6 Common Money Myths That Could Cost You Big

We all make silly money mistakes now and then. We apply for loans we shouldn’t have, waste money keeping up with the Joneses, and spend far too much on takeaway coffees.

These blunders are mostly our own fault, but many others aren’t. The world of personal finance is swarming with misinformation, causing many of us to make small errors that cost us big in the long run.

To protect your finances, here are six common money myths that you should ignore.

#1 Two Incomes Are Better

Bringing extra cash into the house by having both you and your partner working can seem rewarding on the surface, but it often depends on your lifestyle and other circumstances. If you have to pay to travel to work and hire someone to look after your children, then those costs could outweigh the additional income.

Having more money can also make you more wasteful with it.

#2 Paying Cash Is Best

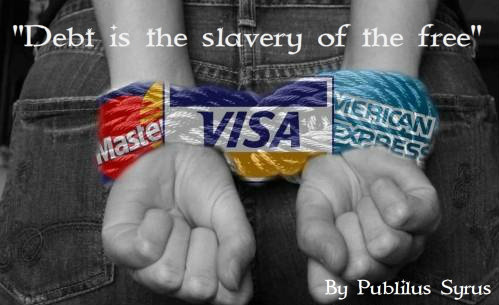

Credit cards and loans aren’t as evil as most people make them out to be.

In fact, if you use them wisely, they can actually be quite useful tools, offering discounts, protections, and other benefits that you don’t receive when paying in cash. You shouldn’t abuse your credit card, of course, or apply for unnecessary loans, but there’s no reason for you to avoid them completely.

#3 Renting Property Is Wasteful

Buying a home is a goal for many families all over the world.

However, while buying certainly does have its advantages, it isn’t ideal for all situations. If you move around a lot, are quite young, or have just started a family, then renting a property is far from wasteful. In fact, it’s the best option for you, as it offers freedom and flexibility, which you simply don’t have when buying.

#4 Only the Wealthy Invest

Investing may be a habit you see most commonly among millionaires, but that doesn’t mean that only the wealthy can invest. If you want to boost your finances and grow your wealth, then there are plenty of investment opportunities to consider, from real estate to

asx smallcap stocks. Just make sure that you start out small and always review the risks before handing over any cash.

#5 Quality Products Are Expensive

Although in some cases you do get what you pay for, this isn’t always true. A lot of the time, it is possible to find high-quality products or services without a huge price tag.

Medications are one of the best examples of this. Generic drugs work in the exact same way as known brand kinds, meaning that, when you pay extra for those brands, you just pay for more colorful packing.

#6 Emergency Funds Are Unnecessary

Even when you have a credit card to fall back on, you still need an emergency fund built up. It can often take months to find a new job, meaning that, if you lost yours, you’d rack up a lot of debt, which you might struggle to pay back. An emergency fund, however, is your own money. Because of this, you should aim to build up one that would cover six months worth of expenses.

Managing your personal finances is never easy, but it can be made simpler by ignoring the damaging myths above.

What kind of money myths can you share?