Where Is My Money Going? A Guide to the Abbreviation Pay Stub Meanings

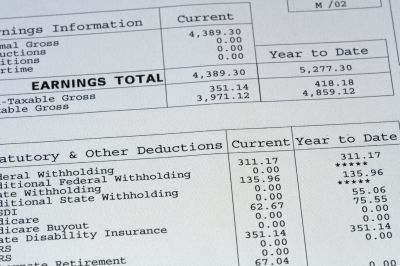

Have you ever looked at your pay stub and just had so many questions afterward?

Have you ever looked at your pay stub and just had so many questions afterward?

What does FT mean? What does YTD mean? What does FICA mean?

These may all be questions that you’ve asked when looking at the slip your employer gave you after working all week. Pay stub abbreviations can be tricky. Have you ever looked at your pay stub and wondered where all that money is going? Learn about pay stub meanings here.

Basic Information

When you first look at your pay stub, some of the information you see will be pretty self-explanatory.

You’ll see things like:

- Your name

- Your employee information

- Pay period the pay stub is for

- Address of your employer

- Hours worked

- Hourly wage

However, some states aren’t required to provide a pay stub for you. If you want to keep track of your income on your own, you can use a check stub maker to keep detailed records.

Pay Stub Meanings: Abbreviations

YTD

This acronym means Year-to-Date. You may see this on your pay stub with something along the lines of “YTD Earnings.”

That just means that this is how much you’ve earned from the beginning of the year to the end of that pay period.

FT/FWT

This stands for federal tax, or federal tax withheld.

This is the amount of money that the federal government takes out of your paycheck.

If you want to change the amount that the government can take out of your paycheck, you just have to fill out a new W-4 form. You can contact your HR representative to ask for one.

ST/SWT

This abbreviation stands for state tax, or state tax withheld.

Like the federal tax, this tax just goes straight to the state that you’re a resident of. Some states don’t have a state income tax, and some of them have different rates than others.

SS/SSWT

This acronym is short for Social Security or Social Security Tax Withheld.

The government takes out money from your paycheck and puts it away in a social security fund that is accessible to people once they reach a certain age.

From your income, 6.2% of it will be taken out for Social Security.

MWT/Med

MWT stands for Medicare Tax Withheld.

Medicare is also a mandatory tax. This money goes towards people who have reached the age to use Social Security to help them pay their medical bills.

FICA

FICA is an acronym for Federal Insurance Contributions Act.

If you see FICA on your pay stub, you just need to know that instead of separating Medicare and Social Security, it’s just combined.

Additional Pay Stub Meanings

On your pay stub, you may also see additional information like insurance deductions, retirement plans, time off information, and other additional notices.

These pay stub meanings can be tricky, but by just understanding these few acronyms, you can start to decipher where your money is going and who it’s going to.

You can also check out our resources page for more information on how to manage your money and make it work for you.