How To Pick Good Investments – It’s Easier Than You Think

Today I’m going to show you how to pick good investments. In this article I’m going to show you how easy it is to set up your own retirement investments by taking a simple quiz that will outline the amount of risk you can handle. On top of that I’m going to show you where to get the best investment with the lowest fees often times refereed to as a No Fee IRA. To learn more you can check out a No Fee IRA here.

This quiz was developed by a company called Morning Star which helps people determine risk tolerance and what suitable good investment options are for you. This quiz is given to almost anybody that has set up a retirement account and is the same quiz given to clients of Charles Schwab.

Below in the 6 question quiz it will ask you some very specific and key questions that will help you determine the amount of risk you are willing to take. Before I start this quiz I want to make one thing clear, be as honest as possible otherwise you will defeat the purpose of this quiz. Are you ready? Let get started.

The Quiz

Question #1: I plan to begin withdrawing money from my investments in:

- Less than 3 year 1

- 3 to 5 years 3

- 6 to 10 years 7

- 11 years or more 10

Question #2: Once I begin withdrawing funds from my investments, I plan to spend all of the funds in:

- Less than 2 years 0

- 2–5 years 1

- 6–10 years 4

- 11 years or more 8

Question #3: Once you have the first two questions answered total the point up for each. For example in question 1 I chose answer number 4 which gives me 10 points and answer number 4 for the second question which gives me 8 points for a total of 18 points. On to the next question. I would describe my knowledge of investments as:

- None 0

- Limited 2

- Good 4

- Extensive 6

Question #4: When I invest my money, I am:

- Most concerned about my investment losing value 0

- Equally concerned about my investment losing or gaining value 4

- Most concerned about my investment gaining value 8

Question #5: Consider this scenario: Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would you do?

- Sell all of my shares 0

- Sell some of my shares 2

- Do nothing 5

- Buy more shares 8

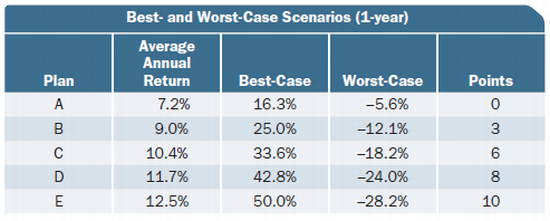

Review the chart below. We’ve outlined the most likely best- and worst-case annual returns of five hypothetical investment plans. Which range of possible outcomes is most hypothetical investment plans. Which range of possible outcomes is most acceptable to you?

The figures are hypothetical and do not represent the performance of any particular investment.

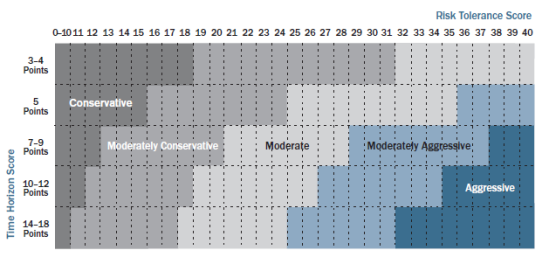

Risk Tolerance Versus Time Horizon

Now that you’ve answered the last three questions let’s see how we did. Start by adding the points up of the last for questions. For me on question 3 I pick answer 4, on question 4 I picked answer 2, and question 5 I picked I picked answer4 and question 6 I pick plan C. This totaled up to 24 points for me altogether. Now lets see what my risk tolerance versus time horizon is. If you look at the chart below you will see that time horizon is on the left side and that risk tolerance is horizontal across the top. I had 18 points for my time horizon and 24 points for my risk tolerance.  By looking at the chart above I fit into the moderate to moderately aggressive category, what did you get?

By looking at the chart above I fit into the moderate to moderately aggressive category, what did you get?

What Are Good Investments For You

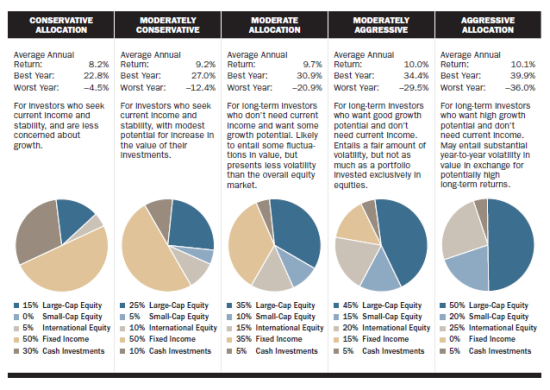

Now that we know what your risk tolerance is we need to pick the investment that best suits you. What’s nice about this is that any mutual fund company that offer the Morning Star Asset Allocation models will already have all of the funds broken down into 4 or 5 different groups to help make the selection process a lot easier. Looking at the picture below I was instructed that the moderate allocation fund would be best for me.

This fund allocation is made of around 30 or more holdings and has around 35% invested in large cap equities, 10% in small cap equities, 15% in international equities, 35% in fixed income holdings, and 5% in cash investments. Now look and see what you got?

This fund allocation is made of around 30 or more holdings and has around 35% invested in large cap equities, 10% in small cap equities, 15% in international equities, 35% in fixed income holdings, and 5% in cash investments. Now look and see what you got?

A Final Thought…

As you can see this is a much easier way to pick funds for your retirement. Now you have a targeted set of funds that fit your specific risk tolerance and time horizon. On top of that your retirement investment isn’t jammed into one or two funds but instead it was spread over 30 different funds that will cut the risk down.

On top of that you should also make sure you check out the fees as well. Investment fees are different with every company this is why I suggest you invest your money in a No Fee IRA. To learn more check out this No Fee IRA

with Lending Club.

In the end good investments are what you make them out to be, feel free to share you answers or if you have a question feel free to ask below.

Thank you for giving me the opportunity to express my self, i don’t know much about investments but i would love to safe invest my money but after i had answered you questionior i realized that i’m falling into the conservative margin and i would love to fall into the aggressive, what should i do

Hi I don’t know much about investing but I’d like to invest to make money as I would like to buy a house for my family is this possible?

Aayesha,

Those sound like some great goals to shoot for. For this kind of situation if you’re looking to build a house and want to get your money working for you I suggest the Vanguard Life Strategy Funds. These funds can help you invest your money based on the amount of time you would like to complete your goal, on top of that these funds also charge very low fees compared to others. You can learn more about the Vanguard Life Strategy Funds here https://personal.vanguard.com/us/funds/vanguard/LifeStrategyList

Hii.. i want to invest 10k Rs. for like 6 months. Can u suggest me some options where i can get the best return?? I have some knowledge of stock market, but can u suggest some other better options for it??

Hi Shashwat. I can’t give financial advice but in all honesty my suggestion is if the money needs stay safe and liquid where you will need in the next 6 months I suggest you keep it in a CD or put it in a high interest savings account from Ally Bank which is doing 0.95% currently at the time of this writing. Here is a link to check it out the

Ally Bank Online Savings Account