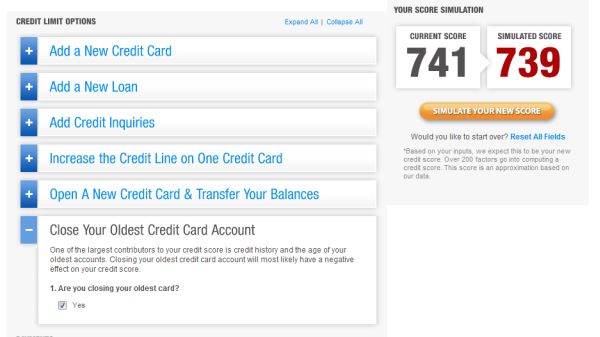

The first thing I tested was what would happen if I would cancel my oldest credit line. Obviously, it had a negative effect on my credit score but not enough to really drag my score down to much. In fact the simulator suggest that my score would only drop from a 741 to a 739.

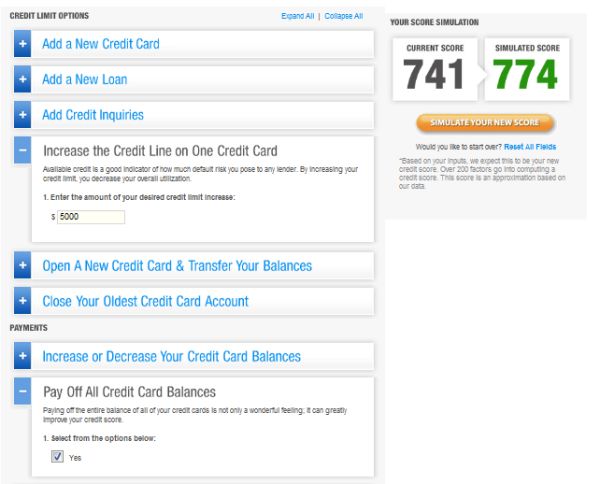

The next thing I did was is I increased the credit line on one of my credit cards by $5000 and I also paid off my current credit card balances. By doing this my credit score increased from a 741 to a 774, not bad!

Action Step: Run several different scenarios with the credit simulator to see what has the most positive effect.

Action Step: Run several different scenarios with the credit simulator to see what has the most positive effect.

Step 5: Implement Your Plan

Now that we’ve tested our ideas and we know what’s going to give us the best positive result going forward it’s time to implement the plan. If you have a lot of problems with your score don’t try to do everything at once. Stick to fixing one thing at a time.

For example, in my case I would work on paying off my credit card debt first and once I have this done I would work on increasing my credit line. In fact I found in my research that increasing an existing credit line has a more positive effect than adding a new credit card or loan.

Action Step: Implement your plan one part at a time. List the solutions in the order you want to complete them and get started now to erase your bad credit score.

A Final Thought…

Is their anything you would add or like to comment on? Feel free to give your input on how to fix your credit score and what you learned along the way.