Excellent Credit Score – 8 Factors That Make Up A Great Score

In my last article I talked about how to fix a bad credit score, so in this article I’m going to go a step further and cover what makes up an excellent credit score and show the 8 main factors that determine what your score will be. So if you’re someone who wants to understand just how your credit score and report works this article is for you.

What Is Considered An Excellent Credit Score

When it comes down to it their are all kinds of different scoring models for determining someones credit. In fact the 3 main credit bureaus, Equifax, Experian, and Transunion all have different ways of determining your score and the weighting that is given to a specific area of your score.

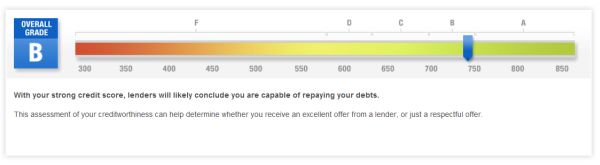

However a typical score will range from as low as 300 to as high as 850, and depending on the range of your score it could determine how lenders might perceive you. For example, the picture below show where my current credit score falls in the overall picture.

If you notice in the picture above a credit score falls in 5 general areas.

- A which is a score of 750 to 850.

- B which is a score of 700 to 750.

- C which is a score of 625 to 700.

- D which is a score of 575 to 625.

- F which is a score of 300 to 575.

So now that we know the range a score my be within lets cover the factors that determine that score in a little more detail.

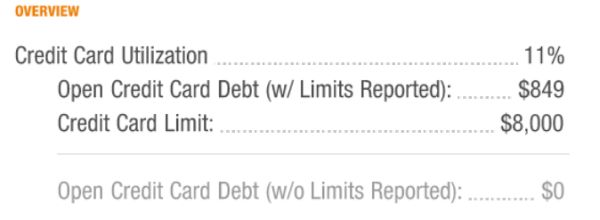

Factor 1: Open Credit Card Utilization

Weight Factor: High

Open credit card utilization determines as a percentage how much of your credit is being used on a monthly basis. This percentage is determined by dividing the total amount of credit card debt you currently have by the available credit. The higher this percentage the more it will damage your credit score. Below is a picture of my current scoring in this area.

I actually score well in this area, but if you would divide $849 by $8000 you would see that I only use around 11% of my total credit limit which is very good. Take some time to figure yours out now.

I actually score well in this area, but if you would divide $849 by $8000 you would see that I only use around 11% of my total credit limit which is very good. Take some time to figure yours out now.

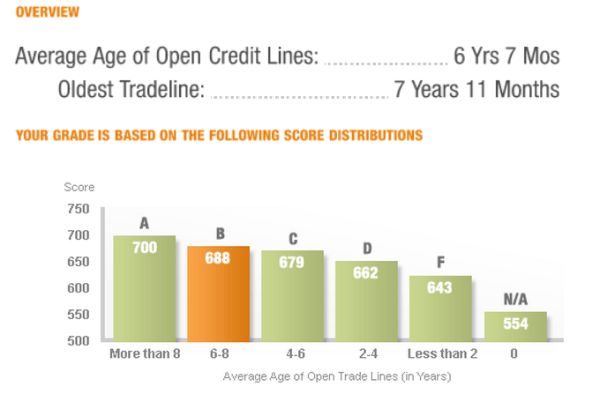

Factor 2: The Average Age Of Your Open Credit Lines

Weight Factor: Medium

Age plays a very important role in your credit rating. Think about it if you have an older credit line they could make the assumption that you can handle your credit decently. To determine your average credit age simply total up the age of each open credit line and divide by the total number of open credit lines over the total age. Below is a picture of what mine looks like.

In my case I’m pushing 7 years on my age which is fairly good. If you look at the chart above and you have an average age of 8 years or more you would be scoring really well in this area. In my case I score a B in this area but in a few years by just letting age do it’s thing I will improve my scores.

In my case I’m pushing 7 years on my age which is fairly good. If you look at the chart above and you have an average age of 8 years or more you would be scoring really well in this area. In my case I score a B in this area but in a few years by just letting age do it’s thing I will improve my scores.

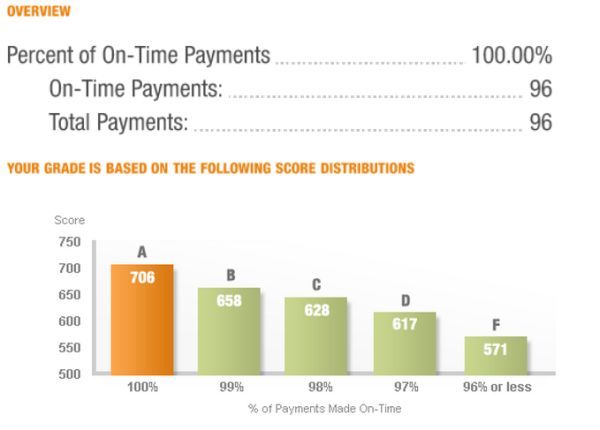

Factor 3: Percent Of On Time Payments

Weight Factor: High

Making your payments on time can make or break your credit score. In fact when I worked in financial services I worked with a loan officer who explained it as the kiss of death. The reason being because it only takes one time to miss a payment and it can have a huge effect on your score. Below is a picture of mine.

By looking at the picture above it’s easy to tell why I have an excellent credit score with 100% of all my payments made on time. In fact if I were to miss 1% of my payment which would be 1 payment in my case it would have a significant effect on my score, that’s why making all of your payments on time is so important.

By looking at the picture above it’s easy to tell why I have an excellent credit score with 100% of all my payments made on time. In fact if I were to miss 1% of my payment which would be 1 payment in my case it would have a significant effect on my score, that’s why making all of your payments on time is so important.

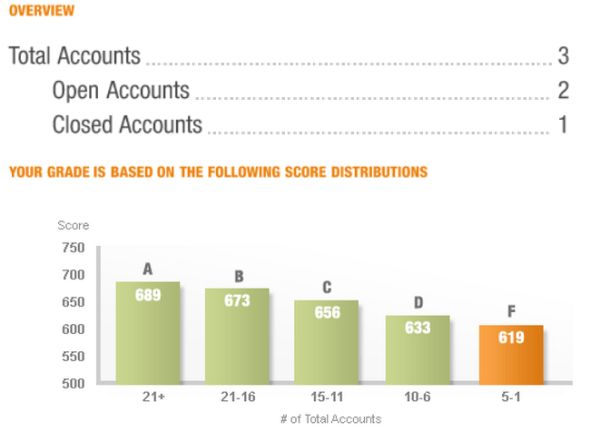

Factor 4: Total Accounts

Weight Factor: Low

By now you’re starting to get a good idea of what’s an excellent credit score and factors that are not but we are now only just half way through on the factors that determine your score. When it comes to the total accounts that you carry creditors will usually give those that have more accounts a better score since it show other lenders are willing to grant credit. I don’t typically agree with this since some people prefer to pay everything in cash and it’s usually these people who get burned playing by the rules and can’t get a loan as a result. To prove my point look at how I rank in this area.

I actually rank very poorly in this area because I only have two accounts. Now I could open more accounts but I choose not to because I don’t want to open myself up to the possibility of more debt. Good thing for me though that it carries a very low weight factor because I’m not planning on changing this any time soon. I should also mention if you have a similar problem with this like I do you could try upping the amount of credit on a current credit line. I’ve found this to be a nice fix.

I actually rank very poorly in this area because I only have two accounts. Now I could open more accounts but I choose not to because I don’t want to open myself up to the possibility of more debt. Good thing for me though that it carries a very low weight factor because I’m not planning on changing this any time soon. I should also mention if you have a similar problem with this like I do you could try upping the amount of credit on a current credit line. I’ve found this to be a nice fix.

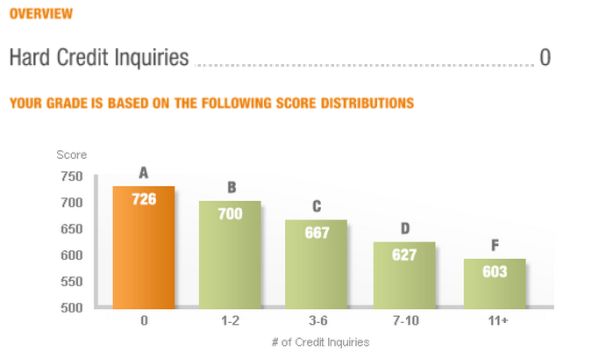

Factor 5: Hard Credit Inquires

Weight Factor: Low

A hard credit inquiry is typically only ever placed on your credit report when you apply for credit, such as a credit card, or loan of some sort. I should also mention that when you check your credit score with an online site such as Annual Credit Report that it is considered a soft inquiry and has not effect on your score what so ever. Below is a picture of mine.

In the chart above you can see I don’t have any inquiries at this time however I’m currently in the process of buying a new house and this will actually have a small negative effect on my score as a result. However it’s a necessary evil if I want to buy a new house.

In the chart above you can see I don’t have any inquiries at this time however I’m currently in the process of buying a new house and this will actually have a small negative effect on my score as a result. However it’s a necessary evil if I want to buy a new house.

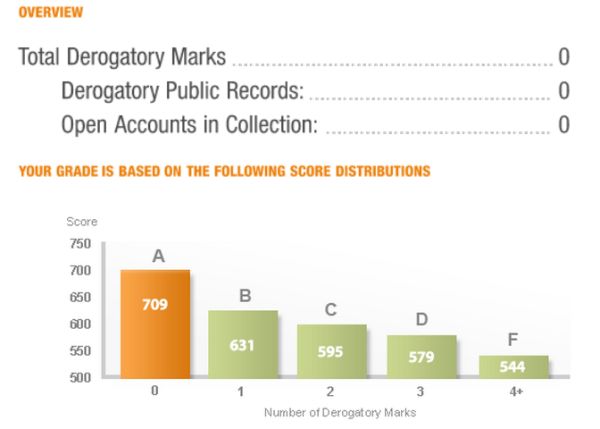

Factor 6: Derogatory Marks

Weight Factor: High

These are marks that count very high against your credit such as bankruptcy, tax liens, and foreclosure. In fact these marks can take anywhere from 7 to 15 years to have removed from you credit score, and some marks can stay on indefinably. For example, if you had a tax lien against you and you didn’t pay it off that mark could remain on your report until you pay it off. Below is picture of my marks.

Obviously, I don’t have any issues in this area but by having just one mark in this area it could significantly lower my score, so take my advice stay way from these type of marks and you will save yourself a ton of financial hardship.

Obviously, I don’t have any issues in this area but by having just one mark in this area it could significantly lower my score, so take my advice stay way from these type of marks and you will save yourself a ton of financial hardship.

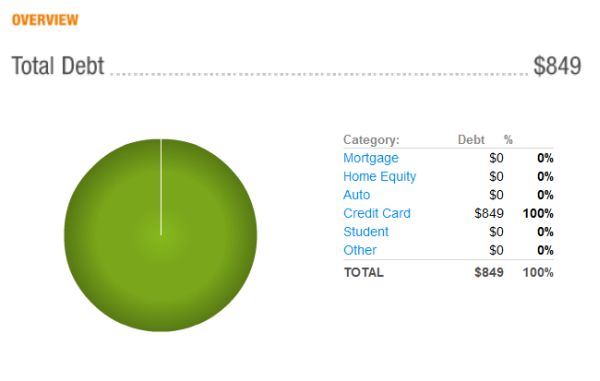

Factor 7: Total Debt

Weight Factor: High

The last 2 factors I’m going to cover in this article are not necessarily going to be scored in your credit report, however the total debt you carry plays a big factor if you want to get a loan for any reason. Having to much debt shows lenders that you may not be able to pay it off and may not be able to handle any more debt. In my case I have very little debt, check out the chart below.

I should also mention paying down your debt in full is one of the quickest ways to improving your score. To learn more about how to do this check out my 8 Step Debt Plan.

I should also mention paying down your debt in full is one of the quickest ways to improving your score. To learn more about how to do this check out my 8 Step Debt Plan.

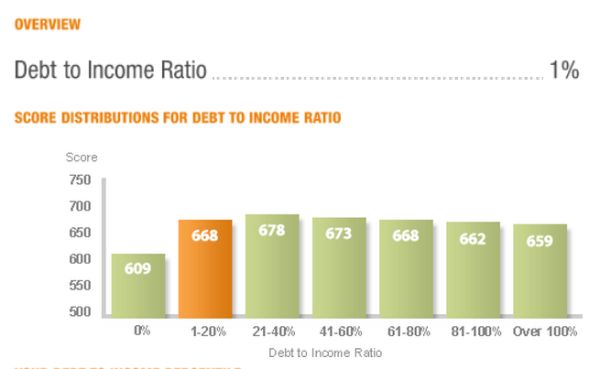

Factor 8: Debt To Income Ratio

Weight Factor: High

The final factor to consider is your debt to income ratio. This is a ratio that determines how much of your monthly income goes towards debt payments. For example if you earned $5000 a month and had a total of $1500 in debt payments a month you would have a debt to income ratio of 30%. Below is what my debt to income ratio looks like.

The lower your debt to income ratio the better but if you want to have the best chance of getting approved for a loan try to get your debt to income ratio down to at least 36% or less.

Questions or Comments?

Now that you know what is an excellent credit score do you have any questions or comments to add? Is their anything that should be added or do you have a question about your own credit score? You credit is very important so take the time to check your report now.