How To Budget Better [3 Actionable Tips]

When you’re trying to manage your money well, you have to make sure that you’re on top of everything. And this can be hard. Because when you hit a rough patch, you can often be too stressed out to focus on making things work.

Yet, the only way to move forward is to take back control of your money and learn to manage it well. And this is where budgeting comes in.

Because when you’re able to master your budget well, you’ll feel happier with your finances. Let’s take a look.

#1 Create Essential Categories

First of all, when it comes to budgeting, you need to be able to allocate your monthly budget into the essentials.

Think about the things that you must spend money on each month, such as rent, bills, groceries, insurances, and more. Then allocate amounts to each.

#2 Track Your Spending

Next, you will want to make sure that you’re keeping an eye on your spending.

You’ll want to make sure that you can track it all against your budgeted categories, to help you to stay on track.

Then, you can cut back or adjust amounts as the month goes on.

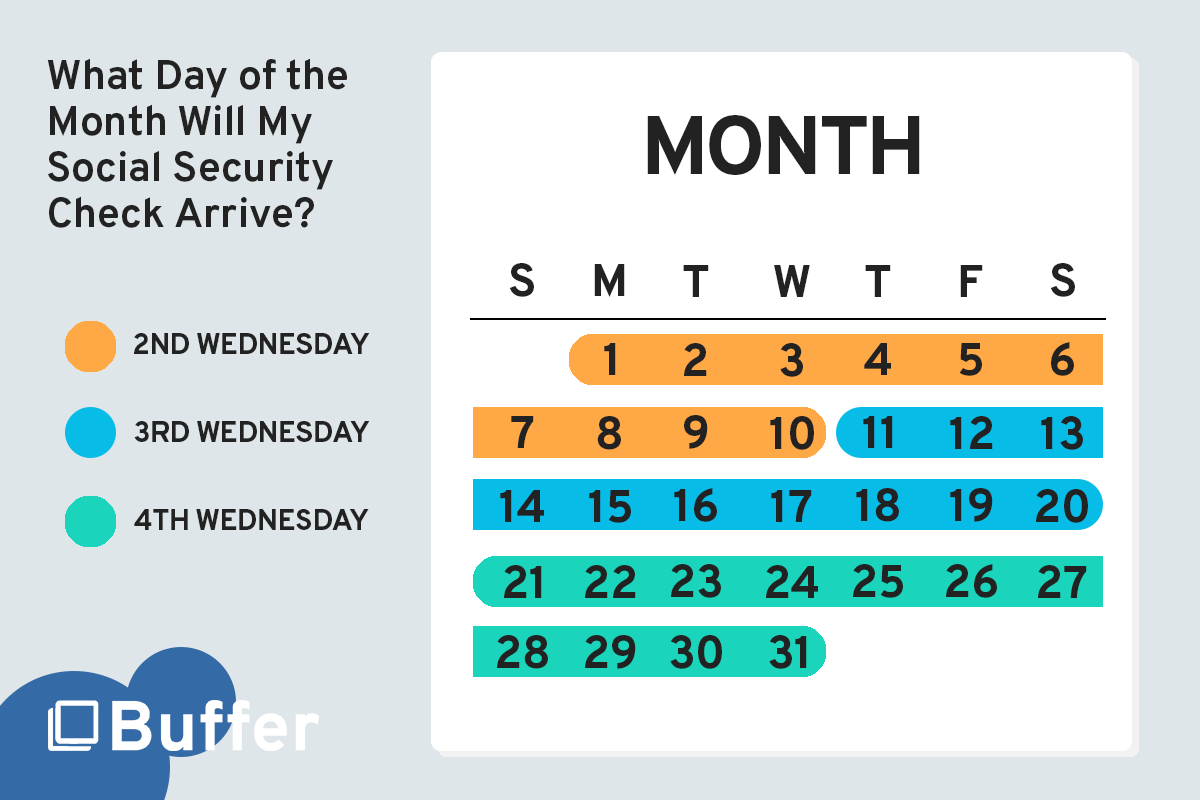

#3 Know When Your Money Comes In

Finally, you absolutely need to know when your money comes in. Because if you’re going to be able to manage your money and budget, you need to be working with the right pay day.

You can then start to allocate your money out to ensure that it will last until your next pay day.

Infographic Design By Buffer Benefits