10 Questions to Ask an Expert About Debt Relief Options

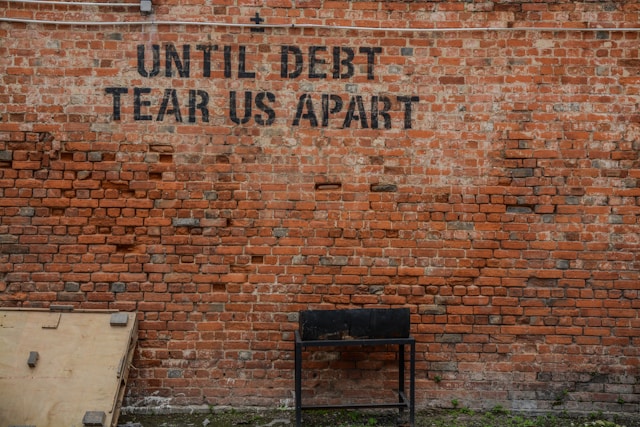

Debt can feel overwhelming, but working with the right expert can make it manageable. To get the most out of a consultation, you need to ask the right questions.

This isn’t about impressing anyone; it’s about understanding your options and finding the solution that truly works for you. An experienced MCA lawyer can help you through this process.

Let’s walk through ten key questions to ask so you leave that conversation feeling confident and informed.

1. What types of debt relief options do you provide?

It’s important to know what’s on the table. Debt relief isn’t one-size-fits-all. Some experts specialize in consolidation loans, others focus on settlement plans, and some offer guidance on bankruptcy.

If they only recommend one type of solution, ask yourself if that’s because it’s your best option—or their only offering. The more options they have, the better they can tailor a plan to your situation.

2. How does this option actually work?

Let’s be honest—financial jargon can be confusing. Whether they’re suggesting consolidation, settlement, or something else, make sure they break it down in simple terms, as the team at Delancey Street does. How does the process start?

What steps are involved? For example, if they mention settlement, ask, “What does negotiating with creditors actually look like? Will I need to do anything?” This isn’t the time to nod along; you need the details.

3. What will this cost me?

Here’s the thing: debt relief isn’t free, so you’ll want to know the price tag upfront. Are there setup fees? Monthly charges? Success-based fees?

Don’t be afraid to ask for a full breakdown—no one likes surprises when it comes to money. A good expert will explain everything clearly and help you decide if the cost makes sense for your situation.

4. Will this affect my credit score?

Your credit score might take a hit during the debt relief process, depending on the path you choose. Settlement and bankruptcy, for example, can lower your score initially.

That’s not necessarily a dealbreaker, but you need to understand how it works. Ask how long it might take to rebuild your credit and what steps you can take to bounce back quickly.

5. How long will it take?

Debt relief isn’t instant—it’s a process. Whether it’s months or years, you’ll want to have a clear idea of how long it will take to see results.

For example, some consolidation plans might give you immediate relief on interest rates, while settlement could take longer as negotiations unfold. Knowing the timeline helps you set realistic expectations.

6. Are you licensed or accredited?

You wouldn’t hire an unqualified mechanic to fix your car, so don’t settle for an unqualified debt relief expert. Ask if they’re licensed or certified by reputable organizations.

Credentials can give you peace of mind that you’re working with someone legitimate. If they can’t provide proof, that’s a big red flag. Walk away.

7. What are the risks I should know about?

No debt relief option is completely risk-free. Settlement, for example, can sometimes lead to creditor lawsuits, and bankruptcy has long-term credit implications.

A good expert won’t sugarcoat these risks—they’ll be upfront about what could go wrong and help you decide if the benefits outweigh the downsides. This transparency is a sign you’re in the right hands.

8. How will you communicate with me throughout the process?

Nobody wants to feel left in the dark, especially when dealing with money. Ask how often they’ll check in and how you’ll receive updates—whether it’s by email, phone, or an online portal.

Will you have a dedicated point of contact? Clear communication is key to avoiding unnecessary stress along the way.

9. Can you share references or reviews from past clients?

This isn’t about snooping; it’s about understanding how they’ve helped others. Positive reviews or testimonials can give you a better idea of what to expect.

While every situation is unique, hearing about other people’s experiences can help you feel more confident in your decision to work with them.

10. What happens after the debt relief process is over?

Debt relief is a step, not the entire journey. Once you’re out of debt, what’s the plan to stay that way? A great expert will offer advice on budgeting, rebuilding your credit, and managing your finances moving forward.

This kind of support can help you avoid falling back into old habits.

Moving Forward With Confidence

Asking the right questions isn’t just about getting answers—it’s about taking control of your financial future.

Debt relief can feel like a daunting process, but with a knowledgeable expert by your side and the right information in hand, you’ll be better equipped to make decisions that truly work for you.

Take your time, do your research, and don’t hesitate to speak up during that consultation. After all, your financial freedom is worth it.