How Far Does The Influence Of Your Credit Score Really Reach?

You’ll hear all about it anytime you go looking for financial advice. It seems like credit is behind just about everything.

There’s a lot of misinformation and confusion in the air for beginners. So we want to clear things up. In this article, we’re going to be talking about the real effects that your credit score has on your life.

On your finances and outside them, as well. We’ll also take a look at how you start taking it seriously.

What Does It Do?

Your credit report is, essentially, a measure of how trustworthy you are to credit providers. Every time you take out a loan, pay in installments or handle bills, you are dealing with your credit.

If you miss payments, fall behind on loans or get into debt, it has a negative impact. Even paying loans ahead of their due date can be damaging to your credit score.

This is because it doesn’t measure whether you’re ‘bad with money’. It measures how well you can stick to agreements regarding them.

Your score will then affect future loans and lines of credit. In general, you’ll get a better deal with better interest and easier repayments if you have a good credit score.

You can get poor credit loans, but these often have larger repayment amounts attached.

Who Can See It?

Here’s where we get into some of the surprising depths of how credit really works. You know that people providing loans will have a look at your credit to see what kind of rates they should offer you.

But your credit can have a much more widespread effect than you realize. A lot people can see it. If you want to pay for something in installments, like a TV, the seller will run a credit check.

If you have bad credit, you might not be able to get the TV at all. But even people like potential landlords and employers can get a look at your credit.

It might not necessarily be fair, but employers can use it to make an inference about your reliability.

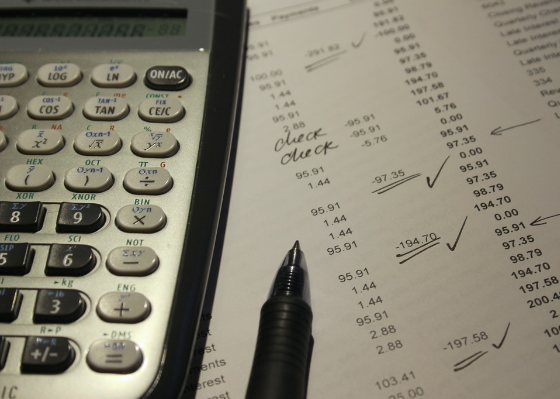

Keeping an Eye On It

One of the serious downsides of credit is that you are not automatically given access to it.

You’re not told when something has a negative effect on it or when your score goes up. A lot of people go through life believing that they have a pristine credit record only to find that they’re unable to get a loan.

That’s why you need to have your eye on the ball and monitor your credit. You can get alerts every time something affects it. Not only does this help you stay familiar with how you’re doing, financially.

It’s an important method of repairing it.

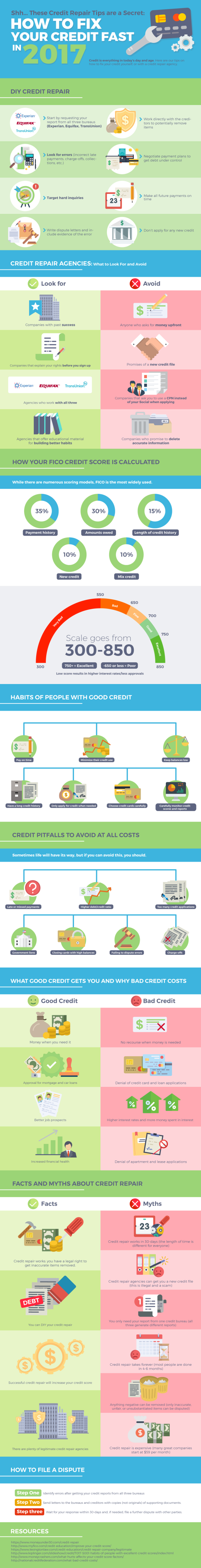

How You Improve It

Keeping an eye on your credit report can help you repair it because there may be some negative marks on your report that don’t belong there.

It’s far from uncommon that erroneous reports pop up on your score. Dealing with these can be as simple as rooting out the source of error and disputing it.

But you can work to improve your score even if the damage done is your own fault. First, you improve it by taking care of any outstanding debts you have and catching up with loans.

There are also a variety of professional credit repair companies who can help you improve your credit.

Maintaining reliable lines of credit, like credit cards and overdrafts, will also help improve your score. If you do get into debt and negative credit, then you may have to simply wait for their negative impact to wear off.

Avoiding Those Big Mistakes

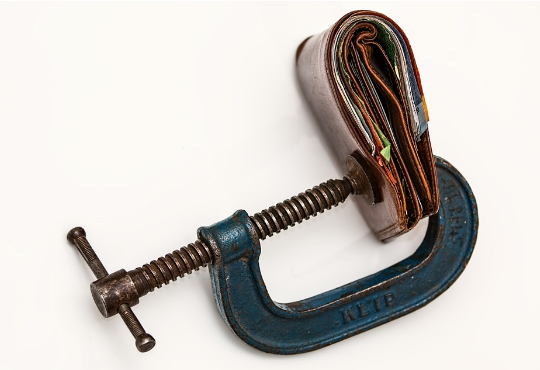

The best way to look after your credit score is to avoid getting it in a negative position in the first place. One of the big mistakes that you need to avoid is how you use your credit cards.

If you have a wallet full of plastic, with cards you’re maxing out, you’re in serious risk of getting into debt.

Similarly, if you’re only making the minimum repayments, you’re paying more money in interest in the long term. Your credit cards and overdraft should not be used like a bank account.

Be sparing with them, dipping into them only when you know you can reliably and quickly pay back the difference in the future.

Final Thoughts…

Have no doubts, your credit report is definitely important.

It can be the barrier to getting a job or a home, just as much as it can help you secure great loans and make big purchases.

Taking care of it is all about being mindful of your finances and how you use your ability to borrow. It’s also about keeping an eye on your credit score.

So what are you doing to keep an eye on your credit score? Share your thoughts and comments and thoughts below.

Cheers!