June 2013 Budget Update

Welcome to the June 2013 budget update, where we will take an indepth look at my personal budget and see just exactly how I’m doing. My goal here is to be as transparent as possible and show you just what I doing to manage my budget and hopefully help you manage yours better.

I started my budget in April of 2013 using Mint.com, which at this point has only been 3 full months but I’ve learned a lot in those few months. I’ve learned that every penny counts, and that watching your money closely is the best way to ensure financial success.

If you are just getting started with your budget or a long time veteran of budgeting you may want to following along as I share my numbers. To do that you can sign up to my RSS here or Subscribe to Stumble Forward by Email to get regular updates delivered straight to your inbox.

With that said let’s get started.

June 2013 Budget Overview

With June and gone and over with it’s time to reflect and see just how well I did and all I have to say is that I didn’t do just to bad. I’m not going to say the worst is over but I’m getting closer to steadier ground.

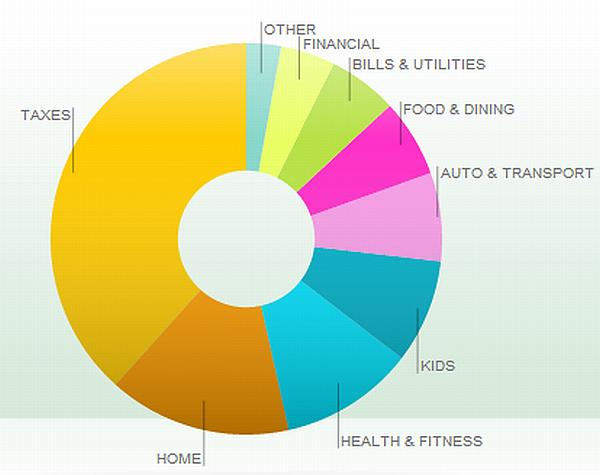

Below is an overview of exactly what I spent my money on this month.

In total I spent $7106.46 but that can be deceiving because I had to pay my quarterly estimated taxes this month which totaled $2,727 for federal and state taxes owed. What’s deceiving about this is that my company reimburses me for the taxes paid. So when you look at the chart above ignore the taxes I paid.

This month my mortgage takes the top honor for the highest spending category which is really a good thing and the way a typical budget should be. I also made a few small adjustments to my budget for June by adding a Kid Savings Account budget. My wife and I have been getting into saving extra cash for kids lately putting a few bucks away here and there.

Overall I came out $209 above my budget which isn’t bad but I know I can do far better and with my recent post about paying off my $6500 credit card debt I know I’m not far from making that happen.

Where I Did Well This Month

As for the month overall I’ve done very well. If you may recall from last budget update back in May I ended up $5oo in the red which was a really tough month. This month did far better as I mentioned above.

Here are a few of the areas I did well in.

- Natural Gas Bill – With summer in full swing I only spent $27 on natural gas last month which is great because normally I budget $80 a month here.

- Electric Bill – The second area I did decent in was my electric bill. In June I spent $163 which I typically budget $180. I’ve actually been spending less on electric this summer since it really hasn’t been just too hot for us here in Ohio.

- BabySitter – The final area I did really well in June was with the babysitter, since my babysitter was off for a week I spent the week carting the kids around to grandma and grandpa’s house which saved me a lot of money. Typically I spend around $650 a month but in June I only paid $354 which saved me a whopping $296.

Where I Failed This Month

Now that we know where I did well there were still a few bumps in the road. Below is where I didn’t do so well last month.

- Fuel Budget – First off we have the fuel budget. With making payments on my gas card and paying for gas in cash we ended up paying$520 for the month when we typically budget around $500. However now that this card is paid in full we should be doing a lot better with it in July.

- Grocery Budget – The second area we overspent in was the groceries. For the month of June we budgeted $400 and ended up spending $457. It always seems like when we get to the end of the month it’s where we really start biting the bullet and end up going over.

- Doctor Budget – Finally, the area I went over the worse was with the doctor bills. I’m still working to pay off my sons tubes for his ears which we did back last December, however I should be making the final payment on that here in September. For the month of June I budgeted $300 in doctor bills and ended up spending $430, a whopping $130 more than I wanted to pay.

Final Thoughts…

When it comes down to it even with overspending on the groceries, fuel, and doctor bills, I still came out ahead which is the important thing, and knowing that makes all the difference in the world.

For now I’m just going to hold steady with my budget until I close on my mortgage for my house here in July, and finish some of the final landscaping tidbits. I’m still walking on some shaky ground right now and one wrong move could screw it all up, so for now slow and steady is the course.

So how did your budget turn out for June? Share your thoughts and comments below.

I think all in all you did pretty good. The grocery budget is way below the Nat’l average. Is health and fitness so high b/c it includes insurance costs? Otherwise that might be one area you could cut back on. Keep up the great work, Chris – you’re getting there! And I think June was a tough month for many budgeters. I know it was for us…..

I think you did well with your food budget. Better than us!

Thanks Laurie, my health and fitness category is so high because we buy vitamins and probiotics which helps with digestive health. On top of that we do a lot more natural health stuff before taking our kids to the doctor, so really it’s actually saving us from paying all the doctors bills since my health insurance sucks.

I think we’re doing well with our food budget as well and we are below the national average compared to what others are spending which is great. I’ve considered uping it to $450 instead of $400 because it always seems that this is the first budget we blow but my worry is that it just gives me permission to spend more.

Our June went okay. We had some unplanned expenses which sucked…but we made more money than we had planned so it made up for it. July is looking much better in terms of staying on-budget.

Unplanned expenses are my biggest problem right now. In the last 3 months it’s been dental bills, doctor bills, and house stuff. Our July isn’t looking to bad right now but I just had a few more doctor bill roll in so I know I’m going to be blowing that budget this month.

Well managed budget. Also your improvements are good, gas reduction from 80$ to 27$ is significant. Good luck for july and hope you have better one too

Hey mate! You had a decent month at least you came ahead and that’s the name of the game. We only were up +0.09% for June but we had many expenses to pay for as well including taxes, dog surgery and a landscaping project so not all is lost. keep up the good work.

Good job!! I did well in June budget-wise as well. I am a little nervous though that gas prices are going to start moving up again. I was under my budgeted amount last month so hopefully a rise in prices won’t put me in the red this month.

Thanks Rita, with natural gas low right now and it being summer it saves a lot of money, but I’m guessing it’ll go back up this winter when I have to heat my house again. As for July things don’t look to bad yet but I know my doctor bills are going to be high this month again.

Thanks Mr. CBB. I still have to do some landscaping and plant my grass yet so I know I’ll be dealing with these expenses as well. Once the medical debt is paid in full, my mortgage is closed, and the landscaping is done I will be in a much better position and able to save a lot more money.

I agree Jon gas is hovering around $3.36 a gallon right now for me which is a lot better than a month ago when it was close to $4.00 a gallon. However I expect it to go up a little more because people are going vacations right now.

I think you did a great job on the budget this month. Remember its all a work in progress and the best part about time is that you hopefully get better and it eases with time. Slow and steady wins the race! As for us we got hammered on food. Having all five of us at home for the summer is definitely going to be tough on the grocery bill. Electric was up as well but again everyone is home so it is expected. Hopefully July works out even better for you.

Thanks Thomas. That is a great point a budget is never finished but rather always a work in progress by improving you finances one month at a time. I can honestly say that it ‘s been the case for me and I plan to make each month a little better one paycheck at a time. Thanks for sharing your thoughts.