Financial Management? Why Your Phone is All You Need

One of the most important things people can do in their lives is to learn financial management. It means being responsible for your economic well-being, understanding how to budget and save money, and making smart investment choices. Learning financial management skills is essential for everyone, but it’s necessary for young people just starting.

One of the most important things people can do in their lives is to learn financial management. It means being responsible for your economic well-being, understanding how to budget and save money, and making smart investment choices. Learning financial management skills is essential for everyone, but it’s necessary for young people just starting.

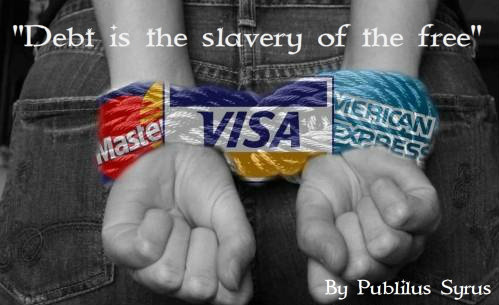

The advantages of being financially responsible are many. For one thing, you’ll be able to live within your means and avoid debt. You’ll also be able to save for retirement and other vital goals. And if something unexpected happens, you’ll be prepared because you have a cushion of savings to fall back on.

Financial responsibility is something that can benefit everyone, regardless of their age or income level. So if you want to improve your financial situation, start by learning about financial management. Your phone is a great place to start – plenty of apps and websites can help you get started. Here are a few of them.

Budget App

When it comes to financial management, budgeting is vital. And contrary to what some people may believe, you don’t need much money to start. Budgeting is achievable with any income level. The goal is to live within your means and save for the future.

However, most people rely on spreadsheets or pen and paper to budget, which can be cumbersome and difficult to maintain. Luckily, plenty of budgeting apps make the process much easier.

One of the most popular budgeting apps is Mint. It’s free to use and syncs with your bank account, making it easy to track your spending. Mint also provides helpful insights into your spending habits and can help you find ways to save money.

Another great option is You Need a Budget (YNAB), which costs $6 per month but offers a free 34-day trial. YNAB can help you change your spending habits to become debt-free and save money.

Budget apps make it easy to track your spending and create a budget that works for you. They also provide tips and advice on how to save money and stay out of debt. Budget apps are available for free on most smartphones and tablets. So if you want to start improving your financial situation, download a budget app today.

Investment App

Investing is another crucial aspect of financial management. When investing, you’re putting your hopes into turning your money into something that could grow in a few years. It can be a great way to secure your financial future and build wealth.

Many investment apps are available, but Acorns is an excellent option for beginners. With Acorns, you can start investing with as little as $5. The app will then invest your money in a portfolio of exchange-traded funds (ETFs). These are low-cost investments that have the potential to generate returns over time.

Another option is Robinhood, which offers commission-free trades on stocks and ETFs. Robinhood is a great option if you’re looking to invest in individual companies or you want to trade frequently.

Investment apps make it easy to start investing with little money. They also offer commission-free trades, saving you money in the long run. So if you’re interested in starting to invest, download an investment app today.

Financial Management App

Financial Management App

If you want a comprehensive overview of your financial situation, consider downloading a financial management app. These apps provide insights into your spending, savings, and investments. They can also help you create a budget and track your progress over time.

Personal Capital is one of the most popular financial management apps. It’s free to use and gives you a clear picture of your net worth, asset allocation, and investment performance.

Another great option is Mint, which we mentioned earlier. In addition to budgeting, Mint also provides insights into your credit score, investments, and overall financial health.

Financial management apps are a great way to get an overview of your finances. They can also help you create a budget, track your progress, and find ways to save money. So if you want to improve your financial situation, consider downloading a financial management app today.

Banking App

Online banking apps provide a convenient way to manage your money. They allow you to view your account balance, transactions, and pending transactions. It can help you stay on top of your spending and ensure that all your transactions get noted.

An online banking app also allows you to set up notifications for when your account balance drops below a certain level, when a transaction happens, or when a payment is due. It can help you avoid overdraft fees and late charges.

Online banking apps make it easy to manage your finances. They provide real-time updates on your account balance and transactions. They also allow you to set notifications for when payments are due, or your account falls below a certain level. So if you want an easy way to keep track of your finances, consider using an online banking app.

Final Thoughts

Making small changes in your spending habits can significantly impact your financial situation. And with the help of budgeting, investment, and financial management apps, it’s easier than ever to take control of your finances. So if you want to improve your financial situation, start downloading one of these apps today.