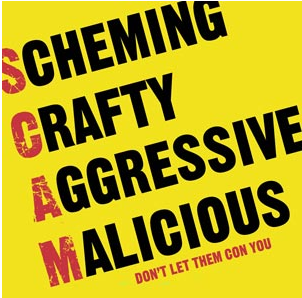

Debtmerica Relief Scam: The Story That Nobody Tells You

Back last year I wrote a review about Debtmerica Relief, a debt negotiation company that helps people get out of debt, and one of the things I’ve been noticing was that a lot of people were claiming Debtmerica and all other debt negotiation companies are a scam.

While I can’t speak for all debt negotiation companies I can speak for Debtmerica Relief. So in this article I’m going to cover a lot of the misconceptions people are having with debt companies like Debtmerica and give you more in depth reasons why they do what they do.

Why Only Unsecured Debt

One of the big reasons people don’t understand about debt negotiation companies is why they only except unsecured debt like credit card debt and not secured debt like a mortgage, and the answer is very simple.

If you were to go 3 months without making a payment on a credit card what could the creditor take away from you? Nothing, because a credit card is not backed by an asset. When you look at a mortgage it is a secured debt and if you did fail to pay the bank would take you home away. However, some secured debts can become unsecured debts.

For example if your house went into foreclosure and the bank repossessed it and they didn’t earn enough money from the sheriffs sale to payback the full amount owed they still make you liable for the debt owed. However, now the debt is not secured because it is not back by an asset now.

Why You Pay One Payment

One of the big claims with Debtmerica and other debt negotiation companies is that the reason you pay them one lump sum payment is so they can disburse the funds accordingly. While this is true for the most part there is another side to it as well.

Think of it this way when you get a mortgage, who gets paid first, your principle payment or the bank through interest payments? If you’re not sure just go to any bank and ask them and they will tell you based on almost any normal amortization schedule that the bank always gets their money first.

Debtmerica and other debt negotiation companies are no different. They do this because they know a lot of people won’t stick with the plan and will probably quit before they complete the program. So what do they do, they pay themselves first.

Why You Still Get Calls From Debt Collectors

If you’re delinquent on any of your bills for more than a couple of month’s debt collectors will start calling you. However one of the big misconceptions is that once you start the program the calls will stop.

In reality though it just don’t work that way, in fact they may even call you the entire time you are in the debt negotiation process, or even after you have paid off the debts.

What Killed My Credit

Another thing many people don’t understand is the fact that debt negotiation will likely hurt your credit score. Think of debt negotiation like a mini bankruptcy, but not with as much of a damaging effect unlike its older brother.

There are two reasons for this, first debt negotiation companies always get paid first like I mentioned earlier and second they may be purposely not paying one debt so they can pay off another.

Missing a payment or two on a debt can be like the kiss of death to your credit report however it’s not as long lasting like bankruptcy were credit score will be totally trashed for the the next 7 years.

Why Am I Getting Taxed

One of the things a lot of people don’t consider is the tax issues you might face when you go through debt negotiation. For example, let’s say you have $30,000 of credit card debt and Debtmerica was able to cut $17,000 of your debt off and you only had to pay back $13,000 of your credit card debt.

The result would be that you would still have pay the taxes on the $17,000 of debt. However, if you want to know how your situation would be effected call you accountant before you get involved with Debtmerica Relief.

What Are The Fee’s

First off a lot of companies don’t usually disclose their fee’s upfront. With Debtmerica it’s somewhere between 15% to 17% of the total amount of debt applied to the program. For example, if you had $30,000 of debt in this program you could expect to pay them around $5000 in fees paid monthly.

Now you might be saying is that really worth it or not, and the truth is it all depends on everyone’s situation. If it saves you in paying $5000 or more in interest payments and get you out of debt sooner it could be very much worth it.

However, I suggest you investigate what all of your fees will be before you sign on the dotted line. There’s nothing like finding out after the fact that you got ripped off.

Can I Get Sued

The reality is that if you do become delinquent on a debt the creditor has the legal right to sue you for amount owed. Will it happen is another question though.

I’ve only heard of this happening in very rare instances, but know that it can happen. I also believe any reputable debt negotiation company like Debtmerica would not likely put you in that situation.

Do You Have A Question

I’ve covered a lot of the questions many people have about Debtmerica and debt negotiation companies but I’m sure I’ve missed something so give me a shout if have a question and I’ll do what I can to help you out.

Chris

I’ve heard of debt negotiation companies before, specifically Debtmerica.

These companies may not necessarily be a “scam”, but I think they do a bit more harm than good.

As you mentioned, using this service is likely to hurt your credit score a lot, and the fees they charge can be substantial.

I think it’d be better for a person in debt to learn how to get out of debt without these programs. Dave Ramsey has good material in this area. Even 0% balance transfer cards would be better than debt negotiation.

I can’t disagree with you more Darren… no dis-respect. These programs are for people in real financial hardship… like me unfortunately. If you can make your payments and even pay more than your minimum payments, I’m not sure why you’re even looking at assistance programs. I’ve tried to get out of debt on my own and no matter what I’ve tried, it doesn’t work. I’ve called some companies and you can just tell they’re shady or the people you speak with don’t know what the hell they’re talking about. When I called Debtmerica, they were honest and explained all the details about how this works. The benefits and the risks. But I think that’s the key. Understanding how this works so I know what to expect after I’m enrolled. And now, they don’t even charge fees until after your debt gets settled. I spoke with them earlier which is why I’m on here but I think I’m going to go ahead and sign up. It’s better than ignoring the problem and the banks sure aren’t willing to help me…

These programs are based on hiding real issues their customers will face and taking advantage of vulnerable folks with view options.

Total cost of service and what can be refunded?

How many people they have actually settled their debt?

What is guaranteed?

% of folks that never complete their program?

Your credit score if you complete the program or not?

Money owned to IRS if you happen to complete the program?

How many law suits current and former customers filed against them?

Other options people do are: bankruptcy, personal loans, consolidation loans, settling all or part of your debt yourself, and not paying your debt at all.

Whether you attempt to do a bankruptcy or not, most credit cards will now settle your debt directly with you these days. You can call them and they will tell you how much and terms they would want to settle all you debt and you are done!!But you are taxed by the IRS on the amount you settled though as the banks right you off.

Or you can just stop paying and not communicate with any collection agencies AT ALL for a few years depending on the state you live and you are done!!Also, since so many folks are not able to do bankruptcies but really have no way of paying and are NOW underemployed to make things worse on house hold income – lots of debt collection agencies are passing on buying some types of personal debt since times are really hard and these agencies are not able to sell off their failed attempts to collect to other shops at all. So, if you live in a real bad state in terms of economics I don’t think you will be hounded for long, more of them trying to scare and trick you into making them a few payments.

In either case your credit will be ruined to the point that future loans will be tough and interest will be charged to the max. But you will have credit

People who are in need of debt resolution services or ccc should not talk or worry about harming credit scores. Its just not relevant. If you are so far in debt and cant pay your bills then you can’t really leverage your credit. Nor should you want to. Negotiating credit card debt when done the right way is a perfect way of avoiding bankruptcy. The problem with the industry is that it has a lot of bad apples. The consumer has a responsiblity to make a proper decision based off evidential facts.

I was a customer of Debtmerica and it ruined my credit more than it helped it. After making payments for over seven months and there was plenty of money in my “escrow account”, they still had not started negotiations on my behalf with ANY of my creditors. I have since found out that I could have done all this myself without the 15% cut that they took from me. After firing Debtmerica, I got my “escrow account” money back and made my first two arrangements myself immediately and found out how easy it was! Within two years I completed what Debtmerica was going to do for me in five! You as the consumer have the right to stop making payments to your creditors, put the money in a reserve fund and after a few months can call your creditors and ask for a settlement. Most, if not all, will settle your debt at 20 – 30% of the original debt depending on the company. Don’t be fooled by the debt settlement companies. They are out to make money, not help you with yours!

Ann,

I am just about to sign up with Debamerica.. How did you put the funds in a “reserve fund” and negotiate with your creditors? What steps did you take?

I pretty much did as they did – rather than pay the creditors, I put the money I would pay them into my savings account (you have to be diligent with this step or else it WON’T work!)until I had enough (about 25% of the debt) to call the first and ask to settle the account . Heck, Debtamerica charges quite a bit off the top so rather than pay them, I paid myself and cut out the middle-man. After several months of non-payment, the creditors were happy to finally talk to me and make a settlement. You just call them (or accept the collectors phone call) and tell them that you would like to make a settlement on the account and they will ask you how much. You can try for 20 – 25% and see where it goes from there. Once they accept your settlement, you will need to either make arrangements to pay them in full or set up payment arrangements with a significant down payment. Be willing and able to pay off within 8 – 9 months and you’ll be done and ready to start saving for the next creditor. That is what I did and I was able to settle over $62,000 in debt in under 2 years. My last creditor will be paid off in April, 2012!!

In response to what “Ann” had to say on 9/27/2011, she is completely accurate !!! You can do th is yourself if you are disciplined enough after recovering from the shock of being overwhelmed in credit card debt. Debtmerica is a SCAM just like the other companies; nothing but a Boiler Room in Orange County, CA that pressures their sales people to reach a quota or they are gone. I did my homework and when I contacted Debtmerica about information, I was pressured into signing a contract online which of course I ended up deleting. They have a high fee of 23% in addition to not telling you there are tax penalties and possible chances of judgments. They do not represent you in court and band-aid the fact you could have a judgment put against the debt. I felt Debtmerica was very unprofessional in the way they phone-stalked me for weeks after I refused to sign their contact and I considered that borderline harrassment. Stay away from them and if you get desperate, contact a debt attorney that can give you sound advice.

There are a series of stories that have been published on debtmerica at uswatchdogs.net in relation to their Pro Se series involving Debtmerica and its founder Jesse Stockwell. The case was filed by his father containing R.I.C.O. charges. People should see the facts that have been exposed by those stories.