What To Do With a Sudden Windfall – 4 Ideas You Should Consider

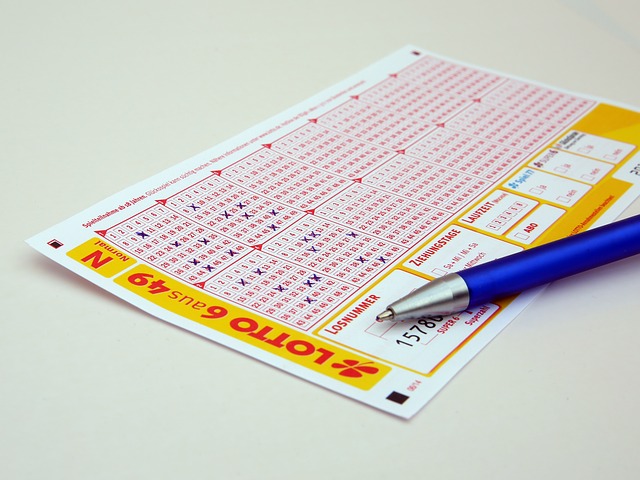

We all have daydreams of winning the lottery or finding an old antique treasure in the attic. We picture ourselves spending our money on holidays, cars and new homes, of how it will change our lives.

We get lost imagining what it would be like to have more money and even plan dream shopping lists. This is a very common fantasy, and a lot of us know exactly what we would buy first if we won a large sum of money.

But, these fantasies are always fun. It’s always a huge amount, and we enjoy the money. We rarely (if ever) dream about opening savings accounts and looking for investment options. If you are lucky enough to find yourself with a sudden windfall, the reality can be a little different.

You won’t want to splurge your money needlessly. You’ll want to use it well, even if it’s not a massive amount. Here are some ideas of what you could do.

#1 Pay off Debts

The very first things that you should with any amount of unexpected cash is pay off as much debt as you can if you have them.

Even if this means all of your money is gone, you’ll have less or no debt, a great chance to start saving, more disposable income and a much better credit score.

Paying off debts may seem boring, but in the long run, it could change your life.

#2 Start a Business

Starting a business is another great way to do something for your future that will change your life. If your windfall isn’t enough to do what you would like, consider adding to it with a loan from Personalloan.co to give yourself more options.

Having a bit of money gives you a great chance to escape the rat race. To get away from a boring job your hate, and do something for yourself. Think about what you love doing, or what you always thought you’d be.

Do you have any talents that you could make money from? Once you’ve got an idea, sit down and devise a business plan and get started.

#3 Buy Property

Property is one of the best investments that you can make. But, unfortunately for many of us, high house prices and reluctant lenders can mean that we are stuck renting for most of our lives. Whether you’ve got enough to buy a house outright, or just put down a large deposit, this could be a great investment for your future.

If you already own your home, consider buying a second to let out. This can provide you with a substantial second income going forward.

#4 Save

It’s never too early to start saving for your retirement. We’re living longer than ever, so need more money to maintain our quality of life for longer. Open a high-interest savings account and start putting some money aside.

Savings and investments are a fantastic way to secure your future, but that doesn’t mean that you can’t have some fun with your cash too. Look at how much you’ve got, and treat yourself to a vacation or something you’ve been saving for too.