How To Increase Mutual Fund Performance And Avoid The Big Loses

Back several years ago while working in financial services I would often get asked by many of my clients to take a look at their 401k statements and other retirement accounts to see if they were investing their money right.

Often times I would find people who had no idea what they were doing with their retirement. When I asked them who helped them pick the funds for their 401k I often got blank stares back in return and them telling me no one helped them. They got a slip of paper and were told to pick four or five different funds and go with it.

You can just imagine what kind of results these people were getting. In this article I’m going to give you the guidance to help you pick the funds and increase your mutual fund performance and a couple of tips to help you avoid a retirement disaster.

Know What Kind Of Funds You Have

The first thing you need to understand is what kind of funds you have. Often times you will see a lot of different names for the funds within you account but have no idea what they stand for. In order to improve your mutual funds performance you need to know what they mean.

The first thing you need to understand is what kind of funds you have. Often times you will see a lot of different names for the funds within you account but have no idea what they stand for. In order to improve your mutual funds performance you need to know what they mean.

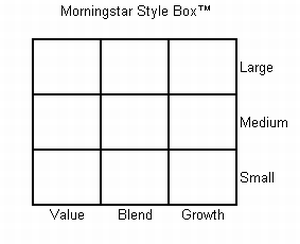

If you look at the style box to right you will see a grid of boxes 3×3. On the right side you will see the words large, medium and small.

The large refers to large cap companies. These are the biggest of the companies we find in the stock market like Walmart, Coke Cola, and Microsoft. These companies will usually have $20 billion in assets or more

Then you will have medium cap companies who are not as big as the large cap companies. These companies will also be a little bit riskier since they will usually experience more volatility in the market. These companies will usually have anywhere from $5 billion to less than $20 billion in assets.

Then you have small cap companies which are the riskiest of them all. These companies are a lot of times the start up companies and business with less than 5 billion in assets. These companies will experience the highest volatility but at the same time will usually see the highest returns as well.

On the top side of the chart you will see the words value, blend, and growth. What this means for your mutual fund performances is that value based means they will usually pay out more in dividends and may do better in a recession. On the other hand growth funds will tend to do better when your in bull market. Finally, blend is a mix of the two.

Now knowing the information that I have given you picking a fund within your 401k or retirement account should be a bit simpler now. When looking at the funds try to pick those that fit your comfort level. Below I will give you a few suggestion as to how I would pick my funds.

What You Should Never Do

Now that we know what funds are and how to pick them in order to get the best mutual fund performances I need to explain one of the biggest mistakes most people will make when picking the funds they do.

What typical people will do is look at the funds recent performance and make decisions based on that. For example, I came across a lady who had all of her retirement money rapped up into a small cap real estate fund once.

When I asked her why she picked this fund she said she liked the funds performance and went with it. Luckily for us we caught here in enough time since at that time the real estate market was on the verge of some major losses.

Instead when picking a fund do as I’ve shown above and if you have to look at performance look at the long term performance of the fund. When you look at a mutual funds performance chart often times you will see returns for one year up to 10 years and since inception. ( the time the fund was started) The idea here is to look at the long term performance since this will give you a better idea of what type of returns you could expect to see from a fund like this.

Looking at just the short term results may show you some big returns but don’t expect them to stay this way.

Finally, one of the final traps a lot of people get caught into when trying to increase their mutual funds performance is they will constantly switch funds within their 401k because they weren’t getting good returns. A lot of times they will then pick funds that did good in the previous year.

The best thing to do in this situation is to pick and stick with what you have. In the section below I’m going to give you a few recommendation as to how you should pick your funds going forward.

My Recommendation

Picking funds for your retirement is based on a person by person basis. However to help you out here are a few guidelines to follow the next time you are review your 401k. I’m providing you these as a starting point and am in no way suggesting you have to do this. In the chart below I have broken recommendation down by age.

- Age 18 to 30. Invest 80% into stocks and bonds and the remaining 20% into small cap stocks and more speculative investments. Doing this will preserve a fair amount of capital and still give you that opportunity to earn higher returns.

- Age 30 to 45. At this point you may want to start cutting down your more aggressive investments to 10% to 15% instead of 20%.

- Age 45 to 60. At this point you will want to cut back your aggressive investments back to 5% or less since retirement is with 5 to 10 years away.

- Age 60+. Finally by age 60 and beyond you will want to cut off the small cap stocks and speculative investments completely to help preserve you retirement nest egg. From here on stick with large cap stocks, bonds,money market funds and fixed investments.

Hopefully this has helped you the next time you are looking at your mutual fund performance charts and need help deciding the best way to stay on track with your retirement. If everything I’ve just mentioned reads like Greek to you feel free to ask a question below.

Chris

6 Comments