5 Tips To Payoff Your Payday Loans Faster

So, you really needed that money and you took a payday loan even though these loans come with really high-interest rates.

However, if you do not pay the loan back in time the interest really starts to add up which means you can get into a lot of trouble if you don’t plan your budget correctly.

We have come up with a list to help you pay off the high-interest payday loans as quickly as possible to save on the high interest.

First and foremost, it is important for you to keep in mind that you need to set a payment plan to pay off all kinds of debts including payday loans, credit cards or medical bills.

Having a payment plan will allow you to figure out your income and expenses for various things including other bills and food.

The amount that is left after paying off your expenses can go towards paying off your loans.

Tip #1 Get Rid of the Stuff You Don’t Use

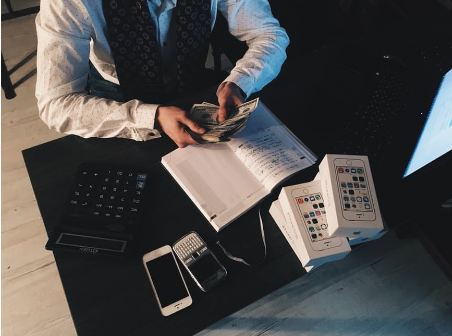

It might sound desperate but one of the best ways to pay off your payday loan debt quickly is to sell all of your unused stuff. There was a time when selling your stuff was difficult but these days, you can use various online auction sites to sell your stuff easily.

If you are selling your stuff on auction sites such as eBay, you will need to consider the shipping charges, especially if you are selling something an item that is large and heavy.

In such cases, posting an ad on Craigslist in your location as well as surrounding locations might be better. There are also some other sites such as Gazelle.com that buy old technology items.

Selling your tech stuff to these sites allows you to get your hands on the money faster as compared to selling on online auction site where you will have to wait for someone to get in touch with you and buy the item after negotiating the price.

Tip #2 Extra Job

This might not be feasible for everyone but if you have the time, it’s better to take on a job, even a part-time job, in order to pay off your debts faster.

You should take up the job even if it’s just on the weekends as it will help you save a lot of money on interest. For instance, you can become an Uber driver as you just need a car that meets certain requirements.

Becoming an Uber driver allows you to work only when you want to. You will make around USD 19 an hour by driving your own car as an Uber driver. It’s a flexible job, and you can work just nights or only weekends.

Tip #3 Get an Advance from Your Current Employer

Many employers like to help out their employees facing financial difficulties by giving them an advanced paycheck. This is especially true if you have worked at a place for a long time and are considered trustworthy.

In case you are unable to get an advance from your employer, you should consider taking a loan from the 401(k) plan.

It’s important for you to know that taking a loan from your 401(k) plan is a better option financially as compared to withdrawing money from your 401(k). When you withdraw money from your 401(k) plan, you will not only have to pay a 10% early withdrawal penalty but also income taxes.

However, if you have a number of payday loans stacked up with interest building up, you might even consider withdrawing from your 401(k) plan.

Tip #4 Ask Your Friends or Family for Help

It might be embarrassing for some people to ask their friends or family members for financial help but sometimes, it is necessary, especially when you are facing high-interest rates on your payday loans.

Keep in mind that letting your payday loan interest stack up is a worse option and therefore, you should ask your friends or family members for financial help.

However, this doesn’t mean that you don’t pay any interest to your friends or family members who are ready to loan you the money.

Instead of paying back the payday loan lender, you can pay back your family member or friend by setting up a payment plan. They act in a way as a guarantor and it will be a lot cheaper as compared to taking on several payday loans.

Tip #5 Adjust the Withholding Pay

Everyone loves to get a big tax refund check but it’s possible that you are paying too much tax every pay period. So, do some calculations and if possible, make changes to your withholding pay in order to get a bigger paycheck every time.

While this will lower your tax refund check but you will pay far less money as interest on your outstanding payday loan.

To make this adjustment, you will be required to file a new W4 form to lower your withholding pay.

The average tax refund check is around USD $3000, as per the IRS statistics, which means you can get about USD $250 extra each month, and this extra money can be used for paying off your existing payday loans faster.

I am considering taking out a loan so I can buy some new appliances for my home, so thanks for sharing this. I like your point about selling some stuff you don’t need online to help pay off the loan. I might consider doing this if I find myself short of cash afterward.