How to Prepare for the Future of Your Family’s Finances

If you know that you are not financially prepared for the future or if you know that you have not made a conscious effort to try and put something away then this can cause you a lot of stress.

It may also have you worried because if something did happen to you, you may feel as though your family is going to be left carrying all of the debt that you have.

Either way, it doesn’t matter whether you don’t have anything put away or whether you do have something put to one side but it just isn’t enough, because there are things that you can do to try and better the prospects of your family’s future.

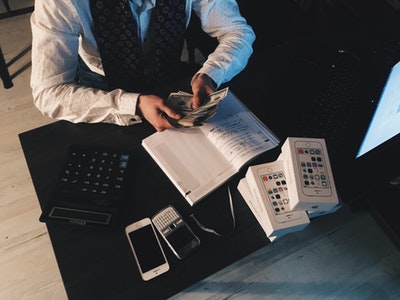

Know What You Have

It helps to have a couple of moments every day where you can sit with yourself and just look back on what you have.

When you do this, you can then be more aware of what you can put away and it will also help you to stop yourself from spending as well.

The first step to saving is to always know where you stand, so it is a good idea for you to go through all of your finances so you can plan out how much spare money you have left over at the end of the month.

Budget Everything

Take the time to go over your budget and find out if you are living within your means. Are you constantly overspending?

Any funds that you have left over from paying your bills can easily be set aside for savings rather than for going out with, and this can make a huge difference to how much you have put to one side.

The problem that a lot of people have is they feel as though saving is basically the end of their life, and they won’t be able to have any fun at all after they have decided to fully commit.

This is not the case at all, and it is more than possible for you to save up every single month without having to limit your recreational activities too much. Just don’t go crazy.

Set up a Payment Plan

It can be hard for you to set up a really good payment plan when you are trying to manage everything manually.

It can also be hard for you to actually stick to your plan when you are doing things this way as well, so one way for you to get around this would be for you to have a direct debit.

You need to have this money going into a savings account, with the bank card being kept in a safe place rather than in your wallet.

This will help you to stop those naughty impulse spends and it can also help you to stay on track with your targets more.

Talk with a Lawyer

Living trust attorneys can work with you to make sure that you have everything planned out for your family’s future.

They can help you to plan out the complexity of your estate and they can also help you to create a plan that is legally sound as well.

This will cover the ins and outs of your future and it will also help you to manage all of your assets efficiently as well.

This is one of the best ways for you to make sure that your family is going to be fully protected if something should happen to you, and if you don’t have something like this in place then there could be serious delays in your family getting the help they need if you do happen to pass.

Talk with your Family

Another way for you to make sure that your family is being protected for the future is to talk with them. Everyone needs to be on the same page when it comes to your passing and they also need to know exactly what is going to happen.

This will help you to avoid any unnecessary confusion and it also helps to provide them with a lot of peace of mind as well. Of course, you should also talk about things like your pension, how much you have coming in weekly, the expenses that you have and more.

This will really help you to know if you need to earn some extra money while you can, and it may even help you to put some more money away for your children as well. This can make the world of difference.

What are you doing to prepare your family’s future finances?