Why Home Warranties Are A Waiste Of Money

In the last couple of articles I’ve covered a couple of different financial product that can be a huge financial mistake, guaranteed acceptance life insurance, and decreasing life insurance. So in this article I thought I would follow suit and cover home warranties as well.

What Is A Home Warranty Plan

If you have home owners insurance it protects against fires, weather damage, and even if some breaks in your home or if you have an accident in your home. Your car insurance protects against your car and the liability of any accident that you may have.

However with a home warranty insurance you are protecting against the problems that your appliances may have, for example if your home burns up your fridge, stove, washer and dryer your home owners insurance will cover the cost of those new items. However if one of those appliances should happen to break in the mean time the cost to fix them will come from your pocket.

This can be costly, for example back several years ago just before Christmas my water softener went out. I called around to different plumbers and the cost to repair was going to be a minimum $1000 to fix. However if I would have had home warranty coverage I would have just paid my deductible and been done.

However as good as that sounds to have a home warranty, you may want to think again. In the following sections I will talk about why you may want to stay away from home warranties altogether.

How Much Do They Cost

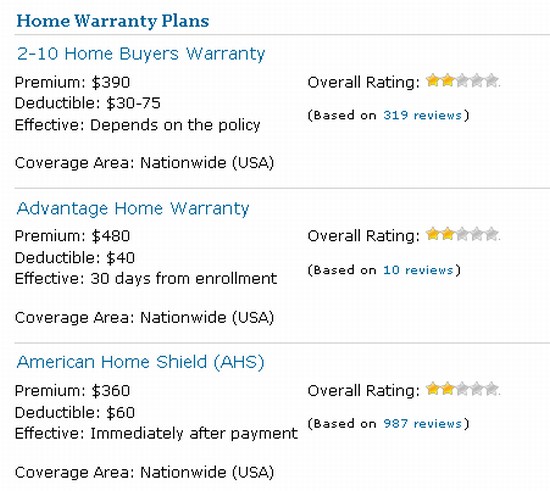

First off, you have to consider the cost of the premiums for a warranty policy such as this. Typical premiums run from as low as $250 a year to as much a $1000 a year. Below is an example a quote I did with a home warranty providers in Ohio. Take note of how much the premiums, and deductibles are. They can vary widely by company. Also notice that service starts immediately with one provider while another does all coverage until 30 days after the policies been enforced.

On top of that most companies make you pay a deductible as well. This will run between $30 and $50 per incident. That means if you washer and dryer both went out you would have to pay $50 a piece for each incident.

Finally, once you sign the contract most companies service won’t be effective until a 30 day enrollment period is up, and you will have to start paying for coverage immediately.

Other Options

When it really comes down to it though how often do you really need this kind of protection. The truth is appliances are being built cheaper and cheaper these. In fact back several years ago I bought a new washer and dryer for $1000 all together.

This might sound like a lot but if your planning for it, it’s not really that bad. In fact I recommend instead of giving all of your money to a home warranty company to save in a rainy day fund instead.

The reason I suggest this over home warranty plans is because this allows you to pick the repair expert yourself and gives you more control over the money as well, whereas with warranty companies they will have their own expert. On top of that home warranties carry a lot of fine print and may exempt themselves from certain repairs which can cause some big hassles.

These companies also only get paid to repair your appliances not to replace them so if your appliance breaks down repeatedly it will only cost in more deductible payments whereas it may have been cheaper to buy a new appliance.

Finally, as a last option know that if you buy a new appliance a lot of times they already come with a one year warranty and that you can also extend that warranty in you need to.

One Comment