July 2013 Budget Update

Welcome to the July 2013 budget update where we will take an indepth look at my personal budget giving you the good, the bad, and even sometimes the ugly. My goal here is to show exactly what I’m doing to manage and improve my budget and hopefully help you do the same, and if you are new to the whole budget thing that’s fine too, their is no better time to get started than right now.

Now for those of you who are new here I don’t use spreadsheets manage my budget, instead I have a very specific process I use to update my budget on a weekly basis using a free online program called Mint.com. So feel free to check that out, set up your budget, and get started today.

Finally, I should also mention that if you would like to follow along with me and get regular updates you can Subscribe to Stumble Forward by Email and get updates delivered straight to your inbox for free without all the spam and nasty email. You can also sign up via RSS here as well.

July 2013 Budget Overview

Well July is here and gone and it’s time for my monthly budget update. As it turns out July was a bust for my wife and I, in fact we ended up short by $229 in the red this month. Not exactly were I want be with my budget right now especially since my June 2013 budget was in the positive by more than $200.

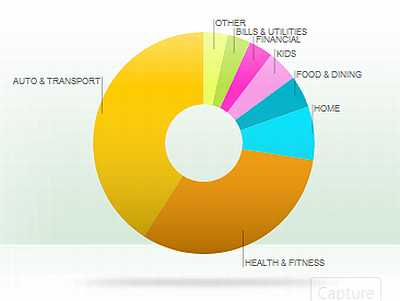

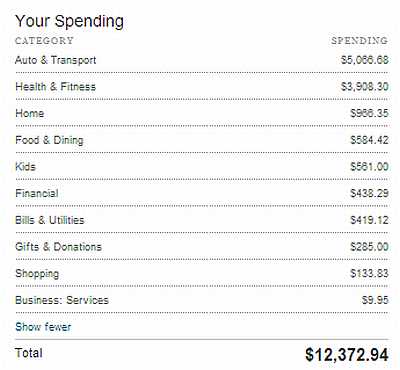

However I should mention the reasons for falling short in July will be short lived or at least I hope it will. I’ll get into to this more shortly but first below is a snapshot of what the month of July looked for me like spending wise.

Now you may have noticed my spending is quite a bit higher than most other months and that is because I paid off my credit cards and that I also had some big doctor bills this month. However my wife’s place of work was kind enough to cover a portion of those bills which helped out greatly.

Where My Budget Did Well

With the overview out of the way let’s look at where I did well this month, and this month I had 3 places I did well this month in.

Dominion Natural Gas

The first area I did well in this month again was with my natural gas bill. Normally I budget $80 a month but this month I only owed $24 due to the fact I’m on a budget billing plan with them. Depending on how things go I’m hoping this expense will continue to stay low.

Total Savings: $56

DayCare

I also did well with my babysitting budget for the month as well Normally I budget $650 a month for babysitting expenses but since our kids didn’t have to go the entire time it saved us a little. I also expect the babysitting budget to go down this fall when my oldest son starts all day kindergarten and my second oldest starts preschool.

Total Savings: $89

Natural Health

Finally I also did well with Natural Health this month. Typically I’ve been budgeting $250 and I only spent $221 this month which is great since this is one particular budget I seem to be blowing every month. I hope to lower this budget over time as well but I just don’t see that happening for a while yet.

Total Savings: $29

Where My Budget Failed

Now lets see where I failed for the month.

Doctor

When it comes to July, doctor bills are my first big failure. Over the last few months my doctor bills have been the top failure when it comes to my budget but their is a silver lining to it. First off, I got the majority of the doctor bills paid in full. Secondly, my wife’s job was also able to help pick up a portion of the tab as well which I am totally grateful for. I’ve never known a business to take care of their employees that well especially when it comes to health insurance.

Over Spent By: $1819

Groceries

Finally, the second area I failed was with my Groceries. This also seems to be an area I seem to blow every month as well. I typically budget $400 a month for food but this I ended up spending $506 which is a bit high. I think what hurt it this month is all the family parties going on.

Over Spent By: $106

Changes & Improvements

For the month of August I’ve decided to stick tight with my budget as is for right now. However I did add one new budget this month and that is a $40 budget for the pharmacy. I’ve noticed that on average I spend around $36 a month for the pharmacy, at least that’s what Mint says.

Finally, I’ve should also mention I’ve been looking into other banking options lately to improve my finances and a few places I’ve looking at are Cash Window, Ally Bank, Capital One 360. What are your thoughts on these banking options?

How Did Your Budget For July Do?

Great read, thanks very much

Thanks Jimmy I’m glad you liked it.

Hey Chris thanks for being so open!

Whoa brother, what’s up the auto spending? How many Lambos do you own???

I wish it was for a Lambo but that was actually for when I switch out of my old life insurance policy to a term policy to get the money out of the cash value which I used to pay of my Marathon Gas Card clearing me of all my credit card debt. Boo Yaa! Thanks for stopping by Todd.