5 Investment Tips To A Smooth Retirement

Getting started with retirement investing can a tough thing to do when your a beginner. You may be wondering where you should invest your money, and how you should do it?

In this article I am going to give you the 5 investment tips that will ensure that you have a smooth and successful retirement.

Start Investing Early

The first investing tip is to start early. This tip is probably one of the most important investing tips I’m going to give you because getting started early will give you a much higher success rate to retiring the way you want to.

For example if you started saving at the age of 18 putting back $100 a day you would have roughly $710,000 earning 10% interest on average by the time you were 60 years old. That’s pretty good and the interest rate may even be a little low.

However on the other hand lets say you waited until you were 45 till you decide to start saving for retirement and instead of just investing $100 you invest $250 a month getting a 10% average return on investment. The result is even though you are investing more and have the same interest rate you will only be able to save around a $105,000.

The moral of the story is you need to put time on your side when investing in your retirement, and start early.

Know What Your Investing In

The second investment tip is also very important. In fact their are actually to parts to this tip. The first part of this tip is that you need to know what type of account you are investing.

Is it an IRA, 401k, Roth IRA, or a Simple Plan. My suggestion here is that if you are already investing a 401k program at your work place I suggest that you get a Roth IRA.

The reason I suggest this is because the 401k is being funded with pretax dollars that you will have to pay taxes on at some point in the future when you retire. The Roth IRA on the other hand is funded with after tax dollars that you will not have to pay taxes on when you go to retire.

The next thing you need to know about when your investing is the fees associated with the investment you are getting involved in. For example American Funds, which is a mutual fund company will charge an initial sales charge of 5.75% on any new moneys that are placed inside that account.

On the other hand if you look at the Vanguard Star Fund the initial sales charge would be 0.37% which is much less than other funds, and that’s why it’s also important to do your homework and know what your investing in.

Dollar Cost Average

Dollar cost averaging is the process of which you invest a fixed amount of money on a certain time period, usually a month, over a certain time period like 30 or 40 years.

The reason that dollar cost averaging is such an important investment tip is because this method will actually help bring the overall cost down when you buy your actual shares.

For example, if you invested $10,000 all at once at and the current share price was $10 at that time you would buy 1000 shares. However if you invested the money over a period of 5 years and in year 1 paid $10 a share, year 2 at $7 a share, year 3 at $5 a share, year 4 at $7 a share, and year 5 at $9 a share., the result would be much different.

The end result would be an average price of $7.60 instead of $10 and instead of getting just 1000 share you would get 1316 shares. That’s 316 more shares than if you would have invested all of the money at one time.

Diversify Your Investments

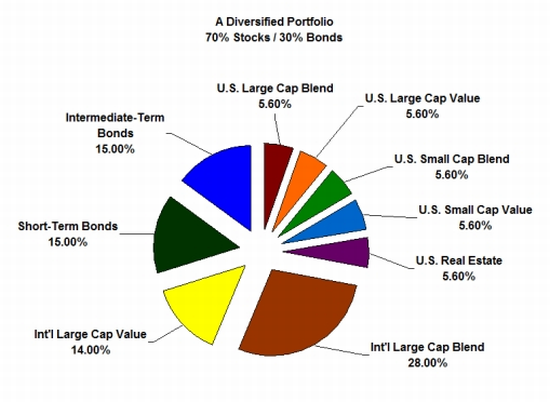

Of the previous tips on investing it was important that you you get started the right way but in this tip it’s very important that you diversify what you invest in. In the picture below is what a typical pie chart would look like of a mutual fund that you may invest in.

Inside the mutual fund you will invest in several hundred companies like huge international companies to US Real Estate, to smaller companies that are just getting up and running. You will also invest a certain portion into just stocks and some into just bonds.

Now you might be wondering how do I figure out which of these areas to invest my money in? The answer is simple, a lot of times these companies will offer what is called an asset allocation questionnaire which is a short 7 question quiz that will ask you what kind of risk level you like in your short and long term investing goals.

Once you fill the quiz you just add up the score and a lot of times you will have 5 different investment models to choose from starting with preservative which takes the least amount of risk to the aggressive which is taking the most amount of risk.

Keep Your Money Where It Is

Finally, in the fifth and final tips for investing it’s so important that you keep your money right were it is. In life sometimes reasons and issues come up were we will be temped to pull the money out of are retirement accounts to help cover the cost.

I urge you no matter what happens to never do this. First off it will have a huge affect on the outcome of your retirement which we’ve already discussed in the first tip. Second, it will affect you by taxing you.

If you pull money out of your retirement account like your IRA, or 401k you will first pay a 10% tax penalty unless your 59 and a half or older, and then on top of that you will still have to pay ordinary income tax on top of that.

For example let’s say you pull $10,000 out of your IRA, you will lose $1000 for the 10% tax penalty and if you had pay an average of 20% in ordinary income taxes you would lose another $2000 to that as well.

The result of doing this means when you pull out $10,000 you will only get $7000 because $3000 will be owed to the government in taxes.

Share Your Story…

Do you have any investment tips to share, or have you made the mistake of not following one of the tips I’ve laid out above? If so please feel free to share your story and tell us how these tips have made a difference or added to the value what you are doing.

Chris

7 Comments