3 Refinance Tips That Will Save You A Ton Of Money

People are refinancing like crazy these days, in fact I just refinanced a year ago myself. Rates have been at their lowest since the early 2000’s. Refinancing is a big buying decision and should not be taken lightly.

In this post I’ve taken all of my knowledge I’ve learned over the years and combined it all into this post to give you the three best refinance tips to help you save a ton of money. These are not tips I’ve learned just as a consumer but also as loan officer myself.

It’s Not All About Interest Rates

The first thing I want to point out, of my refinance mortgage tips, is that refinancing your home mortgage is not all about getting a lower interest rate. There are many other things that contribute to you saving money on a mortgage.

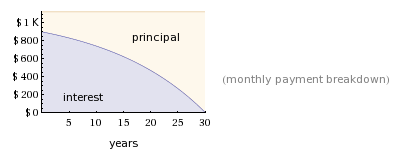

Here’s what I mean. Look at the mortgage graph to the right, the vertical column is the payment. The horizontal row is the years the loan will last. The purple color represents the interest paid out on the life of the loan. The peach color is the principle you pay over the life of the loan.

Here’s what I mean. Look at the mortgage graph to the right, the vertical column is the payment. The horizontal row is the years the loan will last. The purple color represents the interest paid out on the life of the loan. The peach color is the principle you pay over the life of the loan.

According to the graph you are making just over a $1000 payment on your loan. In the first 5 years how much interest are you paying? In the graph above nearly 90% of every payment you are making is going to the bank as an interest payment.

The reason I point this out is because if you were to refinance on average every five years just because the interest rate was lower you would be starting the whole cycle over again paying the bank a substantial amount of interest. This is why I never suggest refinancing just because the interest rate is lower.

Instead of refinancing to a lower rate, refinance to a lower number of years. You may be able to cut your mortgage down to a 20 0r 15 year term and still keep the same payment.

Always Put 20% Down

You may have heard the expression, “you should put 20% down on your mortgage.” So why is this? The reason has to do with private mortgage insurance ( also known as PMI). So what does this have to do with your mortgage? To answer that I will define PMI, here is what Wikipedia says.

Lenders Mortgage Insurance (LMI), also known as Private mortgage insurance (PMI) in the US, is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loan. It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the mortgaged property.Typical rates are $55/mo. per $100,000 financed, or as high as $1,500/yr. for a typical $200,000 loan.

This is why you need to have 20% equity in your home. Let me explain; let’s say you have $200,000 home loan and less than 20% in equity. The total bill for PMI each year would be $1500. That’s a lot of money that could be save elsewhere, not in the banker’s pocket.

After 30 years of making that payment it adds up to $45,000! That’s a ton of money you could have saved for retirement, your kid’s college fund, even taken that nice vacation but instead gave it to the bank because you didn’t know any better.

Now, you might be asking, “but Chris once the loan balance drops below 80% LTV ( Loan to Value) the PMI Payments will stop, right?” This isn’t exactly true. In fact most lenders won’t drop it unless you notify them about it. Cutting this out of your mortgage payment will save you a lot in the long run.

Make Improvements Over Time

Improving your curb appeal is an easy refinance tip that will add tons of value over time. However, there are things you can and cannot control. Let’s start with the things out of your control.

Improving your curb appeal is an easy refinance tip that will add tons of value over time. However, there are things you can and cannot control. Let’s start with the things out of your control.

When you apply for a refinance with a lender they have to do an appraisal of your home to figure out the value. They do this by first seeing your property and then comparing it to several homes in your area to get an estimated value of your home.

The reason this isn’t in your control is because if you live a bad or not so great area even if you have the best looking home around you will not be able to get more value from your home. This is why it’s so important to buy your home in a decent neighborhood with a low crime rate and good schools. This can go a long way to improving value by just picking a good neighborhood.

Now let’s talk about what you can control. There are many things you can do to spruce up your home to get more value out of it. The first thing you need to do is find out when the appraiser is coming through to check out your home. This is the person you want to impress to get more value.

They will be looking at many different aspects of your home but here are a few things you can do to get more value from your home.

- Mow the lawn clean and nice.

- Change out dead shrubs or add a shrub bed around your home.

- Put fresh mulch around your house.

- Repaint old windows.

- Caulk around all windows.

- Replace your old roof.

Here are a few things you could do to improve the inside of your home.

- Install new windows.

- Put in new carpet.

- Repaint walls.

- Organize closets and add extra space.

It’s amazing what a little paint and mulch will do for your home. The best thing is most of these ideas don’t cost much at all, since they are all just minor home repair and improvements. These ideas will also go a long way to increasing your home’s value and help you pay less in the long run.

Do You Have Any Mortgage Refinance Tips

Feel free to share your home refinance tips below in the comments. All the tips I shared with you are what I’ve learned through my own personally experience, so what have you learned?

This post was recently featured in the Money Hacks Carnival by Need Money Tips.

A quick note to your statement about PMI: by law, it must be discontinued at 78% LTV (and a borrower can request it be discontinued at 80%). Any funds paid in PMI beyond 78% MUST be repaid to the borrower by law. Penalties vary by state, but all of them require at the minimum a full repayment of any overpaid funds.

Failing to discontinue PMI fees is in essence misappropriation of funds (placing funds not earned or requireed in an escrow account), in addition to THEFT. It’s also a violation of ethical practice for whomever is managing the escrow account that is collecting the PMI to charge when it is not legally required or allowed.

Any bank that does not discontinue PMI at 78% and continues to charge you for it can be taken to court, and if reported to the state regulator of mortgage loan servicers, can raise holy hell in the abusive party’s life.

I did not know that, thanks for informing us.