4 Options To Getting Affordable Life Insurance For The Elderly

In a recent article I wrote about how to find cheap life insurance for the elderly. In this article I want to go a bit further,and I want to show you where you can actually find affordable life insurance for older people.

In this post I am going to show you four different options that you can take to find life insurance. All of these programs are offer through the AARP so you will need to affiliated with them in order to take advantage of this option but the cost is only $16 a year for a membership. These life insurance options are all provided through New York Life so you will have to check to see if this program is available in your state as well.

AARP Level Benefit Term Life

This is affordable life insurance for elderly people who will need as much a $50,000 of coverage. The best thing about this policy is that their is no waiting period, no medical exam, and getting accepted into the program is based on your ability to answer 3 simple questions.

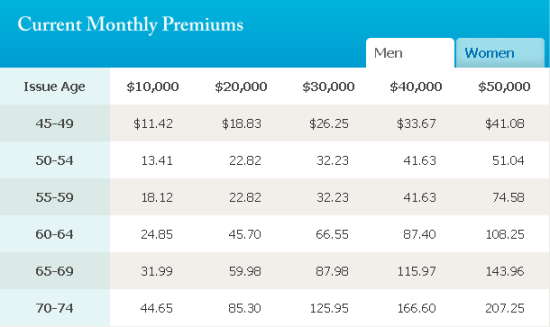

However one big down side to this policy is that the insurance rates can increase over time as you get older. On top of that you must be between the ages of 50 to 74 to get the policy and it will last no longer than age 80. Finally, not everyone will be accepted, if you have a preexisting condition you may not get this policy. Below is a list of rate you could expect to pay.

Extra Protection Term Life

This policy is exactly like the last policy but can offer you between $50,500 to $100,000 in coverage. In order to qualify though you will still have to answer a few medical questions, and rates can increase over time.

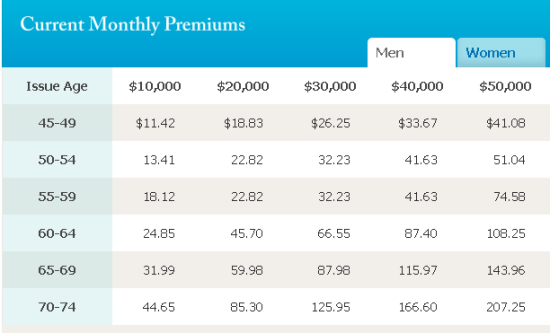

However you again will have to do no medical exam, and to get this coverage you will have to be between the ages of 50 to 74 to apply and coverage will be dropped after age 80. Below is a list of rates that you could pay.

AARP Permanent Life Insurance

Now of the last two options the big down side each of them was that they only lasted until age 80 no matter what. With AARP if you want affordable life insurance for the elderly till the day you die you will want one of the last two option. First, the AARP permanent life insurance policy.

With this policy you will be able to get as much as $50,000 of coverage and you can apply between the ages of 45 to 80 years of age. You will again have to answer a few medical questions and will not have to take a medical exam.

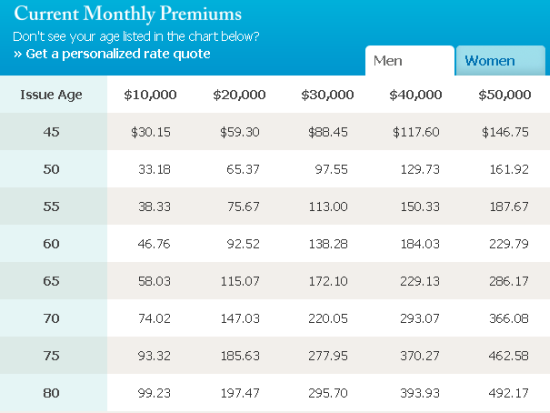

Most people who apply for this plan will be accepted and rates will not increase unlike the first two options. To learn more about the rates check the chart out below.

AARP Guaranteed Acceptance Life

Finally, what if you need a life insurance policy to last till you die that will cover all of your final expenses but you have a preexisting condition that prevents you from getting coverage as in the last three options then you will like this option.

The answer is the AARP Guaranteed Acceptance Life Insurance Policy. This a policy that offers up to $15,000 of term life insurance and will last as long as you live.

It’s also very affordable life insurance of old people who want don’t want to burden others with funeral expenses. With this policy you will have no required medical exams or questioning. Everyone is guaranteed to br insured. On top of that rates will never change once insured and you can enroll between the ages of 50 to 80.

However their is one down side to this policy I should mention. If you happen to die within the first two years of owning this policy from natural causes you will only be paid a portion of your coverage. This is due the fact that nobody can be turned down and they don’t want people to buy coverage while lying on their death bed and still get the full benefit.

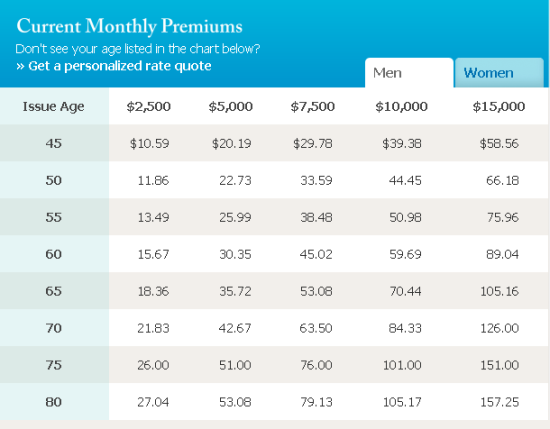

On the other hand if you happen to die from an accident of some kind you will receive the full benefit and the 2 year rule will not apply. To learn more about the premiums and how much this type of policy could cost you look at the chart below.

Is AARP Life Insurance For You

Now that I’ve covered each plan did you spot one that works for you. To enroll for coverage you can check out the AARP Life Insurance website to learn more.

Finally, I should mention if do enroll for a policy and you decide that it not right for you can cancel anytime in the first 30 days you will be refunded 100% of your premiums. So get started now.

Chris H.

looking for life insurance for my mother, who has a small policy with aarp, she is 82. can u help me

Karen it all depends on your mothers condition and how much coverage she is looking for. I ran a few quotes on http://www.wholesaleinsurance.net and found a 10 year term for $50,000 worth of coverage for $230 a month. This is if she is in good health though. Check out this site and see if you can find something there. I hope things work out.

Best way to get a Life Insurance for seniors is through an independent financial advisor that specializes in senior life insurance. He/she will shop a life insurance policy among many carriers.

My husband had new york life insurance for eight years but when I read reviews about it a lot people say it’s a scam is this true have we just throw money away??

Hi Robin, New York Life is not a scam. They are a legit insurance company founded in 1841. You can read more about it here https://www.google.com/finance?cid=13342162 I hope this helps.

What is the name of the term life insurance that you can get until the age of 80/90.