Business Finance: 4 Top Reasons Why Your Business Needs a Reserve Fund

Your company is a single point of failure.

If something happens to your company, it can have devastating effects on you and your employees.

Therefore, it’s crucial to have a reserve fund in place for times when the unexpected occurs.

This article will talk about four reasons why every business needs a reserve fund!

1. Financial Flexibility

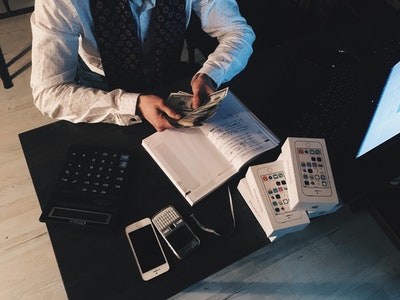

A reserve fund is a nest egg that you don’t touch in your day-to-day operation of the company. You can use it for dealing with emergencies and other unforeseen circumstances, such as replacing equipment or paying bills when cash flow isn’t what it should be.

A good rule of thumb is for every $100,000 in annual sales; you should have a reserve fund of $25-50k.

The main reason your business needs a reserve fund and a rolling reserve is to avoid financial distress and give yourself the financial flexibility you need.

A reserve fund is the best insurance against cash flow problems, unexpected emergencies, and business crises. It’s a way to financially protect your company in case something goes wrong.

2. Alleviates Financial Stress

When recessions occur, businesses have less revenue and more expenses to pay as they try to maintain their business. This means they have less money to spend or save for the future, so a reserve fund helps them continue operating and maintaining their assets in these situations.

The main reason your business needs a reserve fund is to avoid financial distress and give yourself the flexibility you need in case something happens unexpectedly. Even if things are going well, it’s essential to plan for when they don’t go well. A reserve fund is the best insurance against cash flow issues.

3. Avoid Debt Accumulation

A reserve fund is a critical piece of your business plan. You will use it for emergencies and provide additional capital when you need it. Without it, you risk accumulating debt because of unexpected expenses or changes in the economy. In addition, a strong balance sheet provides an effective defense against threats from outside forces like economic downturns or natural disasters.

A reserve fund will help ensure that your business can withstand such external forces and continue operating so you can keep providing goods or services. Reserves also allow for the systematic replacement of equipment and assets, ensuring a healthy inventory turnover rate while saving money by reducing the need for large purchases.

4. Chargeback Prevention

Chargeback prevention is a key component of customer service and reducing business losses. A common chargeback scenario includes an unhappy customer who disputes the amount they were charged for goods or services but accepted them at the time of sale.

Usually, the credit card company will review both sides’ arguments and determine whether to honor, deny, or settle the dispute. If there is no evidence to support a customer’s claim, the credit card company will typically side with the merchant.

For merchants to build and maintain good relationships with their customers, they need to get ahead of situations before they escalate. Chargeback prevention can help an organization monitor accounts where it identifies potential high-risk customers and take steps to prevent them from incurring chargebacks proactively.

Reserve funds have the potential to be a powerful deterrent for chargebacks by allowing merchants to immediately resolve any disputes before they escalate.

Conclusion

As you can see, a business reserve fund is not only crucial for the safety of your company in case something goes wrong, but it also protects against unforeseen circumstances.

In addition, creating and maintaining an emergency fund will help ensure that your company stays afloat even through tough times.