Budgeting Solutions: Why You Should Choose Mint.com

If you’re like me you hate budgeting. With so many things going on in life sometimes it can be hard to keep a budget that you can stick to. If you combine that with the countless other budgeting solutions out there it’s hard to choose one that’s right for you.

However in this article I’m going to cover one personal budgeting solution that will make things for you effortless and more streamlined, it’s called Mint.com. By the end of this article you will have a clear understanding why this option beats out all other financial budgeting solutions, but I will also give a few down sides to make this review fair and honest as well.

However in this article I’m going to cover one personal budgeting solution that will make things for you effortless and more streamlined, it’s called Mint.com. By the end of this article you will have a clear understanding why this option beats out all other financial budgeting solutions, but I will also give a few down sides to make this review fair and honest as well.

The Pro’s

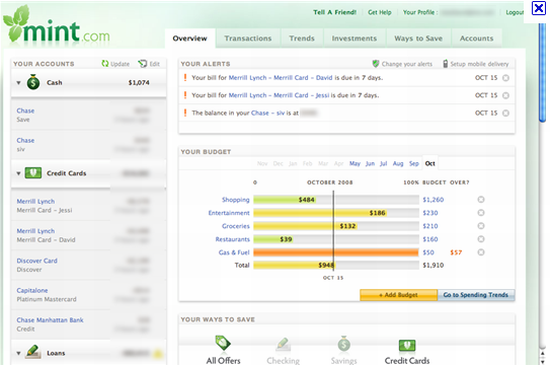

The first thing that makes Mint.com so great is the fact that you don’t have to spend all the time inputting all of your financial transactions into your account. With Mint all you have to do a search for you financial institution and sign up and your done.

Mint will do the rest, they will pull all the financial data from your bank, credit card companies, even from your retirement accounts and place it all in one easy dashboard for you.

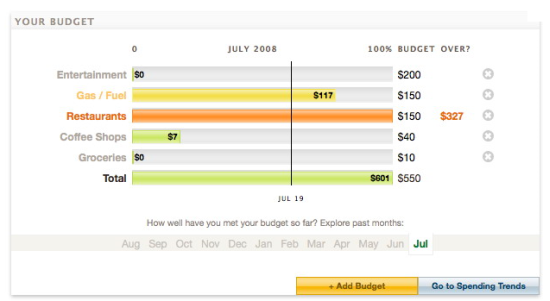

Second, it makes it easy for you to set up a budget. Once you have all of your financial information in place you’re ready to create a budget. Simply go to the budgeting tab and set the numbers to your preference. That’s it, you don’t have to do anything else.

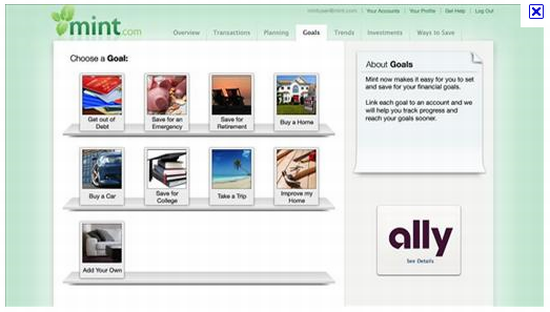

Third, as great as this tool is to use for keeping a budget it does much more, you can also set goals as well. With Mint.com you can pick from predefined goals like buying a new house to getting out of debt. Mint will show you the progress as you work towards your goal.

In fact I currently running a goal in Mint to buy a new house and the great thing about it is that Mint is showing me ways to achieve this goal by walking through a step by step process of how to accomplish this option.

Finally, the last thing I like about Mint.com is that they have an app that allows you to check your account on the fly. I like it best though when I’m out shopping for groceries and I can use it to check over my budget to make sure I don’t go over my limits.

The Con’s

Now that we know all the great things about Mint I want to cover a few con’s to make this review fair and balanced because the truth is nothing is ever perfect.

The first thing I didn’t like about Mint.com was that I wasn’t able to add my bank due to the fact that they were a smaller local bank. Now Mint does have a form that allows you to submit other banks that should be added however when I went to add my bank it took several months for them to add it. In the end you can get you bank added to Mint.com but it will take some time.

Second and lastly, I also found Mint.com could be a bit frustrating if your not good with computers or handling your financial information. The easiest way to sign up your bank and other financial institutions is by having an online accounts already set up with these financial companies because if you don’t you will have to set one up.

On top of that some financial institutions don’t have access to an online account. For example my local credit union doesn’t have access to an online account and if you use a local bank like I do you may find this a bit of a frustration at first.

Who Mint Is For

Finally, now that we know the the good and the bad about Mint.com you may be wondering who Mint is for. In my mind I believe everybody should be using Mint but their are a select group of people I think could really benefit from them as well, so here are a few I recommend.

People looking to get debt free. With Mint they can help those that are looking to get debt free and monitor their finances. With Mint it allows you to set up a debt program that will work with you to get you debt free.

If you’re saving for your retirement, Mint will help you track and plan your retirement as you go. With Mint they will walk you step by step through a plan to help you get your golden years in good order.

If your buying a house. Finally, I found this tool to work especially well if your planning to buy or build a house. They will work with you to get a plan in place to make that dream home of yours become a reality.

Call To Action

So is Mint for you? You might be wondering what Mint.com will cost you and that’s the best part, Mint is free for everyone. It doesn’t cost you anything to sign up and start adding your accounts. So why not join Mint, one of the best personal budgeting solutions out there because it’s an investment in your financial future.

This is very helpful. I called the John Cummuda toll free line and they are sending me some “free stuff” and I have been told I have 30 days if I do want to return it. Can I do this or does this become problematic to cancel. Lin