Statute of Limitations on Debt: How Might This Protect You?

The statute of limitations on debt is complex, because there is not one statute but rather many statutes governing how long a collector has to contact or sue you for a debt. These statutes change according to the type of debt, amount of debt, and even the state in which you live (or that was specified in the original debt contract). The statute of limitations on debt may even be different according to whether the original lender or a third party collector is pursuing the debt.

Still, you should not let this complexity stop you from learning what your rights are under the law. While attempts at debt collection may be legitimate, there are companies out there that will stop at nothing to collect, even if that means breaking the law. When the law is broken on an old debt, the statute of limitations might be your best protection.

If you ended up with an old debt because of job loss, ill health, or another unforeseen disaster, you may have been fortunate to be covered by a payment protection insurance plan from one or more of your financial institutions. However, these plans, also called PPI, don’t always cover you when you need it. Read more about the benefits and restrictions for these plans here.

Once a debt has aged past the statute of limitations governing that debt, the debt becomes what is known as time-barred: The collector loses the right to sue you for that debt. Note, however, that just because the collector cannot sue you for that unpaid debt, it does not mean that the collector has to stop attempting to recover the debt. In fact, there is no statute of limitations for contacting you about an unpaid debt or attempting further collection besides filing a civil suit. It is only the right to a civil suit that becomes time-barred.

Debt Collection and the Statute of Limitations

To start with, many want to know the answer to “What is the statute of limitations on debt collection?” Unfortunately, since there is no one statute of limitations for debt collection, there is no easy answer. However, knowing the general variances of the law for the four basic types of debt can help.

- Oral agreements. An oral agreement debt is a debt for which you verbally agreed to pay, but put nothing in writing. This is also known as a verbal contract. In most states, the statute of limitations for oral agreement debt is short.

- Written contracts. Written contracts include installment loans of all types. The statute of limitations on these debts is typically the highest, up to 10 years in some states.

- Promissory notes. Promissory notes to pay are written agreements undertaken to contract a debt. Along with written contracts, these debts have statutes of limitations of up to 10 years.

- Credit card and revolving accounts. Typically, the statute of limitations for revolving accounts is between three and six years, provided the account was open at the time the initial default on payment occurred.

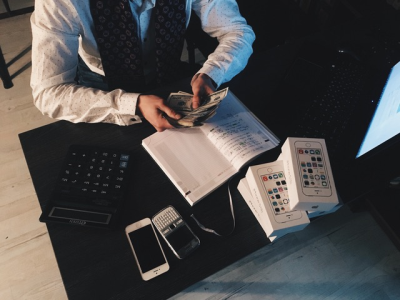

To avoid becoming a victim of your own debt, it’s a good idea to track your finances rigorously. This can be difficult since you might be receiving different bills by mail, through e-mail, and even on your mobile phone; with these 10 mobile personal finance apps, you can know exactly where your money is and where it’s going, keeping debt from ballooning out of control.

Credit Cards and the Statute of Limitations

What is the statute of limitations on credit card debt? Since credit card debt is one of the most common debts to end up in collections, this is an important question. Each state has different laws setting the statute of limitations for residents in that state. However, if you signed a credit card agreement acknowledging that the contract would be governed by the law of a different state, such as the state where the credit card company was based at the time, that state’s laws take precedence.

For most states, the statute of limitations for credit card debt is between three and six years. Rhode Island has the longest statute of limitations for this type of debt, at 10 years, followed closely by Wyoming, at eight years. To see a full listing of statutes of limitations by state, visit Suze Orman’s full listing here.

The Statute of Limitations to Collect a Debt

The term ‘statute of limitations to collect a debt’ is somewhat of a misnomer, since very few places put restrictions on how long a company has to pursue collecting a debt. The statute of limitations on debt really governs how long a company has to pursue collecting a debt in court, but not through other means, such as collection letters or phone calls. The harsh reality is that if a debt is valid, the debtor does still have an obligation to repay.

However, there are things that a debt collector may not do under the Fair Debt Collection Practices Act or FDCPA. Actions that creditors or collectors are barred from taking at any time include:

- Calling you at your employer when you have told the creditor or collector that they may not.

- Contacting friends or relatives to discuss your debt in an attempt to get you to pay.

- Continually update your credit report with negative information after the initial report; typically the limit is seven years from the time the debt originally went delinquent.

- Calling you on Sunday, before 8 AM, or after 9 PM unless previously authorized by you.

If you do receive notice of a lawsuit being filed against you for what you believe is a time-barred debt, your first step should be to contact a lawyer. Only a licensed attorney can give you reliable advice on how to defend yourself against being sued for an old debt. If you believe that a creditor or collector is violating the terms of the FDCPA, you can also contact an attorney, and should contact the Federal Trade Commission and your State’s Attorney’s office to report the violation.

Good post! I think a lot of us suffer from a lack of knowledge on what our rights are when it comes to debt. Many companies, not all though, try to take advantage of this ignorance to make more money. I just wish I would’ve known some of these things when I was paying my debt off.

Good article! I wasn’t aware of the statute of limitations and also what a collector can’t do. I know if I were ever being hounded I wouldn’t want them doing those things.

Nice post. When I did debt collections in college, our system was designed to piss consumers off in order to get them to pay. I never liked that job, but it taught me a lot about the collections industry.

I totally agree John, I had a few collection agents call my business because one of my workers has a debt in collections. I know these people want their money but they were in complete violation of the rules by just calling his place of work. So the next time they call back I will defiantly be prepared.

I agree even if I were in a situation like this I wouldn’t want to be hounded either. I would just think people could settle these issues a little more civilized but some companies just don’t know when to stop.

I would totally had that job Grayson. I don’t see how anyone could even be remotely positive working a job like that when you know that you have to call someone in order to piss them off. On the other hand it sure would be an interesting learning experience in that I know I would never want one of these people to call my house. Thanks for your comment.

While I do think companies should not be allowed to harass you over debt, I think people need to be responsible for the things they buy. Unless you can’t pay because of some terrible illness or similar situation, I think we need to try and pay back what we owe or at the very least not go back and repeat bad behaviors if you get in debt trouble and have it forgiven once.

What Kim said. I don’t think that collectors should be able to stalk you for your life, but I do think that people need to take more financial responsibility!

Wow, Chris. Good information that needs to be out there. I had no idea about most of the stuff you mention in the post. It’s good to know people have rights in this area, but I have to agree with Kim and Holly said about people having an obligation to pay their debts. That’s a very good point.

I have to agree Kim, it’s also the person that takes that debt on responsibility to pay it back in full as well. Thanks for the awesome comment.

I’ve never experienced a collection call before but it would be kind of interesting hear what these people actually say and how they act. This way we could identity a bad collection company from a good one, Thanks for the comment Holly.

I agree Laura sometimes I think people try to hide behind these laws as a means to protect themselves form paying their debts. I think with so many great programs out there from Dave Ramsey’s Total Money Makeover to sites like Ready For Zero and even other free info out there it would empower people to pay off their debts yet sometimes we just can’t help the unwilling.