How To Withdrawal Money From PayPal For Free

If you are an online business owner or even someone who likes pay others and take payments online like me you may have considered PayPal as a viable option and I can tell you over the last 5 years it has been a very valuable asset to me and my business.

If you are an online business owner or even someone who likes pay others and take payments online like me you may have considered PayPal as a viable option and I can tell you over the last 5 years it has been a very valuable asset to me and my business.

However when someone sends you money through PayPal the money does not automatically get put into your savings account at your local bank. In stead you will have to do a withdrawal on your account to move the money over to that account and in this article I will show you exactly how to do this.

Fees To Withdrawal Money In PayPal

First off before I get into the detail I want to dispel on myth real quick, and it has to do with fees. When I first set up my PayPal account I was under the impression that their was a fee involved when moving money, however what I found out is that if you are withdrawing money within the US to move it to bank account in the US there is no fee involved.

However this does not go to say that their is a minimum withdrawal limit you need to hit before you will incur a fee, and in the US you only need to withdraw at the very minimum $1 before you get hit by a penalty.

To learn more about the withdrawal limits with PayPal you can review this chart that they have provided here.

How To Withdrawal Money From PayPal

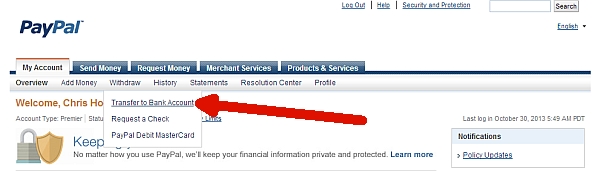

To withdrawal money from your PayPal you first have to log in to your account and click on Withdrawal and a drop down menu will pop up with a few different options. Simply click on Transfer To Bank Account.

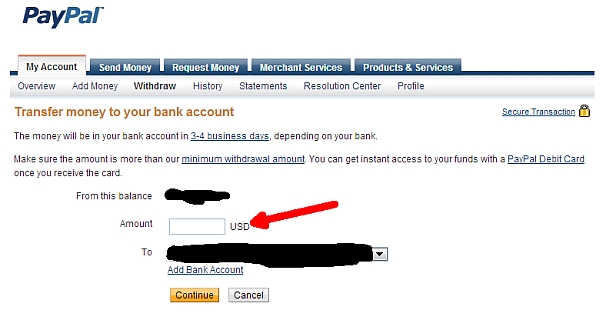

Once you have done this you will come to the transfer page which looks kind like the picture below. Also know that these pages may change over time depending when you are reading this article.

Once you are on this page all you need to do determine how much you want to transfer from your balance. If you are new to this they will have a $500 limit in total transfers a month.

You can lift the $500 limit by confirming either your social security number or credit card number. To do that you will see a link on the page above that will ask if you want to increase your withdrawal amount. Simply click that link and confirm your account.

Once you have entered the amount select the account you want the money to transferred to. If you don’t have a checking or savings account set up you will need to do this before you can transfer your money. Once you have selected how much you want to move and the account you want it to go to simply click Continue .

Finally, the last step is to confirm the that all the information is right. The next page that pops up will have all of the info you selected on the previous page. If everything looks correct simply click Submit button to complete the transaction.

Moving The Funds

Once you have completed the transaction you should receive an email shortly after that confirming the transaction. The actual funds will take 3 to 4 business days to be completed, however if you have a PayPal Debit Card the transaction should be done instantaneously.

So there you have it, that’s how simple it is to move money from your PayPal account to your bank account. One thing I should mention is that their are a lot of scams going around with people trying to steal money from other peoples PayPal accounts and it can be hard to determine who is a scammer and who is not.

To help you out check out my article that will show you 5 red flags to look for when it comes to PayPal scammers.

So do you use PayPal to run your business or buy stuff online?