How to Move 401k to Gold Without Penalty

You can save money through a 401k plan for your retirement or a self-directed IRA account. Aside from the savings, you’ll be able to defer paying taxes when you have contributions, and you only get taxed when you withdraw.

You can save money through a 401k plan for your retirement or a self-directed IRA account. Aside from the savings, you’ll be able to defer paying taxes when you have contributions, and you only get taxed when you withdraw.

However, sudden market downturns may take you by surprise, which is why it’s a good idea to diversify. Learn more about diversified investments on this site here.

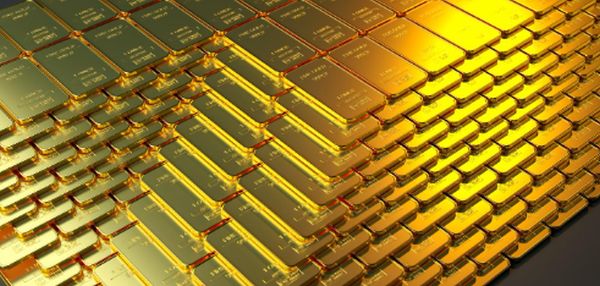

One of the best diversification tools that you can include in your portfolio is gold. Putting a small percentage of your retirement funds in gold can mean that you’ll have a hedge against inflation.

Many people turn to gold for various reasons, and some want to have a tangible asset that represents wealth, and others see it as a beautiful and malleable shiny metal with a lot of uses.

With the market volatility today, it’s always a good idea to park some of your money in precious metals. Unlike a corporation that can go bankrupt at any time, you’ll never experience the same with gold.

Regardless of the turns of the current economy, you’ll be able to have gold coins and bars sitting at a vault in which you can sell at any time.

It’s possible to roll over some of your 401k funds to be put into a precious metals IRA. However, there’s a proper way to do this since the early withdrawal of 401k funds for any other reasons can lead to penalties and tax charges.

But if you want to know how to move 401k to gold without penalty, here are some tips for you.

The Rollover Process

The Rollover Process

If you’ve decided to add gold, the next step is to know how to carry your plan out. There’s a higher chance that your current 401k does not offer you any options to invest in precious metals, and what you need is a new account that will let you invest directly in gold.

What you should do is open a new IRA with the help of gold companies. This is essentially a self-directed individual retirement account that will let you invest in gold and even in cryptocurrencies.

After opening this account, you’ll have to do a rollover from your 401k plan. This is when you transfer some of the money from your 401k to your new IRA.

According to the IRS, this transfer should be completed within 60 days. If you don’t complete the process during this timeframe, the funds will be considered a withdrawal, and you’ll be taxed and penalized.

Many people do these transfers through trusted companies since they don’t want to miss the deadline. Others do direct wire transfers after opening the new IRA so they can start buying bullion and coins.

Other Steps to Know

Other Steps to Know

1. Select the Account that you Want

Doing a 401k rollover will allow you more freedom to invest in gold and other precious metals. In these plans, you’ll be able to save on costly fees as well. Some of the accounts that you can open are:

-ROTH IRA. Rollover to ROTH IRAs may mean that you have to pay taxes, and this is because the ROTH IRA will allow tax-free withdrawals. However, the contributions themselves are taxed.

-Traditional 401K. Rolling over to a second 401K account means that you won’t have to pay any taxes as long as this is completed within 60 days.

-Traditional IRA. This can be a tax-deferred retirement account that’s similar to that of the 401k. More about traditional IRAs in this link: https://www.nerdwallet.com/article/investing/ira/what-is-a-traditional-ira.

Know that you’re allowed to have multiple retirement accounts, and on the second one, this is where the precious metals are going.

There will be a broker or custodian involved, and they will be a company that will store your bullion for you. You’re not allowed to hold the physical bar of gold inside your home because it’s unsafe.

2. Opening of a New Account

You can set up an account when you go online. Others use a robo-advisor to do this, and everything is simple. These robo-advisors can help you set up an account online, especially if you don’t want to pick various investments.

There’s also an option to get an online broker that will provide you with a more hands-on experience, and you can control everything that goes into the new 401k.

You have the option to choose which investments you want to buy. However, it’s best to pick the providers who specialize in gold.

3. Doing a Direct Rollover

Call your previous 401k plan provider and talk about transferring your funds. It’s essential to do this early on because some providers slow down the entire process because they are unwilling to lose clients. It’s best to ask for a direct rollover because the checks go directly into the new account instead of your bank account.

Once the funds leave your old 401k account, they must show up in the new one within 60 days to avoid penalties. Avoiding penalties means that you need to complete the transfer at the soonest possible time.

The process for this may often vary, but your provider will generally send you some forms if you want to do a direct rollover. Call the administrator of your employer’s 401k plans and get them to send the paperwork.

This way, they can send the check that will be funding your new account, and you can buy several gold coins and bars that interest you.

Indirect rollovers may be complicated. If you don’t complete it in time, this can result in taxes and penalties. Some providers will withhold 20% of the withdrawal automatically.

4. Decide on the New Investments

After you’ve completed an indirect or direct rollover, this is when you have the chance to invest in gold futures, stocks, and exchange-traded funds. You can reduce your risks and buy shares in gold mining companies, mutual funds, and bonds.

Some will want to add bullion and gold coins but know that there will be fees and commissions. You also need a depository, and you can always find a gold company that will recommend you a trustworthy custodian.