When Should You Start Saving For Retirement?

As often as I have been asked, when should I start saving for retirement, over the last several years while working in financial services I can answer it in five short words, Start As Soon As Possible.

As often as I have been asked, when should I start saving for retirement, over the last several years while working in financial services I can answer it in five short words, Start As Soon As Possible.

That’s right, whether you are going to be retiring in Utah, or Florida, or anywhere in the country, there is no time like the right to start saving for retirement, and the sooner the better.

The fact is most people believe that it’s the amount of money you save for retirement that matters most but rather it’s the time needed to build a successful retirement that matters more and in this article, I’m going to show you just why this is.

Why You Don’t Want To Wait

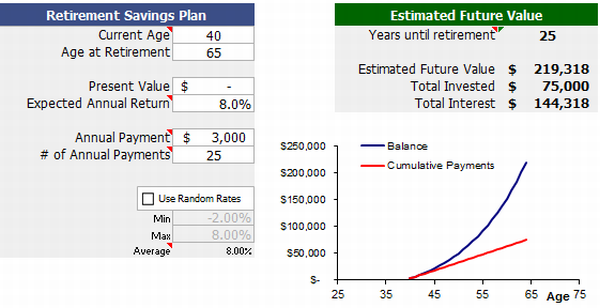

In the first example, I’m going to show what would happen if you waited to start saving money for your retirement till age 40.

I’m also going to assume that you don’t plan to retire until age 65 which means you will have a total of 25 years to save for retirement.

On top of that, I’m going to show that you will earn an average return of 8% and will contribute $250 a month for a total of $3000 a year toward your retirement.

Now let’s see what your retirement might look like if you would wait.

By looking at the picture above we can see that over a 25-year period, you would have paid a total of $75,000 in contributions and earned over $144,000 in interest on that money, earning a grand total of $219,318.

Not bad but let’s see what might have happened if you would have started saving 20 years sooner.

Why Starting Early Makes All The Difference

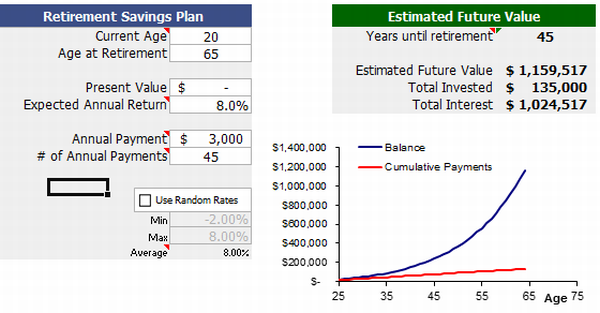

Now for this example let’s assume that you decide to start saving for retirement at age 20. I’m also going to assume that you will contribute the same amount of money ( $3000 a year) and that you will still earn an 8% average return on your money as well.

The only thing that will change is that you’ll contribute to your retirement account for 45 years instead of 25 in the previous example.

Let’s see what your retirement would look like now.

As a result of starting 20 years sooner, you would contribute a total of $135,000 to your retirement, and earn over $1 million on the interest of the account for a grand total of $1,159,517.

It’s obvious that starting sooner rather than later is always better but you might wonder can you still have a good retirement if I get started late?

Can You Catch Up

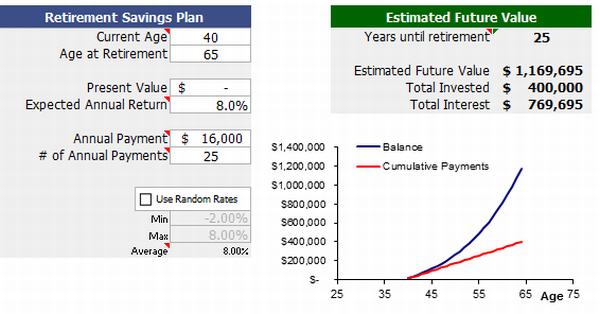

Now for those of you wondering how much you would need to set aside each month in order to earn the same amount of money as in the second example I went ahead and ran the numbers and here is what I found.

In order to have the same amount of money as the second example you would have to save $16,000 a year instead of $3000.

On top of that, it also means you would have to contribute a total of $400,000 over a 25-year period instead of $135,000 as in the second example. So this has to lead me to one important fact, the sooner you start saving for retirement the less expensive it will be.

In order to catch up it’s going to cost you $265,000 more in contributions, something which could have been avoided if you would have started 20 years earlier. Now don’t get discouraged if you are a latecomer because you still have options. Below are a few suggestions to consider.

- Take a later retirement. The first thing you could do is take a later retirement. The examples above are based on retiring age of 65, but why not wait 5 more years and you could save just that much more? Doing this could be enough for you to get through those golden years.

- Take Up a part-time job. Another option is to take up a part-time job on the side. Personally, I know a lot of retired people including my own parents who are doing this.

- Stash More Cash. Another option is to consider setting more aside for those later years in life. Even just setting an extra $50 to $100 a month can make a huge difference toward your retirement.

- Start a part-time business. Another option to consider is to start a part-time business and with so many different options available why not? In fact, it can be as simple as starting a little internet business as I’ve done.

- Consider a reverse mortgage. Finally, the last option to consider is a reverse mortgage. Now, of course, you need to have a mortgage and it needs to be paid in full but if you do this can be an excellent way to supplement your retirement income.

- Downgrade your lifestyle. If you’re thinking about retiring someplace else consider cutting back on your lifestyle and less expensive options.

When Should You Start Saving For Retirement

So are you ready to start saving for retirement now? I’m hoping this article has been an eye-opener for you and shown you that every year you wait to start saving for retirement is one more year you may be losing thousands in retirement money.

So take this time now to contact your local financial adviser and let them know you are ready to get started saving. Also take this time to share this article with others and give it a tweet, like, or +1 on Google. By doing this you will give the gift of knowledge and hopefully help a few families along the way.

However, if you need some help getting started you may want to consider checking out Lending Club. Lending Club has a great retirement IRA program in fact their average investment returns have been between 5% to 9% as of the writing of this article. On top of that, they offer a No Fee IRA program that doesn’t charge you a penny to invest with.

So check out Lending Club and sign up for a No Fee IRA now and secure your retirement for years to come.