4 Myths about Buying Silver Demystified

Oftentimes, perception is used as a driver of investment decisions on the market.

When it comes to investing in precious metals, the perceptions can be misleading, perhaps making you buy or sell at the wrong time.

When it comes to silver, it is prudent to follow facts for better protection against inflation and impressive returns on investment.

In this post, we demystify the common myths when targeting to buy silver.

#1: Silver is a Highly Sensitive Metal Economically

When looking forward to buying silver bars, the argument that silver is highly sensitive economically is incorrect. During the 2007-2008 recession, silver demand from the industry, jewelry, and photography dropped by approximately 80 million (CPM silver Yearbook).

The mine supply increased by approximately 30 million ounces, indicating that investors had to buy more to push up the price significantly. But what was the result?

Between 2008 and 2009, the price of silver did not fluctuate much. Indeed, it even experienced some major swings. Therefore, when investing in silver, especially during a recession, expect the price to have minor movements because the market adjusts promptly to meet the emerging demand.

Because of this stability, silver can be an excellent pick for protecting your investment.

#2: Silver Bars and Coins are Plentiful Compared to Gold

This is a common misconception that you are likely to get when buying silver bars online. Indeed, we must say that the reverse is true.

For example, it is estimated there are about 1.4 billion ounces of silver bullions and coins on the globe.

Yes, it is true that about 80 million more ounces of silver than gold are added to the market, but it will require a very long time for silver quantities to reach the levels of gold.

#3: High Price of Silver can Push Down the Demand in the Industry

This is another myth that is not supported by facts, and you should not use it to make investment decisions.

If you take the period 2000-2010, the demand for silver remained relatively flat. During the same period, the price of silver rose from $4 to $20, implying that the reverse is indeed true.

When the price of silver starts moving up, more investors are willing to buy, expecting to get some returns. Therefore, do not shy away when you notice silver prices taking a bullish trend.

This might be an excellent time to buy silver. Remember to always work with a trusted dealer, such as GoldAvenue to reduce the chances of getting scammed.

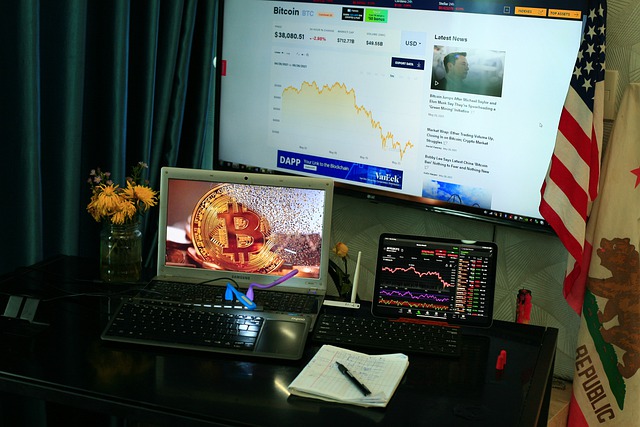

#4: Buying Silver is Difficult

This is a falsehood. Some of the investors who hold the view are mainly used to buying stocks via brokerage and argue that any other investment is tough to buy. The truth is that investing in precious metals, from gold to silver, is pretty straightforward. Actually, you can buy from the comfort of your living room.

All that you need is to identify a good online silver seller and place your order. The silver bars will be delivered to your doorstep. Remember that just like gold bullions, you also need to have a good storage unit in your home. The bars can also be delivered to your selected repository, but this will come at an additional fee.

If you want to invest in silver, do not be distracted by the myths we have listed above. Instead of following the myths, which are very many, you should consider following expert investment advice.

For example, experts can help you pinpoint when a recession is about to start, giving you a signal to reduce the investment in stocks and increase that of silver.

![Understanding Risks and Returns in Business [Using This Simple Analogy]](https://stumbleforward.com/wp-content/uploads/2017/11/pexels-photo-59197.jpeg)