How To Manage Your Budget Better – 7 Things I’ve Learned

I suck at keeping a budget, their I said it.

Of all the financial strengths I have, managing my budget is probably my biggest weakness. I’ve started a budget dozens of times with the intent to improve my financial situation and make it better but failed each and every time.

So over the last couple of weeks I’ve decided enough is enough, and decided to step up to the plate once and for all and face this challenge head on. Over the last week I figured out how to manage my budget better using Mint.com and as a result I’ve learned a lot. For those of you don’t know what Mint.com is you can check out my review of it right here.

So in this article I’m going to cover seven things I’ve learned on how to manage a budget better.

How To Manage Your Budget Better

Keep Things Simple. The first thing I feel that is so important to keeping a budget is that you keep things as simple as possible. I’ve found with all the other budgets I’ve had the moment I made things to complicated I would ultimately end up veering of course.

The best way I’ve found to do that is to use Mint.com simply because it does most of the heavy lifting for me. I’ve found anytime that I used a spreadsheet or program that requires me to input every single transaction I manage to find a way over complicate things.

Link All Of Your Accounts. On top of that I’ve also found that by linking all of my accounts into a great program like Mint it automatically brings in every transaction made with every account I have.

What’s great about this I can see every transaction made from one spot. So whether it’s an account transfer, a paycheck being deposited, or a withdrawal, I can see it all in one place.

Categorize Your Transactions. This brings me to my next tip on how to manage your budget better and that is to categorize every transaction you make. Being very specific with the way you categorize your transactions has everything to do with making your budget a success.

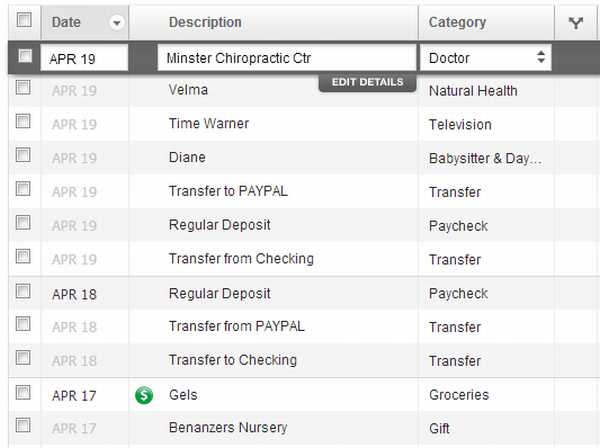

What’s great about Mint is since all of your transactions are already brought into the programs it’s really easy to label them correctly an know exactly how much you are spending in any given area. I should also point out that if you don’t categorize things right your budgets will be off so take the time to thoroughly categorize your transactions. Below is a picture of what my transactions look like when they are properly categorized.

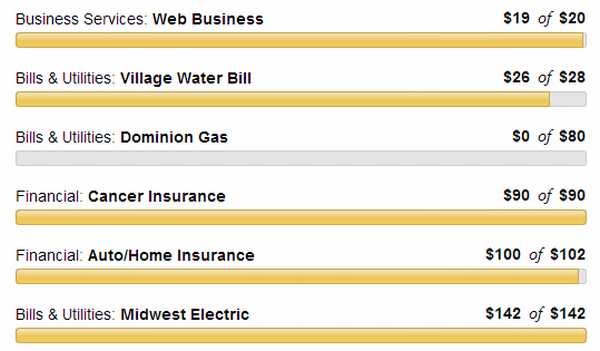

Set A Budget For Everything. The next thing that is very important is to set a budget for everything you can. Budgets allow you to designate money towards each individual area of your finances. For example I have a budget for my television internet & phone, electric, gas, water & sewer, insurance, and groceries just to name a few.

I also budget for harder things that tend to vary a lot like doctor bills and health care as well. When it comes down to it set a budget for as many things as you can, this way it allows you to track the spending of those things as you go. Below is a sample of my budget looks like.

Monitor Your Trends. Another thing I learned from managing my budget this way is that it allows me to monitor trends within my budget over a long period of time. This way I can spot things that may have gone unnoticed over the long term.

For example, a few things I didn’t realize that I spent so much money on was things like the kids and natural healthcare stuff. Before keeping a budget I knew we were spending money in these areas but I didn’t realize how much it was. This has allowed me to look for other ways to lower the cost these areas and spend less overall.

On top of that I’m also able to compare things from month to month or from this month a year ago. So in a year from now I see how my spending has improved since I’ve started keeping my budget.

Set Goals. One area I’ve yet to dive into yet with Mint is setting goals, however I can already see the huge advantage to this already. Personally I have a lot of goals in life, I want to travel, I want to pay off my debt, I want to have an emergency fund, and I want to quit my full time job and start my own business.

The thing is all of this stuff takes planning and without a good plan in place most of these things will only stay a dream. With a budget it allows me to set goals to complete these task, and I hope to talk more about this as things progress.

Make It Fun and Work Together. Finally, most of all I feel you have to make things fun. Without that what is the point in doing all of this. I think running a budget requires both spouses to work together to make it work successfully. So when it comes to my budget my wife usually pays all the bills and I update the budget to make sure we are on track with our goals.

On top of that we are setting a goal to reward ourselves once we achieve a certain level of success. For example, one of my goals is to take a trip to St. Lucia which has been a goal of mine for a long time. So as a reward once we have completed several of our goals and improved are finances we plan to take a nice vacation to reward ourselves.

So what are you doing to manage your budget? Do you use web based programs like Mint or YNAB? Share your thoughts below.

Congrats for getting back on the budgeting horse Chris! I started and stopped so many times it was starting to get a little ridiculous. I think the keeping things simple is a vital step that many overlook, as well as the goal setting. We do not use any software…just plain ol’ Excel and it works for us.

We’re not too good with staying with our budget. I don’t ever track it, but we should!

Thanks John. Simplicity is a big part of keeping your budget going, in fact this why I feel most people don’t start one in the first place. I’ve tried using Exel to manage my budget but it always just ended up getting to complicated for me, but it’s great to hear that you have one. I also feel people just got to do what works for them.

For me it’s Mint because their program is simple and easy to use, on top of that I also have their iPhone app which allows me to review my budget while I’m out and about. For example one place I’m looking to try it out at is when me and the wife go grocery shopping to see how well we can stay inside the budget. Knowing how much we can spend will go a long way to helping us out financially.

I know right where you are coming from Michelle. Budgets can seem like a daunting task but with programs like Mint it’s really not as tough as I thought it was going to be. One of things I fell into a bad habit of was not having a budget when I didn’t have any financial issues and debts. The problem with this is that I was spending a lot of money in the wrong ways and I didn’t even realize it.

I’ve used Mint in the past, but gave up on it because I became tired of all of the error messages when it tried to access my accounts. But I am glad you found a system that works for you. Everyone has to find their own system and go from there. I track my budget using excel – yup I’m old school, but I don’t track every category. It’s too overwhelming. I track those problems areas and if things still don’t add up – which rarely happens anymore, I review my account statement for the trend and add that category going forward.

Mint.com sounds like a great tool to help get the budgeting started and keeping it going for the long-run. How much does it cost? I’m interested to see how things are going for you in a few months,. Hopefully, you’ll be hanging in there and getting closer to St. Lucia. I think having a reward to work towards make so much sense. We budget and keep track of our spending by categories similar to yours. We find that when our income is feeling flush we fudge on our budget and overspend. The trick is to keep on track through thick and thin.

Hi Craig, Mint is a great program and the best part about it is that it is completely free. As far as St. Lucia goes it feels like it’s a long way off, but we’ll get there. Thanks for the comment.

I would have to agree I have that same problem every now and then with Mint Jon. I’ll admit Mint actually didn’t work so well for me in the beginning because I couldn’t add my bank since it was a smaller more local bank. However once you get past that hurdle it’s pretty simple and easy to use.

We are tracking our expenses to know where our budget goes. This way we’ll know if we overspend or not and so we can avoid making the same mistake again.

Great point KC. I’m doing exactly the same thing. Tracking things by categories allows you to see how much you are spending in a given area and also shows you were their might be some leaks in your budget. Thanks for stopping by.