Is It Better To Pay Off Your Mortgage Early Or Invest Your Money

In yesterdays article we talked about whether you should pay off your mortgage early or not, and in that article I gave valid reasons why this may or may not be a good idea. So in this article I’m going to take this idea one step further and see if it is better to pay off your mortgage early or invest money towards retirement.

In yesterdays article we talked about whether you should pay off your mortgage early or not, and in that article I gave valid reasons why this may or may not be a good idea. So in this article I’m going to take this idea one step further and see if it is better to pay off your mortgage early or invest money towards retirement.

Some Assumptions

Before I start I know that everybody’s situation is different. So in the examples below I’m going to use the same variables, however feel free to add your own variables to see how things could work for you. Below are the variables I will be using.

- Loan Amount – $100,000.

- Loan Payment – $507

- Extra Available Cash – $250

- Interest Rate – 4.5%

- Loan Term – 30 year fixed

- Investment Return – 8%

Pay Off Your Mortgage First Then Invest

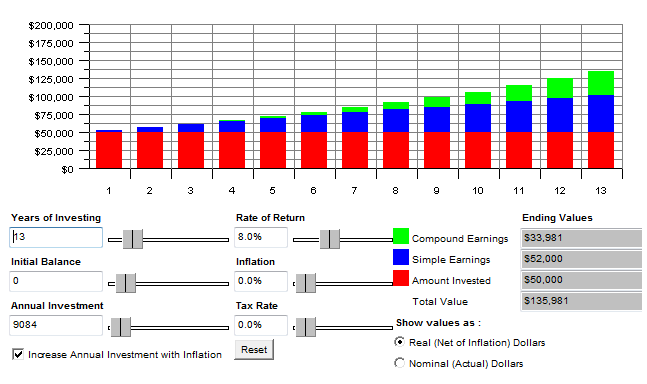

In the first pay off mortgage or invest example I’m going to show you what would happen if you decided to pay off your mortgage first and invest what’s left over. Below is chart of how things would end up.

First off, in the picture above if I were to pay an extra $250 a month towards this mortgage the loan paid off in roughly 17 years, and I would have saved over $38,000 in interest payments as well.

First off, in the picture above if I were to pay an extra $250 a month towards this mortgage the loan paid off in roughly 17 years, and I would have saved over $38,000 in interest payments as well.

However we’re not done yet.

Since we are only 17 years into the 30 year term period we are now going to invest the extra payment of $250 along with the mortgage payment of $507 for a total annual investment of $9084 for the next 13 years.

As you can see by investing the remaining amount of money of $9084 for the next 13 years I would end up with an extra $135,981. That’s not a bad deal for paying considering that we paid off the mortgage first.

As you can see by investing the remaining amount of money of $9084 for the next 13 years I would end up with an extra $135,981. That’s not a bad deal for paying considering that we paid off the mortgage first.

Don’t Pay Any Thing Extra Towards The Mortgage

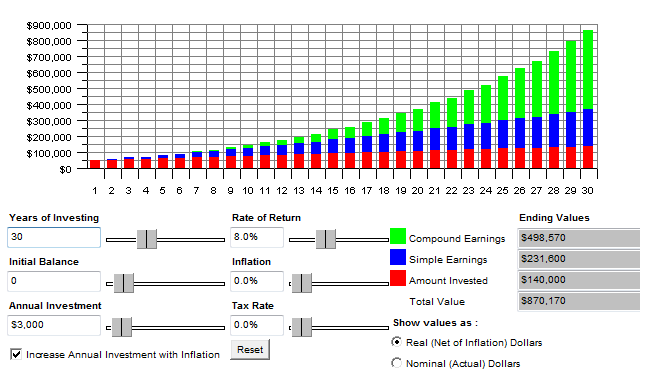

Now let’s consider what would happen if we would not pay any extra money toward the mortgage and invest the extra $250. Obviously, it would take 30 years to pay off the mortgage still but by lets see if investing the money fairs better than paying off the mortgage first.

By looking at the picture above we can see that if we were to invest the extra $250 over the full 30 year period that it would have earned us $870,170, the mortgage would be totally paid off as well. Now let’s see how things compared.

The Results

When we compare the results we find that in example 1 the mortgage will be paid off nearly 13 years faster and that when we invest the extra funds at after 13 years that we end up over $135,000. On the other hand in the second example when we don’t apply any extra payments towards the mortgage and invest it we end up earning or $870,000 as a result.

Why is this?

The reason the second example in the invest or pay off mortgage early option worked was because it had more time to compound the money versus the first example where we only had 13 years to invest and save money. To prove my point look at the investment chart in example 2 and notice how the compound interest gets bigger and bigger, especially in the later years. This because as the money grows it becomes easier and easier to grow the amount of money you have.

Final Thoughts…

So what are your thoughts? Is it better pay off your mortgage early or invest the money towards retirement? Feel free to share your thoughts, comments, and questions below.

This article was recently featured in the Carnival of Personal Finance by Beating Broke.

One Comment