Why You Don’t Want To Refinance To Often

Have you refinanced lately?

Have you refinanced lately?

I know a lot of people have been refinancing lately due to the record low-interest rates available. But is refinancing too often a mistake?

In today’s post, I will discuss why this can be a huge financial mistake.

Why You Don’t Want To Refinance

When you refinance your mortgage a whole lot of things happen all at once. I should know I just recently did this. Everything from a new payment interest rate, to even a new mortgage program altogether.

Besides all the cost of refinancing your mortgage, there is one thing you may not have thought of when you refinance. That is how much interest you will be paying to the banks over the years from refinancing.

When banks designed the amortization system to loaning money out to people they designed it so the banks would make their money first.

So why did the banks design their system like this?

Because they know that when someone gets a mortgage they’re not going to stick with it for life. Think about it. If you have a mortgage how many times have you refinanced? Personally I have refinanced now twice and now that I look back at the situation I wished I never would have.

The average family will refinance every three to five years for a multitude of reasons like, a new job, a loss of a job, low rates, consolidating debt, or even to buy a bigger or smaller home. The point is the reasons are endless and that we will refinance for one reason or another.

Let me illustrate my point with a simple example.

The Refinance Mistake Example

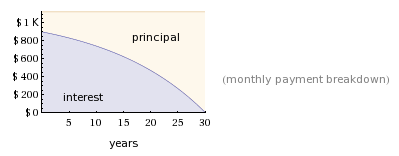

If you look at the illustration below you will see what an average amortization schedule looks like. This example is of a $200,000 loan at 5.4% amortized at 30 years fixed.

If you look at the graph you will see that the purple is the interest that you pay to the bank and the lighter color is the principal paid towards the home. If you’ll notice in the first five years, who is getting most of your payment?

That’s right the bank is getting most of it. So here’s another question, at what year are you halfway paid off on your mortgage? If you said 15 years you are wrong. The answer is year 21. That means it took you 21 years to pay half of your mortgage off and only the last remaining 9 years to pay off the rest.

But here’s the worst part and why most of us don’t get that far. If we refinance at year 5 do you start your next loan out at year 5?

Nope.

You start at year one again paying all of that interest. In the example above if you would stick with the mortgage for 30 years you would pay $204,302 in just interest payments to your bank. This doesn’t count the interest you paid before you refinanced.

Staggering, isn’t it?

How To Avoid This Mistake

There are a few ways to avoid this mistake. First, you could make one extra mortgage payment a year. This would cut five years off the life of your loan.

Second, you could apply for an extra principal payment every month. In our case, we will use the example from above and add an extra $100 a month to is the principle. The result would again cut around 5 years off of the life of the loan.

The final option is to refinance to a shorter mortgage time frame. For example, if you currently have a 30-year mortgage and you’ve been paying on it for some time you may be able to refinance down to a 15-year mortgage and not change payments much.

One Comment