Maximizing Your Paycheck: 5 Simple Ways to Lower Your Monthly Bills

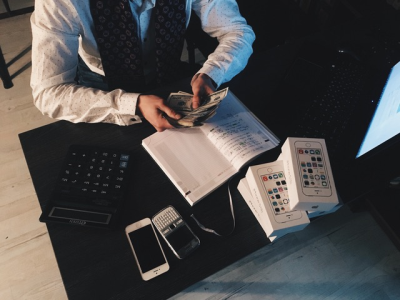

If you’re like most hard-working people, you either get paid every week, bi-weekly or once a month. But regardless of the frequency of your pay, the fact still remains that as soon as you get paid, you seem to be “broke” soon after you pay all your bills… This vicious cycle is called living paycheck to paycheck.

If you’re like most hard-working people, you either get paid every week, bi-weekly or once a month. But regardless of the frequency of your pay, the fact still remains that as soon as you get paid, you seem to be “broke” soon after you pay all your bills… This vicious cycle is called living paycheck to paycheck.

For some people, they have very little extra money after paying all their bills, while others have a decent amount of money leftover but they “piddle” it away on unnecessary items or habits.

That’s not necessarily saying that you can’t enjoy life or spend your money on the things you enjoy but when you find yourself facing the harsh realities of “adulting,” your pleasures sometimes have to be put on the back burner until you can get to a better place financially.

***This may involve creating a budget and making lifestyle changes you don’t want to make***

If that’s the case, then how can you get the most out of your paycheck while lowering your monthly expenses. Well, there’s always the option of simply getting an additional source of income to help you afford the lifestyle you live. But, if that’s not an option for you, then what you’re going to have to do is first stop and write down all your monthly expenses.

Once you make a list of all your monthly expenses, make a second list of all the places your money goes. Mark of the “monthly expenses” from your list of “places that your money goes” to help you determine the important expenses.

From there, look at your list of places your money goes to see what all is left over. That will let you see all the miscellaneous ways you spend your money, and 9 times out of 10, those are items or habits you can probably eliminate and save lots of money on.

To give you a better idea of how to maximize your paycheck, take a look at these money-saving tips and see if you can implement them to your own lifestyle, and make the appropriate changes.

5 Simple Ways to Get the Most Out of Your Paycheck and Save On Monthly Expenses

#1 Buy Generic Brands From Grocery Stores

Okay, there are certain products and items you can buy generic and certain things you just can’t because you can immediately tell that the level of quality isn’t there.

But for the items you can buy generic, they can help you save significantly on your monthly expenses and stretch your paycheck pretty far.

The key to success here is to look at the ingredients/materials used in comparison to name brand products.

#2 Ditch Cable

This particular tip is almost not worth mentioning because most people are now using streaming services for their home entertainment these days.

Things like YouTube TV, Netflix, Prime Video, and other streaming services give you access to premium shows and movies for less than half the price of what certain cable providers are charging.

#3 Cook Your Meals

You’d be very surprised at just how quickly you can “eat your money away” on dollar menu items and dining out.

Before you know it, you’ve spent nearly $300 in one month on fast-food and restaurants. Instead of taking that fast-food run on your lunch break, consider packing a lunch for work.

If you enjoy Subway sandwiches, why not make your own subway sandwich?

In general, cooking at home is going to save you a considerable amount of money because, according to USA Today, the biggest thing you’re paying for with dining out is the convenience of not having to prepare it yourself. To maximize your paycheck, stay home, and cook.

Hop on YouTube or other recipe sites to create your own version of your favorite restaurant meals and save money in the process.

#4 Compare Electricity Prices

The thing about electricity is that it’s not common that you get to compare the prices of utility providers. With traditional electricity generated from fossil fuels, you typically have to stick with the provider that’s in your area. But that’s not

the case with electricity powered by renewable energy.

To ensure you’re getting the most from your utility provider, consider visiting an online comparison site of alternative electricity providers.

This will not only allow you to keep your home cooler at a much affordable rate but it also gives you the peace of mind of paying a monthly flat rate for your electric bill versus having fluctuating monthly rates.

#5 Stay Home

That after-work happy hour session you enjoy with co-workers every Friday may have to get put on hold until you get a better hold on your finances. Sometimes learning how to say no and stay home can have the greatest return on your paychecks and you don’t even realize it.

To go out for drinks every Friday night with co-workers for Happy Hour can quickly add up and cost you anywhere from $50-$70 a month. If you stayed home, that money could be put towards an important bill or stashed in your savings account.

Learn how to enjoy being at home. You may find that you actually enjoy being at home more than you enjoy being out. And if it’s the drinks you enjoy, have your own Happy Hour at home! Plus, by staying at home, you won’t have the temptation to spend money staring you in the face.