Out of Debt – Now What Do You Do?

Congratulations on getting out of debt. As much as most people want to live debt free, few get the chance to ask I’m out of debt now what? The steps that you take now will determine how long you stay debt free and how strong your finances become, so it’s an important question to ask.

In addition to the types of tasks that went into creating a debt free lifestyle, such as maintaining a budget and avoiding taking on further debt, there are a number of things that you can do to strengthen your financial position and ensure that you remain debt free. As with any major undertaking, some of these tasks are simple while others are more complex, but in all cases they are important to your financial standing.

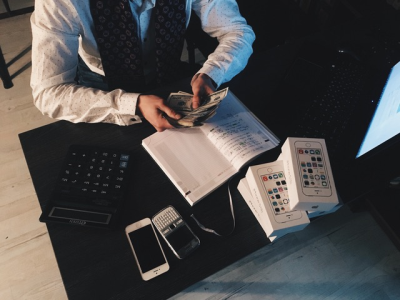

This also pertains to business owners and those handling a corporate budget. The financing growth within a business can be demanding and if not properly administered, the business will eventually fall into debt. Once a business has recovered from debt, it is smart to seek the professional advice from an experienced factoring company, which will not only offer advice but can also provide financial services.

Consider Limitations on Credit Cards and Other Debt

Did you know that you can ask to have your credit limit lowered? If sticking to a self-set limitation on purchases isn’t working for you, you do have the option to call your credit card issuers and ask to have your limit lowered. As long as you have an acceptable credit score and your credit cards are paid off, this should not have a major impact on your overall score.

Lowering your credit limit also has benefits beyond reducing the temptation to spend. Having lower limits can make you a less appealing target for identity fraud, and you may also receive fewer unsolicited credit offers. These two things alone are strong reasons to consider restricting your debt limits.

Another option at your disposal is to have your credit and other debt accounts send you notification emails when you spend above a certain amount. These notifications help remind you that you are spending money, and reinforce your will to pay back those debts promptly so that you can remain debt free.

Set Up Savings and Investment Accounts

The best answer to the question I’m out of debt now what is to start saving for the future. Assuming that the threatened fiscal cliff is averted, interest bearing savings and dividends from personal investment accounts can be attractive second income streams, since for most taxpayers these types of income are taxed at a lower rate than standard W2 income. Make the most of your debt free status:

- Funnel money from your paycheck into an interest bearing savings account

- Regularly invest in stocks that you understand using a personal investment account

- Continue to save towards retirement, and be sure to contribute the maximum you are permitted – especially if you have an employer match

Take Time Out to Consider Bad Habits

Although sometimes debt is caused by unavoidable events such as a major medical bill, just as often debt is slowly accumulated over time until it becomes unbearable. In the worst case scenario, a slow accumulation of debt balloons into a crisis when an expensive event occurs.

The best way to ensure that you can stay out of debt is to examine the spending and saving habits that got you into debt in the first place. Knowing your spending triggers and the things that most influence you to save will help you remain debt free much more effectively than any other single method.

Remember also that those triggers might not be obvious; according to Jordan Amin, Chairman of the National CPA Financial Literacy Commission, recent studies prove that technology brings “financial challenges, like taking money that could go to savings, for instance, or contributing to credit card debt. We have to mind these expenses and budget for them to ensure the benefits outweigh the costs.”

Correct Any Errors on Your Credit Report

It’s important once you are out of debt to make sure that you stay out of it, and measuring your risk of identity theft while taking safeguards is a critical step towards this goal. Read about the most common identity theft targets in Stumble Forward’s coverage of “The 4 Groups Most At Risk of Becoming Identity Theft Targets.”

Even if you think you have a handle on your debt, you should always regularly check your three credit reports, maintained by Experian, Equifax, and TransUnion, respectively. If you find any errors, it’s important for you to act quickly. Here’s how to get incorrect or fraudulent information removed:

- File a police report if there is any fraudulent information, and send a copy of the report to the bureau(s) by certified mail.

- Send the bureau(s) reporting the error a letter by certified mail explaining the error, and provide proof of your identity such as a copy of your Social Security card or driver’s license.

- The bureau is required to act within four days of receipt, either by blocking the incorrect information or contacting you to let you know why it will not.

The Federal Trade Commission also offers further tips on clearing up your credit after identity theft and other credit reporting errors.

For more ideas on what to do once you’re debt free, check out Stumble Forward’s recent weekly round up of ideas for guarding your financial information, retiring comfortably, and more. Stumble Forward would also like to hear from you on how you managed to reach the point where you can ask out of debt now what – share with us in the comments section!

These are great tips on how to handle life after debt. I worked on all of these over the past few months and I am glad that I did.

They can make a huge difference if you apply them. One I’m working on right now is to correct a few of my bad habits. I haven’t had to deal with debt for quite some time until recently and it’s really made me realize some of the wasteful spending I’ve been doing. Thanks for the comment Grayson.

I think changing your bad habits is the most important thing. Otherwise, you are very likely to run the debt up again.

I agree Kim, I know people who actually make great money with their jobs but are broke because of poor spending habits. In fact a lot of the people I even work with are always talking about the next thing they are going to buy. My mentality is more along the lines of how much money am I going to save back instead of spend.

I called once and had my credit limit lowered on a card from something like $28,000 which I thought was ridiculous! And I totally agree about challenging incorrect information on your credit report. I did once and they had to take the incorrect information off.

I’ve never found any issues with my credit report before but it just makes me wondering how many people have never looked at their credit report for these kinds of things. Thanks for the comment Holly.

Changing habits is pretty hard! But if you have worked so hard to get out of debt chances are you will keep up the good habits. Great tips!

I totally agree Pauline. Whenever change is invovled it tough but you just got to keep telling yourself things will work out as long as you give it enough time. Thanks for stopping by Pauline.