Should I Pay Off My Mortgage Early

Do you you have a dream to pay off our mortgage someday. I know this is one my dreams, to be free and rid of a monthly mortgage payment that does noting but eat up your income. However before you consider, should I pay off my mortgage early, you may want to think about some of the reason you should and should not do this.

Do you you have a dream to pay off our mortgage someday. I know this is one my dreams, to be free and rid of a monthly mortgage payment that does noting but eat up your income. However before you consider, should I pay off my mortgage early, you may want to think about some of the reason you should and should not do this.

When You Should NOT Pay Off Your Mortgage Early

High Interest Debt. First off, you should not consider pay off your mortgage when you have other high interest debts such as credit cards, personal loans, or even car loans. These debts will typically carry some extremely high interest rates.

On top of that high interest debt doesn’t carry any benefits it. For example, with your mortgage you are able to tax deduct the interest you pay, while with credit cards and other debts you cannot. So before you consider paying down your mortgage pay off your credit cards and other high interest debt first.

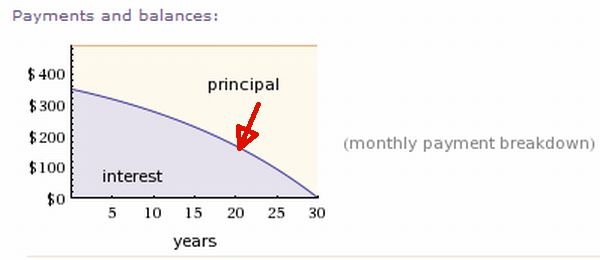

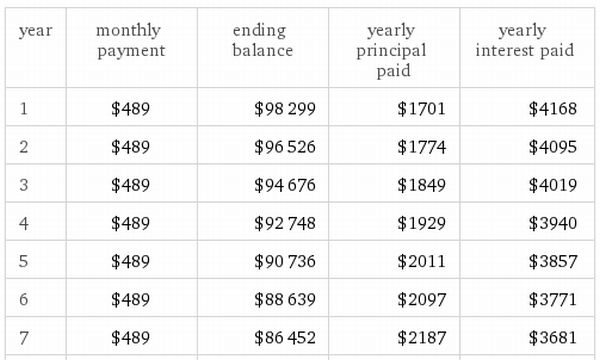

At The End Of Your Loan. The reason you may not want to pay off your mortgage is if you are in the last 10 years of a 30 year mortgage. The reason for this is because in the last 10 years of a 30 year fixed mortgage you will pay hardly any interest. Take a look at the picture below.

In the chart above you can see that in the last 8 to 10 years you are paying mostly just principle payments. This means that any extra payments you pay aren’t going to have a major effect when it comes to cutting interest down. On the other hand any payments that are made will mostly go towards the principle portion of the loan.

Job Loss. Finally, the last reason you may not want to apply extra payments to your mortgage to pay it off early is because of the possibility of losing your job, and in today’s economy their is a very good chance that this could happen.

That last thing you want to do when your paying off your mortgage early is to tie up all of your hard earned money in your mortgage and then lose your job as a result. Even worse you could end up on the unemployment lines for months and not be able to pay your mortgage payments, and even though you made extra payments lenders are not going to be as forgiving.

Instead of paying that money towards your lender consider saving it for rainy days such as this. You will stand a much better chance of surviving a major catastrophic event such as losing your job a lot easier.

When You Should Pay Your Mortgage Off Early

Now that we’ve covered the reasons not to pay off your mortgage early let’s consider a few reasons why we should pay are mortgage off early.

At The Beginning Of Your Loan. If you just refinanced or started a 30 year fixed mortgage making extra payments right now is the best time, simply because it will allow you to cut down the interest you owe over time. To prove my point look at the chart below.

If you look at the chart above consider how much in interest payments you are making each year versus principle payments. In fact with a 30 year fixed mortgage it isn’t until year 15 when at least 50% of your mortgage payment goes towards the principle portion of the loan.

However, if you were to pay extra each month you would pay down principle portion much faster and avoid paying all the extra interest in the end.

Older Age. Secondly, when you are in your older years say 60 and higher you will defiantly want to consider paying more towards your mortgage. The reason for this has to do with income. Older people, especially those who are retired, may tend not to have as much income, and when you factor in the issues with social security it’s a good idea to have your mortgage payed off sooner rather than later.

However, their is another issue seniors need to consider also, and that is taxes. As seniors get older they are pron to lose some of their tax privileges. For example, a few tax issues to consider are things such as the deductions you may have received from contributing to your works retirement plan, or the tax deductions you use to get if you had dependent children at home. Without these deductions your taxes could go up.

When You Have The Cash. Finally, last thing you should consider when your thinking, should I pay my house off is if you have the cash to do so. If you have the available cash to pay off your mortgage right now, do it. The option to live without a mortgage payment is the best way to go especially when you have the money.

However, I again offer a few restrictions. One being only if you again have your high interest debts all paid off first. The second reason is if you are pulling it out of some sort of retirement fund. It’s great that you have the money to pay it off but if you need that money for retirement don’t do it.

Final Thoughts…

As a final thought before you consider should I pay my mortgage off early, consider the thoughts I’ve published in this article first and you will be likely to avoid and mistakes. Also feel free to share your thoughts, comments, and questions about paying your mortgage off early below.

4 Comments