What You Should Know About Guaranteed Acceptance Life Insurance Before You Buy

Not many things are known about guaranteed acceptance Life Insurance also known as guaranteed issue life insurance. This is a life insurance policy that guarantees coverage no matter what your health or risk you take in life. However before you consider guaranteed acceptance life you may want to read over these talking points first.

5 Points To Consider

Age. First off, guaranteed life insurance usually has an age restriction for those usually between the ages of 50 to 85. However just because you fit this age range you may want to consider other options first such as looking to a term policy first. In fact at the end of this article I’m going to show you the difference in cost and benefits between acceptance guaranteed life insurance and a normal term policy and show you which is better.

Coverage. Second, you need to consider the amount of coverage you will need. The typical guaranteed policy will usually go no further than $15,000 as with the AARP life insurance policy with New York Life. This much coverage will only be enough to pay for funeral expenses.

Cash Value. Third, you need to consider if the policy contains a cash value or not. The reason I bring this point up is because if you are considering a guaranteed acceptance life insurance policy I recommend you stay away from them and only deal with term or non cash value policies only.

The reason you should stay away from cash value policies is because at an older age you won’t see much benefit from it. For example if you bought a $100,000 universal life policy at the age of 20 and by age of 60 you had $80,000 in the cash value you would have 80% of your life insurance paid up and you would only be paying for $20,000 worth of coverage. However at the the age of 60 a cash value policy doesn’t make much sense because you won’t be able to offset the cost enough to make it worthwhile. This is why I suggest a term policy.

Ratings. Fourth, you also need to consider what kind of rating you will get by going with guaranteed acceptance life insurance. By applying with a traditional term insurance policy you will need to answer medical questions, get a blood test and even take a physical. This may all sound like a lot of work but the result is if you turn out to be fairly healthy your insurance premiums will be a lot cheaper. With guaranteed life insurance you’re more than likely to receive a very low rating such as standard or even worse substandard. This in the end will drive premium prices way up.

2 Year Rule. Fifth and finally, you also need to know that guaranteed acceptance policies have what is known as the 2 year rule. This is a rule that states that if you were to die from natural causes within the first two years of owning the policy would receive nothing or a depreciated amount.

The reason guaranteed life insurance has this rule is because they don’t want people who are on their death bed to sign up for this policy and pass away a day later and only make one payment. So to deter these types of situation they have this rule. However if you would happen to die from a freak accident such as a car crash you would receive the full amount.

How Much Guaranteed Acceptance Life Insurance Cost

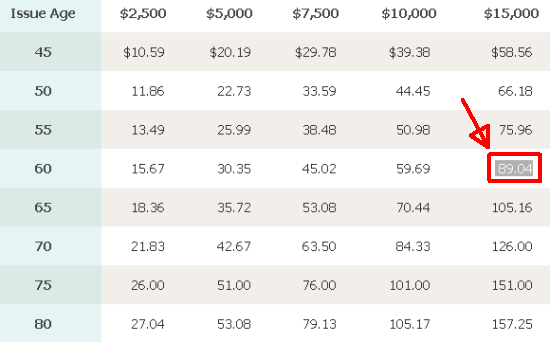

If you look at the chart below you can see how much a typical guaranteed acceptance policy for someone between the ages of 45and 80 might cost. So in this example I’m going to cover the difference in cost between a guaranteed policy and a traditional 30 year term policy.

If you notice on the chart above you can see that a 60 year old man getting $15,000 in coverage will run around $90 a month. So compare a similar policy I ran a quote on a 30 year level term policy and here’s what I found.

If you notice on the chart above you can see that a 60 year old man getting $15,000 in coverage will run around $90 a month. So compare a similar policy I ran a quote on a 30 year level term policy and here’s what I found.

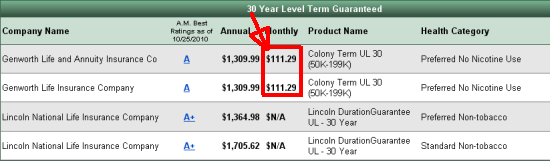

If you notice the cost of a traditional 30 year term policy would cost a healthy male around $112 a month. This is $22 a month more in cost, however with the guaranteed policy you are only getting $15,00o of coverage and with the traditional policy you are getting $100,000 of coverage. Need I say more why a traditional term policy is much cheaper.

Then to boot I should also mention if you would go with a shorter term the premiums get even cheaper. For example a 5 year term policy for a healthy 60 year old male would only run around $50 a month for $100,000.

In the end knowing the fact about guaranteed acceptance Life Insurance can mean the difference between paying to much to saving some serious money, which would you rather do?

![What is the Best Age to Get Life Insurance? [Includes Rate Chart]](https://stumbleforward.com/wp-content/uploads/2020/02/chess-board-protect-yourself-life-insurance.jpg)

Can I get more than one guaranteed acceptance life insurance policy for more than $15,000?

Thank you.

Unfortunatly not David. However this doesn’t mean you couldn’t with several different insurance companies who offer guaranteed acceptance life. Thanks for your question.

I am looking for a policy to cover my aunt and my head is swimming from all the information out there. We are leaning more towards the guaranteed policies because she does have some medical issues. I only want enough to help cover any major medical costs if something happens to her. Her funeral expenses are taken care of but she is only on Medicare and of course they only pay 80%. Can you give me some insight on which companies are better than other? I’m getting quotes but some are outrageous.

Angela,

A guaranteed policy with the AARP will only get you $15,000 in coverage. Check out my article on high risk life insurance companies as well, you can check that out here: https://stumbleforward.com/2010/10/22/high-risk-life-insurance-companies-5-companies-that-may-accept-your-policy/. In this article I cover 5 different companies I recommend to look into for impaired risk cases.

Thanks for the question.

Chris

Is it possible to buy $5k life insurance on 75 year old spouse to pay off credit card. Can I buy the policy for my husband and be the owner/beneficiary of the policy, or does he have to initially be the owner of the policy? It would upset him for me to ask him to get a policy, but it upsets me to pay off his credit card which I would be responsible for as his wife.

You can retain ownership of the policy however in order to get the coverage on your husband he will need to answer some medical questions in person and sign several forms that go along with getting a policy such as the application, the HIPPA form, and any other state required forms.

Thanks for the question.

My husband is 64 and has congestive heart failure. I need a policy, but don’t know which way to go, because, there is so much information out there. Can you recommend, or guide me to make the proper decision, and get a decent amount for burial, etc…?

Hi Jeg. I’m sorry to hear about your husbands situation. In your situation I would go with a Guaranteed Acceptance policy with the AARP. However under one condition, if you don’t feel your husband will live pass the next 2 years this policy will work just fine but they have a rule in this policy that will not pay the full amount unless they live the full first 2 years. Otherwise you will only get a depreciated amount.

As far as the coverage goes you can only get up to a $15,000 policy but you can always get less if you need which would be plenty to cover the cost of a burial. You may want to talk to your local funeral home and ask them how much a burial will cost just to get an idea of how much coverage you will need to get.

Finally, if the AARP Guaranteed Acceptance Policy doesn’t work you may want to consider a high risk policy. Here is a link to a few companies that I recommend https://stumbleforward.com/2010/10/22/high-risk-life-insurance-companies-5-companies-that-may-accept-your-policy/

I hope this helps.