September 2013 Budget Update

Welcome to the September 2013 budget update where we will take an in depth look at my personal budget giving you the good, the bad, and even sometimes the ugly. My goal here is to show exactly what I’m doing to manage and improve my budget and hopefully help you do the same, and if you are new to the whole budget thing that’s fine too, their is no better time to get started than right now.

Welcome to the September 2013 budget update where we will take an in depth look at my personal budget giving you the good, the bad, and even sometimes the ugly. My goal here is to show exactly what I’m doing to manage and improve my budget and hopefully help you do the same, and if you are new to the whole budget thing that’s fine too, their is no better time to get started than right now.

Now for those of you who are new here I don’t use spreadsheets manage my budget, instead I have a very specific process I use to update my budget on a weekly basis using a free online program called Mint.com. So feel free to check that out, set up your budget, and get started today.

Finally, I should also mention that if you would like to follow along with me and get regular updates you can Subscribe to Stumble Forward by Email and get updates delivered straight to your inbox for free without all the spam and nasty email. You can also sign up via RSS here as well.

Important Things Going On Right Now

Well it’s October and their has been a lot going for me personally. For all of you in the personal finance blogashpere you may have heard #fincon13 is going on this week and actually is getting started today in St. Louis to be exact. Last year I vowed I would make it there this year and so many things have happened over the last year forcing me to cancel out.

So I’ve gone the extra mile this year to make sure I get there next year and I even wrote a post about what I plan to do next year to make sure I do get there. You can check that article out here. I also caught wind that #fincon may be in New Orleans next year which would be pretty cool since I’ve never been there but regardless of where it is I will definitely be there and I hope to see many of you there next year as well.

September 2013 Budget Overview

Now on to the budget and let me start of by saying September has been an awesome month for me financially. Things are really on the up and up for me and I can’t wait to share all the details with you.

However before I get started you may have noticed that I didn’t put a budget update out for August and this was due to the fact that I just ran out of time with things. In fact it’s taken me nearly half of the month of October to just get this one out but I plan to get these out a little quicker as things progress.

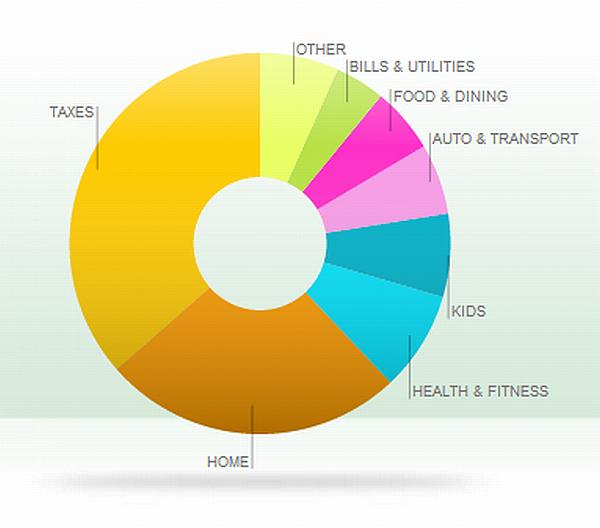

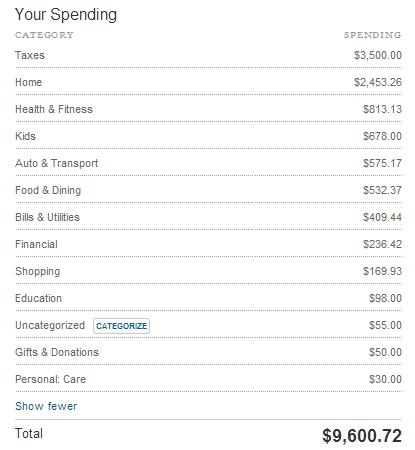

First off I should mention that my numbers look a bit skewed because I had to pay my quarterly income taxes which are always a pain but I deal with it. On top of that I also had to pay for the cost to have my lawn seeded. I didn’t count this because this money came from my savings to pay for this.

$3500 For Quarterly Estimated Taxes

$1404 For Seeding the Lawn

Minus $9600.72 comes to a total of $4696.72 actually spent in the month of September.

For the total month of September I earned $1328 in blog income plus $4200 in regular income for a total of $5528.

$5528 income minus $4696.72 equals $831.28 in saving for the month.

I would say all in all I did fairly good for the month but as anyone who has a budget knows their is always room for improvment.

Where I Did Well For September

- Natural Gas. For the month I budgeted $80 on natural gas for heating my house and it only cost me $24 since I’m on budget billing with my natural gas provider saving me $56 this month. However I do expect this to go up over the winter but I’m not to worried about it.

- Babysitter. The second area I did well was with babysitting. Typically it cost me $650 a month but I only spend $593 saving me $57 on my budget this month.

- Electric. Finally, I also saved a little on my electric bill as well. Typically I budget $200 dollars and I only spent $191 saving me $9. I know that isn’t much but a dollar saved is a dollar earned.

In total I saved an extra $122 in these three areas.

Where I Didn’t Do So Well

- Groceries. Groceries were again my hardest hit area for the month. I budgeted $400 for this month and I spend $533 and went over by a $133 this month.

- Doctor. Again my doctor bills were a bit over the top as well. I typically budget $300 for doctor bills and I ended up spending $393 going $93 over budget.

- Natural Health. The final area I didn’t do so well in was natural health. Typically I budget $250 in this area and I spent $334 and going over by $84.

In total I went over by $310 in these three areas alone.

Areas I Can Improve

When it comes down to it food, doctors, and natural health cost seem to be the big culprit to my budget most months. However their is some good news, September was the last month of paying on my sons ear surgery, which means it will save me $220 a month alone.Minus that off the $310 I went over this month and I would have only gone over by $90.

As far as the food goes I think it all depends on the month. With the holidays fast approaching my guess is that my food budget won’t be going down anytime soon. However I am still planning to do my best to keep things under control and within reason.

Finally, I have natural health and this is one area that has more to do with my wife and kids. We do a lot of natural health and preventative stuff with our kids and the extra money we end up spending there is far cheaper than putting it towards doctor visits.

So how about you, how did your budget end up for September?

That hurts my stomach to see in a pie chart that you’re paying more in taxes than in your home.

I agree Todd, however I only pay those taxes once every three months and my company usually covers the cost for me which isn’t a bad deal since I have to deal with tons of other issues from financial stuff to HR.