5 Tips to Managing Your Money When Running a Home Business

Home businesses are a popular way of combining work with family responsibilities. You can also set up a home business and earn some income on the side while you work a full-time job.

It’s not always easy. You will find that wearing multiple hats is a drain on your energy levels and time. It can also be difficult managing your money, especially in the early stages of setting up a business.

Here are a few tips to help.

#1 Enlist Help

Trying to do everything will only end in tears. Too many small business owners delay hiring help because they don’t want to spend money on paying staff to do jobs they can do themselves. This is a mistake. If you want to grow your business, you need help.

The beauty of a home business is that you can enlist the help of family and friends; at least in the early stages. Encourage your teens to do some packing or data entry; keeping teens busy is never a bad thing! Ask your partner to help out with the accounts or persuade your mom to deliver a few packages to the post office.

Enlisting help means you have more time to manage the financial side of running a home business.

#2 Keep Accounts

Don’t neglect the accounts. It might be tempting to put 100% of your effort into attracting clients and pushing out orders, but if you do this at the expense of doing the books, it won’t be long before you end up in trouble.

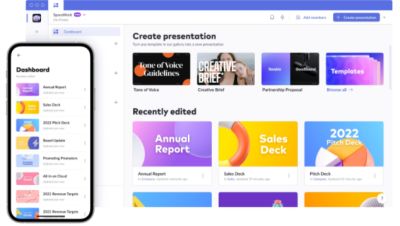

Try and update your accounts at least once a week. Use cloud-based software packages so you can log in from different devices and update the accounts on the go.

Many accounts packages for small businesses have apps. You can scan receipts and log orders remotely. This makes it much easier to keep a track of what you’re spending and earning.

#3 Embrace Technology

Paper checks and cash are still relevant, but you will find it much easier to manage your money if you embrace technology. Instead of paper checks, use eChecks. You can email them to suppliers and save money on postage.

Be open to electronic payment options such as PayPal. The easier it is for people to pay you, the faster the payments will come in.

#4 Monitor Cash Flow

Keep a close eye on your cash flow. Run a cash flow forecast every month and watch out for recurring payments and bills that arrive intermittently.

Always keep a cash reserve so you can cover unexpected payments. It’s the small things, like an unexpected emergency on top of a slow-paying client that cripple a home business.

#5 Credit Control

Pay close attention to who owes you money. As soon as payments are overdue, send out a polite reminder. In many cases, poor memory is the culprit, but if the client is having their own cash flow issues, you need to know. Don’t hesitate to take matters further if a client can’t or won’t pay, but always be polite.

The better you are at managing your money, the easier it will be to grow a successful home business.

What are you doing to manage your money running your home business?