May 2013 Budget Update

Since starting my budget back in April I’ve learned a ton of things. I’ve learned exactly where I’m overspending, how much I’m overspending by, but I’m also learning where I’m doing well in my budget and making great improvements. It’s been a very enlightening experience thus far.

As a result I thought it might be a great idea to share my budget with everyone going over where I did well on my budget and where I didn’t do so hot. As a result I’d like to hear your thoughts as well.

What could I improve on and make better? Doing a budget will also allow me to get feedback from others and improve my financial situation and hopefully yours as well. With that said let’s get started.

May 2013 Budget

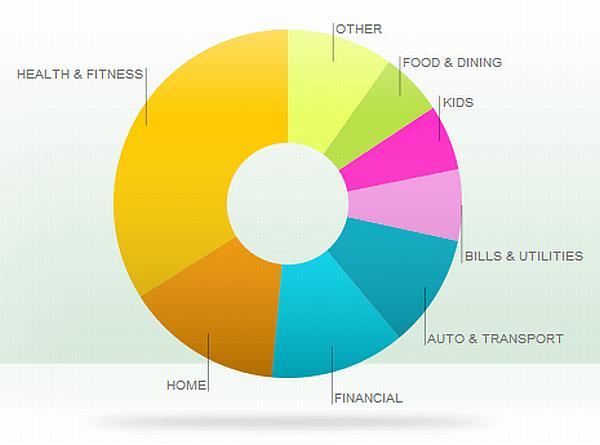

To start May was a tough month for us as you can see from the graph below.

The area we got hit the worst was in health and fitness with everything from doctor bills, natural health stuff, to the dentist. Here’s a complete breakdown on the cost.

The area we got hit the worst was in health and fitness with everything from doctor bills, natural health stuff, to the dentist. Here’s a complete breakdown on the cost.

- Doctor Bills – $796

- Dentist – $773 due to a cleaning and filling 3 cavities. Ouch!

- Natural Health Supplies – $511

- Pharmacy – $36

The only good side to all of this is that the dentist bills won’t be a repeat here in June since I only go once a year. However the doctor bills are not going to be slowing down any time soon since my wife just had her gallbladder out. Luckily, her insurance is a heck of a lot better than mine.

Now let’s focus on what I did great on this month, and as bad as things were with doctor bills and the dentist the areas I did do good in were a welcome surprise. Below is a complete breakdown.

- Gas & Fuel – Normally I budget $500 for this but we only spent $300 in May.

- Groceries – Normally I budget $400 a month for this and we only spent $364 which isn’t much of a savings but I’ll take all I can get.

How May 2013 Ended Up

When it comes down to it our budget was a complete fail this month, in fact we overspent by a total of $573 in the month of May. When I look back on May it was a rough month but what’s good about it is that a lot of the items that caused me to overspend for the month are only a one time deal, so hopefully things will be on the up and up for June.

So where did you overspend on your budget and where did you do well on your budget in May?

That stinks about all of the health spending! Luckily that category is always almost nonexistent for us.

Sorry about those dental costs! That’s part of the reason why I hate going. 😉 We did fairly well in May thankfully.

It’s AWESOME that you are doing this Chris! Saving and budgeting are the two fundamental things a person can do to succeed with their personal finances. Don’t worry too much about one single month…there are always rough months. That’s where an emergency savings account comes in handy, for bills like you had in May. Keep at it! It took us 3-6 months of budgeting before ours began to work like we wanted it to.

It sure does Michelle. 2013 is definitely becoming the year of medical bills for me. What’s worse is my son may have to get his tonsils out yet which could be more doctor bills.

Thanks John. I’ve never had to much problem ever going to the dentist in the last several years until now, and it’s only going to get worse because as my kids get older they are going to be going as well which will only cost more, so I may have to look into dental insurance to help me cover the cost.

Thanks a lot Brian. I’ve been thinking about doing a budget update for a while now and I think this just helps me stay in line with things but it also allows me to put a lot of my thoughts about my budget on paper and figure if what I’m doing is really the right thing. As far as the month goes, June has been going better so far but only time will tell.

the dentist costs are crazy high! In France I went for a cleaning it was about $35 and cavities are the same price (before social security refunds you 70% if you are covered, but anyone can go and pay $35). Next time take a flight to Paris instead!

That would be so awesome to only pay $35 for a cleaning or a filling. Since I had over $700 in dental work done last month the round trip ticket to France couldn’t have to far off. The sad truth of it is things are just getting more and more expensive. Thanks for the comment Pauline.

Those unexpected costs really get you. Each month I budget $200, and it shocks me how often we go over.

That’s a lot of expenses for your health and fitness. Dental cost are too much. Thank God we’re not spending that much for our teeth. I wish you well.

Hi Michael, it seems like their is always something unexpected each month but I’m hoping June will be the month we get thing back to a more normal pace. Thanks for stopping by I really appreciate it.

Thanks KC, once the doctor bills die off things should be back to normal but since my wife just had her gallbladder removed earlier this week I know we are going to be facing a few more medical bills for the next 2 or 3 months.

Thanks for sharing this – I enjoy seeing how open and transparent you are. I’m thinking to do a similar type of thing on my blog also. It’s useful to track this kind of stuff – it just adds to our awareness of our spending habits.

Thanks Stefan. Being more transparent is one of my bigger goals here at Stumble Forward and I think sharing everything from my budget to my mistakes will help me and everyone else learn more about our finances in the end. Thanks for you input, I look forward to hearing more from you.