Why Buying Gold Is Still A Good Investment – A Guide For Beginners

You may have at one time or another recently heard an ad on the radio or on TV claiming that you need to buy gold now to protect your financial future. In fact, this is often true when the stock market takes a huge dive people tend to look towards commodities such as gold as safe havens to protect their investments.

In fact if you look at this recent chart below of what gold prices have done over the last year alone you can see that they’ve done exceptionable well.

With over a 30% gain in the last year alone it’s no wonder people are jumping on this band wagon, but before you get caught in all the drama you may want to take a deeper look. So in this article I’m going to give you the pro’s why buying gold is still a good investment, the con’s, and how to buy gold the right way.

With over a 30% gain in the last year alone it’s no wonder people are jumping on this band wagon, but before you get caught in all the drama you may want to take a deeper look. So in this article I’m going to give you the pro’s why buying gold is still a good investment, the con’s, and how to buy gold the right way.

The Pro’s Of Buying Gold

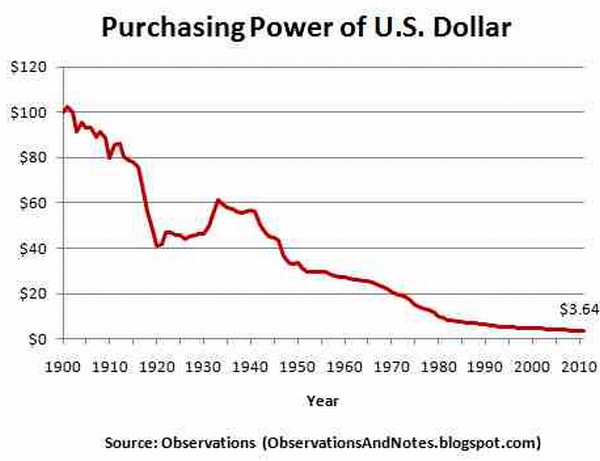

Currency Devaluation. The first thing that makes gold so great is that as the US Dollar continues to be worth less and less while gold is still skyrocketing. In fact, when we look at the historical value of the dollar in the chart below we can see how the value of a dollar has drop over the last 110 years.

Market Downturns. On top of that, gold also does well in market downturns as well. If you’re still looking for that one reason to buy gold as a good investment, it can be a great way to protect against losing out in big market downturns like the recent one we faced in 2008.

Market Downturns. On top of that, gold also does well in market downturns as well. If you’re still looking for that one reason to buy gold as a good investment, it can be a great way to protect against losing out in big market downturns like the recent one we faced in 2008.

Below is a chart showing the last 5 year market returns of the Dow Jones Industrial Averages, which is the blue line. The red line is a random gold exchange traded fund I found.

Notice how the gold ETF is up by 155% while the DJIA is only showing just over a 1% average. Just by these numbers alone shows that gold is still a good investment.

Global Currency. Another great thing about gold is that is accepted almost everywhere and can be exchanged for money or other assets all over the world.

Physical. Finally, unlike stock, bonds, and other paper assets you can actually hold gold in you hand and won’t lose its value if some company goes under. In fact gold will always have a value.

The Con’s Of Buying Gold

Now that we have an idea of why gold is a good investment it doesn’t mean that their isn’t any disadvantages though. So here are few to consider.

Fee’s. If you plan to buy gold in the physical form such as gold coins or bullion you will have to realize that their will be fees known as a spread, and not only are these fees charged when you buy but also when you sell. Later in this article I’ll show you how to avoid these fees altogether.

Storage. The next thing you need to consider is where you are going to store your gold at. If you plan to store it you’ll defiantly need a safe of some sort. With gold trading around $1700 or more for just one ounce you will need to protect it, especially if you are buying large amounts.

However, if you don’t like the idea of buying your own safe you may be able to have someone hold it for you, however this will cost money as well and can be an extra added fee that will cut into your earnings.

Volatility. Finally, when it comes down to it gold is a very volatile investment. In fact if you look at the chart I showed in the very beginning of this article you will notice even in the short span of a few months prices can drop dramatically. If you notice in the last 4 months of 2011 gold lost over 14% in this period.

How To Buy Gold The Right Way

Step 1: Diversify. Now that we’ve covered the pros and cons of buying gold I feel it’s still worth owning. So in this section I’m going to show the best way to buy gold. First off, one thing you should not do when investing in gold is that you should never invest all of your money in gold.

As I mentioned earlier it can be a very volatile investment and instead I recommend that you not invest anymore than 10% to 20% of your entire portfolio in gold. Just like any other investment you need to diversify your money and with gold it’s no different.

Step 2: Choose Your Investment Vehicle. One of the first places I suggest people to look when it comes to investing in gold is their current investments. So if you have an IRA or a 401k at your place of work they may already offer a gold fund within their current portfolio.

However, if you would rather invest in gold on the side I suggest going with a gold exchange traded fund, also known as a gold ETF. A gold ETF allows you to have the investment power of a mutual fund were you don’t have to physically own the gold but also allows you to sell your gold at any time you want like a stock or a bond.

On top of that when you choose either of the two options I’ve covered you won’t have to worry about the spread fees and storing the gold since this will all be done for you.

Step 3: Use Dollar Cost Averaging. The last step to investing you money with gold is to use Dollar Cost Averaging. This is the process of investing your money on a gradual basis, such as every month. The reason I suggest this is because investing in gold is again very volatile and if you invest all of your money at the wrong time you could take a huge lose right up front.

By gradually investing your money you will spread the risk of volatility over time and stand less of chance to losing your money.

Final Thoughts…

When it comes down to it gold really is a good investment right now, you just need to be careful how you do it. On top of that know that even though at the time of this writing gold prices have been going through the roof but they will fall. Just like any other investment gold has it’s up’s and down’s, so follow my simple 3 step process and you should do just fine.

Do you invest in gold? How is it working for you? Are investing in gold ETF’s or are you buying gold coins or bullion? Feel free to share you thoughts, comments, tips and questions about why buying gold is still a good investment below.

Cheer!

3 Comments