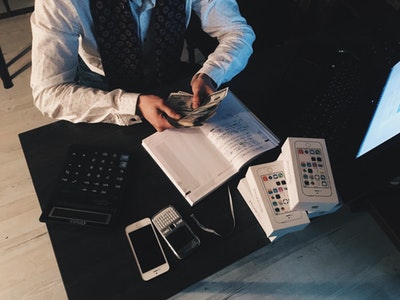

6 Personal Finance Tips For Your Wallet

Financial goals and boundaries are elemental when you’re working to gain control over your finances. True financial freedom takes a long term commitment and a wealth of personal control and knowledge.

Start working towards a successful future now, and learn to manage your finances early on in life.

Here is a brief look into a few personal finance tips for your wallet and your stability.

#1 Create a detailed budget

Structure is a friend of financial security. Create a meticulously detailed budget, and live by what you decide.

Be so detailed in your budget listings that you even include the regular purchase of beard oil to condition your beard. The more detailed you can get with your budget, the easier it will be for you to move forward financially.

#2 Work hard while you’re able

When you’re young, you have the ability to work longer hours. You have the ability to work a more physically driven job. When the opportunity to make more money presents itself, take it.

Don’t waste your youth being broke on the couch. Use the vibrancy of being young to push you forward in your financial journey.

#3 Always work towards a larger savings

Make savings a regular part of your budget plans. Your savings should be large enough to cover six months of survival, but that is certainly a goal to work towards.

Most people don’t have such a comfortable financial safety net so early in life. Change your financial stars while you’re young, and start building a savings now.

#4 Invest in your retirement

As soon as you have the option, you should opt-in on a 401k retirement savings. Relying on social security to get you through is a gross misconception.

By the time the youngest generation is at the age of retirement, it’s not likely that social security will even be worth much in the way of financial support. You’ll have to pave your own way to financial security, and starting young is the best way to avoid struggles.

#5 Actively work to build your credit

Your credit will dictate a lot in terms of your financial abilities. If you start early building good credit, you’ll have the clearance to purchase a home by the time you’re ready to take on the responsibility.

You could even use your ability to purchase a home as another money-making opportunity. House-flipping can be rather lucrative with enough planning and solid resource connections.

#6 Live a frugal existence

No matter how much money you make, you can save money on living costs by living a frugal existence. You don’t need name brand clothing. If you think you do, then buy them from a thrift store. You can purchase a $30 shirt for five bucks at Goodwill.

What tips do you have to help keep more money in your wallet?