Sinking In Quick Sand? Here Are Some Ways To Help You Reach A Debt Free Road

The only way to stop sinking in quick sand when it comes to money problems is to stop racking up more debts to help you get out of other debts.

Roll your eyes you might, and that’s completely understandable because it’s no easy feat.

But if you are serious about solving heavy debt problems, it’s the only way you are going to strike lucky. And it will still take time, patience, organization and cut backs to reach this point.

But, once achieved, the relief you feel will make you feel weightless. And you’ll be floating on air rather than sinking faster than a shipwreck.

If you want to get on the road to a debt free life, take a look at some of the sure-fire ways below.

Make A Conscious Decision To Stop Using Credit

Much like many other emotional and mental problems in life, the only way to get on the road to recovery is admitting you have a problem. And once you admit it, the next step is to stop using credit to fund your lifestyle.

The key here is to cut up credit and store cards and make the conscious decision to focus on paying back your debts. Get into the habit of only living within your means.

Find ways that you can cut back on things. It may be no takeouts for the next few months, or no clothes shopping for the next year. Take the bus instead of a cab and cut out your daily coffee and newspaper.

Even the little things add up. It’s time to start getting frugal and smart.

There are tons of little ways you can start reducing your expenses and make savings. And even selling items that are cluttering up your house can go a little way to making you a bit more money to keep for emergencies.

My wife and I made this decision back several months ago and it has worked out great for us. We no longer use to credit for nearly anything. The only place we might use it is to buy stuff online but we are very careful to pay the card off each month.

Start Organizing Your Debt

You need to take charge and start mapping out a plan for how to pay off your debt. This isn’t a time to stick your head in the sand. It’s time to take the responsible approach and start getting out of it.

You may want to reach out to websites such as reducemydebts.com which offers ways to consolidate your debt and arrange a debt relief program that can range from 12-48 months.

If you are feeling particularly overwhelmed, this is a viable option to help you manage your debt crisis. Another way of dealing with your debt is to start paying off your debts from smallest to largest in order.

This can be effective as once you have paid off your first debt, you will feel motivated to continue reducing your expenses and hit your next target. The third way is to list your debts in order of the highest interest rate first.

This makes more sense mathematically as you will start saving on interest rates from the get-go. All three methods offer a way out of debt and the impetus to start taking control.

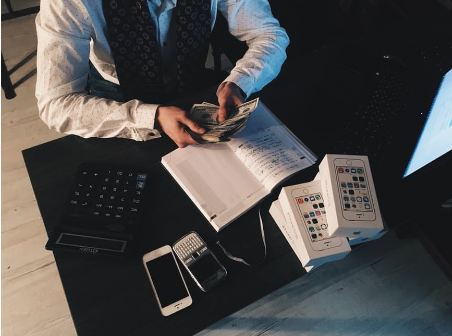

Counting The Dollars

And our last tip is to throw any extra dollars you have straight at your debt.

Whether this is canceling your Netflix or turning down a night out, throw this money at the debt. The more you hit it on the head, the quicker it is going to deflate.

And once you start, I promise you; it’s going to get easier. The extra money you throw towards your debt can add up over time and rather than just waste is on something you probably don’t need to you’ll be heading down a pay of financial righteousness.

Final Thoughts…

So what are you doing to get rid of debt and improve your finances? These are just a few of the unique ideas I’ve done in the past but what have you done.

Feel free to share your stories, comments and ideas below.

Cheers!

Good and to the point information. Really appreciate the views of poster, for making such good expression on the topic. Making such posts are actually laborious and tiring. But hats off to the poster who has made it possible.

Keep posting such good stuff. Lots of inspiration is provided that boosts the morale of readers. I wish to congratulate the poster and also wish to encourage the readers to go thru such informative articles.

Mirgi ka ilaj