The Best IRA Company: A Vanguard Review

Are you looking for the best IRA company to handle your retirement investments? With so many different companies to pick from it can seem overwhelming at times to just choose a company so in this article I’m going to show you a company that I feel is the best IRA company around, Vanguard. In this article I’m going to show just why this is.

Who Is Vanguard

Vanguard was founded in 1975 under the belief that you shouldn’t have to pay a lot for your investments. Their offices located nationally in North Carolina, Pennsylvania, and Arizona. They also have offices located internationally in Australia, France, and the Netherlands.

Vanguard has 160 domestic funds plus 50 international funds totaling around $1.4 trillion with a T, in assets. Vanguards mission is to help people reach there retirement goals while giving them the highest value of products and investment services.

Why Is Vanguard One Of The Best IRA Companies

Now that we got the basics out of the way you may be saying that’s great and all but what really makes Vanguard the best IRA company around, and in this section you will learn just why that is.

No Junk Fees

First off, Vanguards investments are less expensive than other investment companies. The fees are the lowest I’ve seen from any company around. They carry no sales loads on their investments. For example with some investment companies like American Funds they will charge as high as 5.75% up front while Vanguard charges nothing.

They also carry no 12b-1 fees, better known as marketing fees. These are junk fees that most other companies charge to recoup their huge advertising cost, but with Vanguard they don’t charge for this.

Vanguard also pays no commissions. The benefit behind this is that it doesn’t force sales agents to use dirty sales tactics in order for them to earn a paycheck.

Finally, Vanguard doesn’t charge an account service fee as long as you receive your account statements electronically via email, otherwise you will have to pay a $20 annual fee per fund you invest in.

Low Annual Fees

Secondly, Vanguard charges low annual fees for their accounts. In fact the average annual fee for Vanguard is around 0.23%. Compare that to other companies like Transamerica who charge around 1.19% for an annual fee and that makes a big difference.

For example, if you were to invest $205,000 over a 30 year period at 1.19% for an annual fee you would end up paying around $622,000 in fees over that time alone. On the other hand if they would have only charged 0.23% for an annual fee you would have only paid around $137,000 in fees over 30 years. This is a cost saving of nearly $485,000 over 30 years!

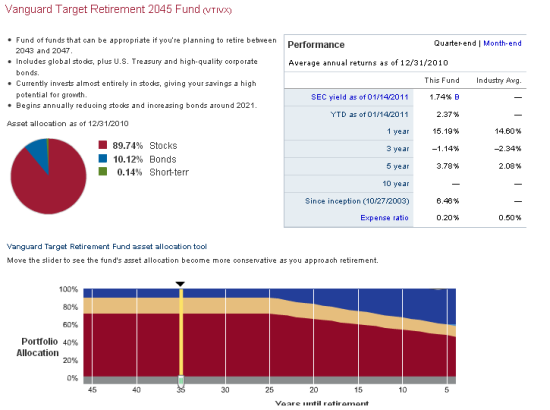

They Use Target Retirement Funds

Finally, on of the best reasons that makes Vanguard so great is that they have what are known as target retirement date funds. These are funds that work by picking a fund that is close to the date of your retirement and as you get closer to your retirement your investments will become more and more conservative.

For example, the fund I use is the Target Retirement 2045 fund. This fund is set up for me retire in the next 35 years or roughly in the year 2045, and is currently investing my money more aggressively with a majority of my funds in stocks. Look at the picture below.

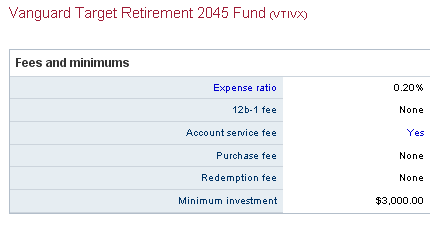

On top of that notice what kind of fees this fund carries. Look at the picture below.

The fund carries a 0.20% annual, that’s it. Think of the cost savings you will incur over time just because of paying lower fees.

The fund carries a 0.20% annual, that’s it. Think of the cost savings you will incur over time just because of paying lower fees.

Get Started Now

Is this the best fund around, maybe, maybe not, but one thing I do know is that their is never a better time to get started saving for your retirement. To get started investing check out Vanguards IRA program now you will be making a good choice for your financial future.

Question or comment, let me know below.

Nice write up about vanguard. I use Vanguard for the majority of my Roth IRA investing and love their low fee, common sense approach to long term investing for non sophisticated investors. I agree, they’re one of the best companies out there.