Problems With Credit Cards – Why It’s So Hard To Get Out From Under Them

Many of you who have been around for some time on Stumble Forward know that by following my entire series on building my new house that it’s been a daunting project. It’s been stressful physically, mentally, and financially.

In fact, as a direct result of building my house I’ve ended up with around $6000 worth of credit card debt from all sorts of unexpected bills. Below is an exact break down of the two credit card debts that I have.

- Credit Card #1 – $943

- Credit Card #2 – $5096

Problems With Credit Cards

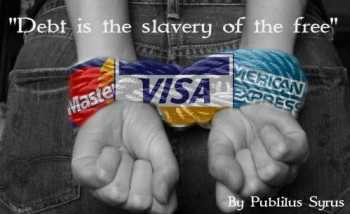

The problem with credit cards is that it can be really hard to stop using them once you’re so use to having them. I kind of like to think of them like an addiction that’s hard to break, and that’s what I want to spend the rest of this article talking about, why it’s so hard to get out from under your credit cards.

The problem with credit cards is that it can be really hard to stop using them once you’re so use to having them. I kind of like to think of them like an addiction that’s hard to break, and that’s what I want to spend the rest of this article talking about, why it’s so hard to get out from under your credit cards.

Uncertainty. One of the biggest problems I’ve faced towards paying off my credit cards is the fact that I’m going through some very uncertain times financially. Most of this is due to medical bills with my kids. My second oldest had tubes put in late last year and it cost us around $3500 in medical expenses.

To boot my oldest child has issues with his ears as well and may have to have tubes as well. We’ve been doing almost everything we can to prevent this from happening from going to the chiropractor to using an unique product called the Ear Doc.

On top of that my health insurance has a $3500 deductible with an 80/20 coinsurance with no drug card or doctors copay, which means I basically pay for everything until I hit my deductible. I’ve been looking to switch plans but the problem is since my oldest child was recommend to have tubes the health insurance quotes have been running anywhere from $800 to $900 a month.

Finally, the cost to buy medication for my oldest child since I don’t have a drug card is very expensive. I bought one prescription of Nazonex and it cost me around a $150. Add up a few bills like this and you’re talking about a lot of money.

When it comes down to it unplanned medical bills have been the real culprit of my problems and until I can manage to solve this problem it will take me more time to payoff my credit cards since I’m not able to put as much towards them.

Dependence. Another issue I see with credit cards and why it’s so hard to pay them off is dependence. Their are several things my wife and I have grown accustom to when it comes to credit cards. The first is using are gas card. We us to use cash when buying gas but this was so tough with fluctuating prices.

One week we might need $40 or $50 and the next week it might be $70 or $80. With a gas card it eliminated the whole cash mess and we stickily used it for buying gas, until it came time to buy a few appliances which we needed for the house. Now it’s gotten to the point where we are paying off enough to cover our cost for gas each month but we still have a $4500 to $5000 credit card bill at the end of each month.

The other problem we face is that we have a few reoccurring payments on the other card. However, I’m working to move these payments to some other location which I will cover more in the next part of this article.

Ease Of Use. Finally, the ease of use can also be a problem as well. I run into this problem mostly when I’m in a pinch and need a way to pay for something. This has been happening less and less lately but it still does none the less.

For example, the other day I was looking to buy a 4×4 post for my mail box and I realized I forgot my checkbook and I had no cash on me. This left me with a dilemma, do I drive 10 miles back home and get my checkbook or do I just use my credit card.

I’m sure some of you may have been in that situation before, but just because of all the issues I’m facing right now doesn’t mean I still couldn’t pay off my two credit cards and still eliminate this debt in short time, I just need to change the way I’m doing things a little. After all, I’ve dealt with far worse debt problems than this before.

How To Fix The Problem

When it comes to paying off your debt a lot of us, me included, often think all we have to do is put a simple debt plan together such as the debt snowball or debt avalanche plan together and things will be be alright but as you can see with the issues I’ve covered above this just isn’t true.

Below is a step by step plan I’m using to pay off my debt. If you are finding yourself in the same situation hopefully this may help you with the progress of paying down your credit card debt.

#1 Stop Creating More Debt – The first step is to stop creating more credit card debt. This may sound simple but when you’ve spent a lifetime of dependence on them it can feel really tough. If this is really tough you may need to take some extreme measures and cut them up altogether.

#2 Move Reoccurring Payments – The next step I took was to remove or get rid of any reoccurring or dependent payments. A few ways I’m going about doing this is by using a checkbook, a debit card, and one of my favorite options, Paypal. With Paypal I can pay bills and the money taken directly out of my Paypal account and not put on a credit card. As for my gas I’ve been resorting back to cash but I’m looking at getting a debit card.

#3 Focus On One Debt At A Time – Finally, the last thing I am doing is focusing on one debt at a time. In my case I’m paying off the debt with the least amount owed, so in this case I’m focusing on Credit Card Debt #1. This debt use to be around $1500 but I’ve managed to pay down $500 of this debt so far in the last few months, and in the next 2 to 3 months I should have this debt paid in full leaving me with one credit card to go.

Final Thoughts…

With so many hurdles to jump when it comes to paying off your credit cards it’s no reason for you to give up. Instead do like I did and break the situation down to it’s core problems and solve each one individually.

So what problems do you face paying off your credit cards?

Hi Chris,

Good article. I know I have become dependent on credit cards even though I am still buried in some debt. I think our problem is that fact as you put it, they are easy to use. I am not a huge fan of walking around with a lot of money in my pocket. But the main reason we do it is to consolidate our expenses into one easy payment. Well this works for the one credit card we pay off each month.

Hi Alan. I don’t like to carry much cash with me either. It’s not the fact that I don’t like to carry that much but rather the fact that I know I would just spend it if I had it so the easiest way to avoid it is not to carry it.

Chris, that’s a tough situation you’re in. My prayers are definitely with you and your family. Credit card debt really does take the freedom out of life and enslaves you. The only other thing I like to recommend, and you might be doing this to, is to pay off the debt with the highest interest rate. That interest can really add up!

We only use them for rewards anymore and no longer carry a balance. I hope that everything works out for you!

Thanks for the support John I really appreciate it. Credit card debt really does take the wind out of your sail, and as a result I won’t be doing a lot of things this year such as going to FINCON 13. I really wanted to make it to that conference this year but it’s looking more and more like I won’t be able to do it, and to tell you the truth I’d rather be rid of the debt than go further into debt. So it’ll just have to wait till next year.

That’s exactly what we were doing Holly. The one card is a gas card that would save us around 5 to 25 cents per gallon of gas and we paid them both off every month no exceptions. Then we decided to do it this one time buy some appliances, but I can’t blame anyone else for the financial issues I have, and I alone will work hard to fix them. Thanks for the support.

I can’t believe the costs you have to pay for healthcare in the USA, it’s unreal. I’ve never had credit card debt nor paid a penny in interest from using one. I do know that for those that do use them they become a life line or extension or an extra income which is really money that is being spent that is not yet earned. This can be a terrible revolving door if one is not careful. We also use our cards only for rewards, which is a great perk!

I have actually switched to paying everything with my credit card. it makes it easy to have just one bill and I can pay it multiple times a month, plus I get rewards. I wouldn’t do it unless I got the cash back.

Your healthcare costs are crazy expensive. I am happy for the plan I have through my employer.

You are exactly right Mr. CBB health insurance stinks. The group health plan we had at work went up by over 50% in the last 2 years alone and we had no choice but to get rid of it. I’m not trying to make this a political thing but Obama Care has driven the cost of health insurance up dramatically. Normally cost might increase by 10 to 15% in a year but they are going up by 20 to 30% in year now.

As for the credit card debt we only ever used are cards for the rewards as well and I did get a lot of great rewards from my gas card but now we just have to get them paid of to protect ourselves from the uncertain issues that the future holds that could make our situation worse.

That’s a great point Grayson. Credit cards do make it easier to track spending espcially when you link your card up to something like Mint or YNAB. As far as the health insurance goes I’m going to try and apply for a new plan next year and hopefully all the issues I’been facing with my kids will be done with.

I don’t have revolving credit card debt anymore – my biggest challenge now is making sure I remember where all of the money is coming from that is allocated to pay off the card each month. Clothing fund, sports fund, spending cash… it’s an organizational issue now more than anything.

Sounds like a good problem to have CF. About a year ago before I built my house I was doing very well financially and I even had a decent saving built up, now that I’ve built my house things are a bit tighter but they will get better once I’m done dealing with these medical issues and pay off my credit cards.

Great post, Chris. Glad to see you are getting back on track and are working a plan to get rid of the balances. Our biggest hurdle in paying off the CC’s is our high DTI. We’ve pared down spending with a super-strict budget, but our high DTI makes it hard to put extra toward the CC’s. We just do what we can, though, and remember that every dime or dollar extra we are putting toward the balances adds up. I can tell, Chris, that you are motivated enough to get rid of them quickly. And glad to hear that you are working with the Chiro to find alternative solutions. That can really be a money saver some times!

I hear you on the kid expenses. Our daughter had ear issues and eventually tubes as well. I’m so glad that stage is over. Credit card debt can certainly creep up when you have so much going on. It looks like you have a solid plan for breaking the cycle. Best of luck.

Thanks Kim. Tubes are not fun. I just got the surgery bill in the mail the other day after writing this article and it was over $1300. I’m defiantly going to have to set up some sort of payment plan to get this paid off. Thanks for the support.

Thanks for your support Laurie. The ENT ( Ear, Nose, and Throat) doctor we’ve been talking to seems to think that the only way to solve the problem is either by surgery (aka Tubes) or medication. It only seems to be affecting his left ear and our chiropractor says that tubes don’t always work because once they fall out the problem could just start all over again.

On top of that it’s not like it’s causing any sort of infection either. It’s just a little fluid behind the ear. I feel as long as it’s not causing him any pain or damage to his ears we will continue to use alternative methods and if it does start to hurt his ears we’ll cross that bridge when we get there.