What Is a Cash Out Refinance Mortgage And Is It Worth It

Back a few years ago I was in a tight position with money. I had credit card debt, a car loan, and mortgage to boot. Around this time I received a call from my lender telling me that I could lower my mortgage rate. In fact, the lender even mentioned that I could do a cash out refinance and consolidate any debt since I had such a great credit rating and plenty of equity in my home.

Back a few years ago I was in a tight position with money. I had credit card debt, a car loan, and mortgage to boot. Around this time I received a call from my lender telling me that I could lower my mortgage rate. In fact, the lender even mentioned that I could do a cash out refinance and consolidate any debt since I had such a great credit rating and plenty of equity in my home.

As a result I ended up consolidating my credit card debt into my mortgage and was eventually able to free myself of all the heavy debt I was paying. However in my situation a cash out refinance loan worked great but you might be wondering would it work in yours? In this article I’m going to cover what is a cash out refinance, the rules behind them, and when you should and should not get one.

What Is A Cash Out Refinance Mortgage

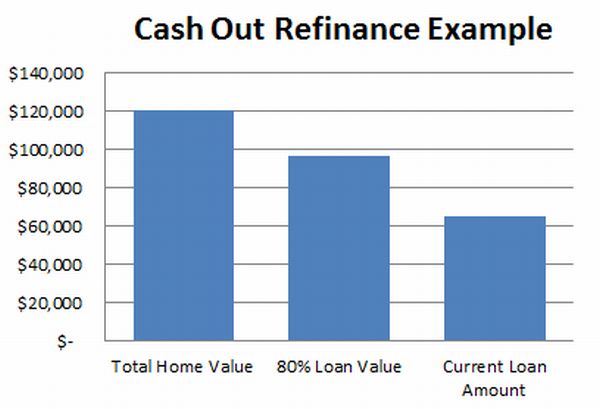

To start a cash out refinance mortgage is a loan that will allow you to pull extra cash out of your mortgage provided you have enough equity in your home. For example, if you owe $65,000 on your loan and your home was appraised at $120,000 it would mean that you would have a total of $55,000 of equity in your home.

This means if you needed to take $10,000 out to pay some bills, debts, or even buy a new car you could do it. Now this doesn’t mean you would be able to pull all $55,000 of your home equity out in cash. In fact in most cases you would only be able to pull around 80% of your homes equity, which would only be $96,000. Look at the chart below.

In the chart above the difference between 80% of your homes value, which is $96,000, and what you owe, $65,000, is only $31,000 in available cash out equity. Now I should mention some lenders may get you to take more than this out but my strongest suggestion is that you don’t.

In the chart above the difference between 80% of your homes value, which is $96,000, and what you owe, $65,000, is only $31,000 in available cash out equity. Now I should mention some lenders may get you to take more than this out but my strongest suggestion is that you don’t.

The reason for this is because once you cut the value of your equity down to less than 20% the loan could end up costing you more. First off, you will have to pay private mortgage insurance. Also known as PMI, this is an insurance that protects lenders in the event that you default on your home mortgage since you are at a higher risk to them. Secondly, with less than 20% equity you will likely have to pay a higher interest rate on your loan as well.

Should I Do A Cash Out Refinance

Now that we know how a cash out refinance works and the basic rules behind them let’s look at a few reasons why getting one would be in your favor and why they would not be.

- Cut Interest Rates. This option works great as it did in my situation were I was able to pay off my credit cards and eliminate those high interest rates.

- Debts All In One Place. This option would also allow you to keep all of your debts in one place and not have to pay several debts each month.

- Better Than A Home Equity Line Of Credit. If your thinking of going with a home equity line of credit over the cash out option you will want to consider the fact that a home equity loan will typically have a much higher interest rate.

- Gives Tax Benefits. Finally, when you take a cash out refinance all interest paid is tax deductible.

- Less Than 20% Equity. As I mentioned earlier if you have less than 20% equity in your home this may not be a good idea.

- Buying Things You Don’t Need. If you’re using a cash out refinance just to buy that flat screen think again. Racking up debt like this can be expensive and put you in bind especially if you already have a lot of debt.

- If Your Going To Sell Your Home. Finally, the last reason you should not get a cash out refinance mortgage is if you are planning to sell your home in the near future. When you do a cash out mortgage refinance you will have to pay closing cost which could be as high as $3500. So before you consider this option know that you will have to tact those extra fees on the bill as well.

Final Thoughts…

In the end before you consider doing a cash out refinance take time to weigh all the pros and cons carefully. In my case it worked out great and saved me a ton in high interest payments from my credit cards, but I also know this isn’t the case with everyone.

So are you considering the idea of doing a cash out refinance any time soon? Feel free to share your thoughts, comments, ans questions below.

This article was recently featured in the Carnival of Personal Finance by Retire By 40.

One Comment