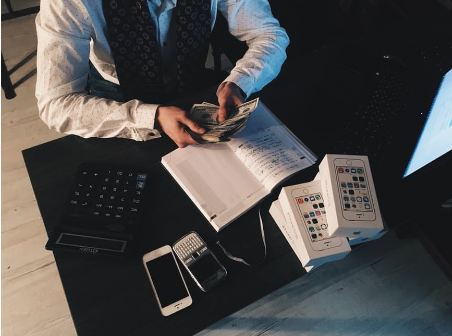

4 Tips to Digging Your Way Out Of Business Debt

Owning a business is a complicated thing. You are spinning so many plates at once that it’s easy to fall into the debt trap.

Lenders are tightening their belts in response to the economy and the costs of everything from materials to healthcare for your business is on the rise. Because of this, business owners around the world are struggling to keep up and keep their business heads above water.

Filing for bankruptcy is usually not something on the horizon for a business, especially those who would rather look at how selling a business could dig them out of a debt hole do that first. Bankruptcy comes at a price for a company, so ideally, you’d want to avoid that at all costs.

4 Ways to Dig Yourself Out of Debt

There are a lot of companies out there that would prefer to dig their way out of the trap of debt before looking at bankruptcy as an option, and we’ve got some of those ways below:

Cut Costs. You’d do the same thing in your personal life if you wanted to save for a new home or a new car, and it’s no different in a business. Identifying the areas of your business that are unnecessary and cutting them off is the best start. Next, you need to look where you’re hemorrhaging money and attack those areas directly. Everything from lazy staff that can be cut and customers who aren’t paying for services on time and so need to be chased are important areas to look at.

Recheck Budget. Look at how you arranged your business budget on your business plan. Contrary to popular belief, you don’t need to ditch your business plan once the banks say yes to your business loan. Dig it out, dust it off and recheck where you allocated your funds. Once you see those areas, figure out where you are overspending on your budget, and you can quickly turn things around.

Prioritize Debt. As a business, you will have taken on initial start-up debt. Making sure that those debts are paid off and squared away is so important, so pay down your credit cards can hold off creditors coming for your assets when things are going belly up.

Communicate. If you are avoiding your creditors and burying your head in the sand, you are doing it all wrong. Creditors aren’t vultures – for the most part – so you need to get in touch and have a conversation with them about what you can afford and how you can pay what you owe. If you are talking to them, you’re able to arrange payment plans and take the stress off your finances.

Final Thoughts…

Contacting debt management companies and getting some help with your debt can steer you away from failing as a business.

Half of all businesses fail in their first year, but if you are efficient about recognizing when things are going wrong, you can make sure you are turning your business around.

There’s no need to panic about your company folding if you are keen to put the work in and make it right.

So what are you doing to dig your business out of debt? Are you using one of the methods above? Share your thoughts and comments below.

Cheers!