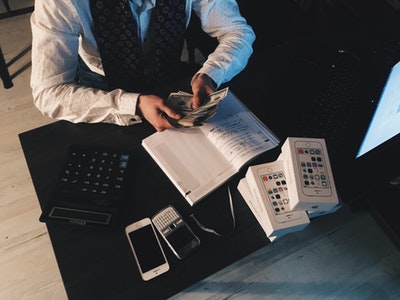

3 Tips on How to Budget Your Daily Needs

Budgeting is important for many reasons. When you know how to budget your money wisely, you’ll have peace of mind knowing that you’ll always have funds to spend on essential things.

Budgeting also keeps you out of debt and improves your credit score.

Everyone needs to budget their finances, yet only a very few are successful in their attempts. If you belong to those who attempted to budget but failed in the past, this article is for you.

Listed below are simple but effective hacks on how you can budget your daily needs.

1. Change Your Shopping Habits

How, when, and where you shop significantly affects your budget. Even if you’re a low-maintenance person, if you often shop at expensive stores, you’ll end up spending more or even living beyond your means.

To budget, your daily needs, start by changing your shopping habits. You can achieve this goal when you:

- Buy in bulk: Instead of buying groceries twice or thrice every week, buy in bulk at wholesale stores to score discounts. It’s best if you prepare a meal at the beginning of the week, so you’ll know what to buy when you visit the groceries.

- Shop second-hand: Who says second-hand is no good? The next time you need new clothes and furniture at home, visit garage sales and thrift stores. You’ll be stunned at the treasures you can discover in second-hand shops!

- Compare prices: Before buying anything, compare at least three different stores to determine which offers the best price. This applies to both online shopping and buying goods from brick-and-mortar stores.

2. Insource Everyday Spending

With the number of businesses operating worldwide, it’s very tempting to pay more just so you can experience convenience. For example, instead of cooking meals at home, you’ll likely choose to dine in at a fancy restaurant because it’s very convenient.

Another way to budget your daily needs is to insource everyday spending. This simply means avoiding outsourcing products or services that you can actually make by yourself. Here’s how you can save money from your day-to-day expenses:

- Limit dining out: Choose to cook meals at home instead of dining out. Yes, this can be challenging at first but can actually help you save tons of money and can encourage you to learn how to cook—it’s a win-win for you!

- Make your own coffee: Do you always start your day with iced coffee from your favorite local coffee joint? By preparing your own coffee at home or in your office, you’ll be able to save around $1,000 every year.

- Try DIY: You can save money every month if you skip seeing your favorite hairdresser or nail artist. The internet is a goldmine of information that can teach you how to trim your hair or do your own nails, so why not give it a shot?

3. Reduce Recurring Costs

You need to pay for several services in your home to live comfortably. For one, you need to pay your electricity bills to ensure that you can use all of your appliances and amenities at home. You might also have an ongoing cellular service to make calls and send messages.

All of these services can easily put a dent in your bank account. And although these are important, there are several ways to minimize repeated expenditures, namely:

- Pare down your cable: If you can’t maximize all of the 500 channels of your cables, choose a cheaper bundle with lesser channels.

- Reduce call or data usage: If you’re subscribed to a postpaid plan, minimize your data usage to save money. If you’re a prepaid subscriber, check your minutes consumed regularly to avoid any excess charges.

- Let the natural light in: Save money on your energy bills by pulling your curtains or blinds to let natural light inside your home. In this way, you won’t have to turn on your lights and heater, allowing you to reduce your energy consumption.

Everything Will Be Worth It

Budgeting your daily needs successfully is an ongoing process, so don’t expect that you can see results immediately. You need to change your lifestyle to handle money better—and this can be very challenging, especially for some who never had a budget.

If you’re truly committed to achieving financial independence, you should be ready to exert time and effort to make the necessary changes.

Yes, this can be very challenging, but the rewards will surely be worth it in the end!